EUR/USD Price Forecast: A test of the 2025 high in the offing?

- EUR/USD kept the bullish impulse well in place beyond the 1.1700 barrier.

- The US Dollar sold off on the back of lower yields, trade concerns, and Fed jitters.

- The ECB is expected to keep its interest rates unchanged later in the week.

The single currency extended its recovery on Tuesday, triggering a strong move higher in EUR/USD, which managed to break above the 1.1700 hurdle with certain conviction and clinch its third daily gain in a row.

The pronounced uptick in spot came in tandem with a deep correction in the US Dollar (USD), as trade concerns, threats to the Fed’s independence, and declining US yields all collaborated with the decline to two-week lows in the US Dollar Index (DXY).

Trade‑war drumbeat rattles investor nerves

Washington’s decision to postpone its next tariff call to August 1 has done little to calm markets.

Investors are still bracing for the threat of 30% levies on European goods, a 25% hit to Japanese and South Korean imports, and even a 50% surcharge on copper.

Brussels, sensing a stalemate, is preparing far-reaching “anti-coercion” tools that could curb US service access or shut American firms out of public tenders if talks collapse. President Trump has made it clear that if no deal materialises by the deadline, he will target Europe.

Fed cautious, ECB on hold

The Minutes from the Fed's June meeting revealed a division: some officials advocate for immediate reductions, while others aim to assess the impact of new tariffs on inflation. A June uptick in consumer prices strengthened Chair Jerome Powell’s case for patience, yet futures still price a modest easing later this year.

Across the Atlantic, the ECB trimmed its deposit rate to 2.00% in early June but signalled that any fresh stimulus would hinge on clearer evidence of weakening external demand. Traders expect the Governing Council to reach an impasse later this week.

Specs bullish, commercials hedge

CFTC data to 15 July show speculators ramping up euro longs to nearly 128.2K contracts, the most since December 2023. Commercial players, meanwhile, pushed net shorts to roughly 184.2K contracts, their biggest stance in months. Additionally, overall open interest has risen for four straight weeks to just over 820K contracts, the highest since March 2023.

