EUR/USD Price Forecast: A test of 1.2000 is not that far away

- EUR/USD gathers extra steam and advances to four-month highs past 1.1900.

- The US Dollar remains on the back foot amid geopolitics jitters and shutdown concerns.

- Germany’s Business Climate came in at 87.6 in January, matching December’s print.

The upward momentum of EUR/USD persists, consistently tracking the growing selling pressure on the US Dollar, which continues to grapple with issues related to trade, the Fed's independence, and the shutdown.

EUR/USD advances for the third straight day on Monday amid a very optimistic start to the trading week, breaking above 1.1900 the figure to clock fresh yearly highs at the same time.

The rebound largely mirrors a renewed pullback in the US Dollar (USD), as investors continue to digest remarks from President Trump at the World Economic Forum (WEF) last week, while geopolitical concerns, trade woes and shutdown jitters .

The mood around US–European Union trade has clearly brightened after President Trump softened his tone on the threat of fresh tariffs tied to the Greenland issue last week. That change in stance has gone down well with markets, lifting risk appetite and giving a helpful boost to the Euro (EUR) and other risk-sensitive currencies.

At the same time, the US Dollar Index (DXY) is still sliding, slipping back below the 97.00 level for the first time since mid-September. Indeed, the move lower in the buck comes amid multi-day lows in US Treasury yields across the curve and a mixed performance in US equities so far.

The Fed cuts, but stays cautious

The Federal Reserve (Fed) delivered the December rate cut that markets had fully priced in, but the real signal came from the tone rather than the move itself. A split decision and carefully calibrated language from Chair Jerome Powell made it clear that further easing is far from automatic.

Powell reiterated that inflation remains “somewhat elevated” and stressed the need for clearer evidence that the labour market is cooling in an orderly way. Updated projections barely changed, still pointing to just one additional 25-basis-point cut in 2026, alongside steady growth and only a modest rise in unemployment.

During the press conference, Powell ruled out rate hikes as the base case, but was equally reluctant to hint that another cut is imminent. He also pointed to tariffs introduced under Trump as one of the factors keeping inflation sticky.

The Minutes later underscored how finely balanced the debate remains within the Federal Open Market Committee (FOMC). With divisions still evident, confidence in further easing is waning, and a pause increasingly looks like the default option unless inflation cools more convincingly or the labour market weakens more sharply.

ECB in no rush to move

The European Central Bank (ECB) left rates unchanged at its December 18 meeting, adopting a calmer, more patient tone that has pushed expectations for near-term rate cuts further out. Modest upgrades to growth and inflation projections helped reinforce that message.

Recent data have steadied sentiment, with euro area growth surprising slightly to the upside, exporters coping better than feared with US tariffs, and domestic demand offsetting some of the weakness in manufacturing.

Inflation remains broadly aligned with the ECB’s framework, hovering near the 2% target and driven mainly by services prices. While projections still see inflation dipping below target in 2026–27 before drifting back towards 2%, policymakers remain wary that sticky services inflation and slow-cooling wage growth could complicate the outlook.

According to the ECB Accounts published last week, policymakers signalled they are in no hurry to adjust rates. Inflation being close to target gives them room to be patient, even as lingering risks mean they must remain ready to act again if needed.

Furthermore, Governing Council (GC) members said they could afford to wait, but were careful to stress that patience should not be mistaken for hesitation. Policy is in a “good place” for now, but not on autopilot. Markets seem to have taken the hint, pricing in just over 4 basis points of easing this