Chart check

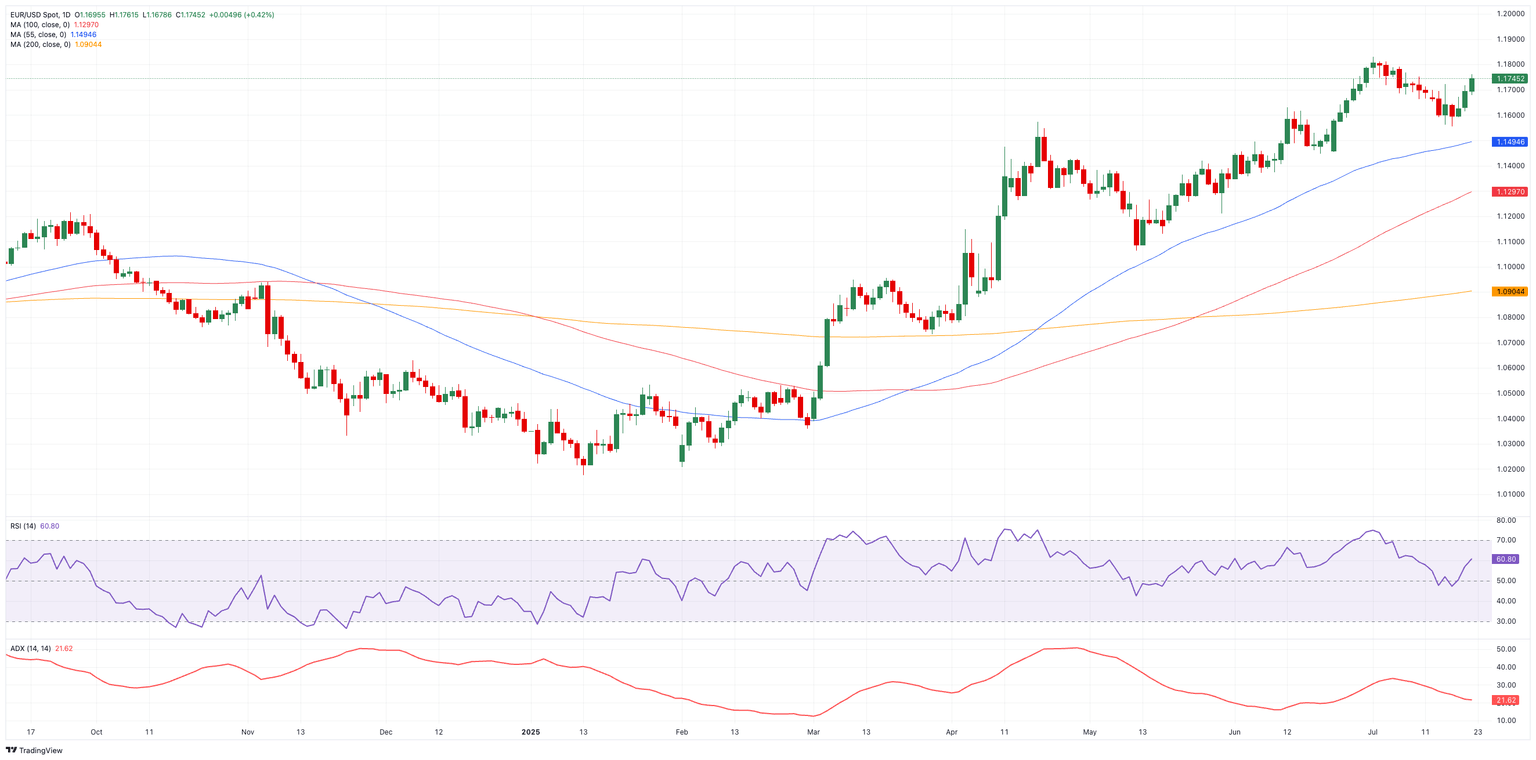

Bulls need a clean break above the 2025 peak at 1.1830 (July 1) to target the June 2018 high at 1.1852 (June 14).

Alternatively, failure to hold the July base at 1.1556 (July 17) could invite a slide towards the provisional 55‑day simple moving average (SMA) at 1.1491, ahead of the weekly low at 1.1210 (May 29), and, ultimately, the psychological 1.1000 handle.

Momentum has improved somewhat: the Relative Strength Index (RSI) hovers near 61, and the Average Directional Index (ADX) near 22 still flags a trend lacking conviction.

EUR/USD daily chart

What could tip the balance

The pair’s rebound appears to be gathering traction despite persistent tariff worries and the growing policy divergence between the Fed and the ECB. A definitive indication that Washington would moderate its tariff objectives, or a more conciliatory stance from the Fed, could rapidly shift sentiment back in favour of the single currency.

US-China Trade War FAQs

Generally speaking, a trade war is an economic conflict between two or more countries due to extreme protectionism on one end. It implies the creation of trade barriers, such as tariffs, which result in counter-barriers, escalating import costs, and hence the cost of living.

An economic conflict between the United States (US) and China began early in 2018, when President Donald Trump set trade barriers on China, claiming unfair commercial practices and intellectual property theft from the Asian giant. China took retaliatory action, imposing tariffs on multiple US goods, such as automobiles and soybeans. Tensions escalated until the two countries signed the US-China Phase One trade deal in January 2020. The agreement required structural reforms and other changes to China’s economic and trade regime and pretended to restore stability and trust between the two nations. However, the Coronavirus pandemic took the focus out of the conflict. Yet, it is worth mentioning that President Joe Biden, who took office after Trump, kept tariffs in place and even added some additional levies.

The return of Donald Trump to the White House as the 47th US President has sparked a fresh wave of tensions between the two countries. During the 2024 election campaign, Trump pledged to impose 60% tariffs on China once he returned to office, which he did on January 20, 2025. With Trump back, the US-China trade war is meant to resume where it was left, with tit-for-tat policies affecting the global economic landscape amid disruptions in global supply chains, resulting in a reduction in spending, particularly investment, and directly feeding into the Consumer Price Index inflation.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.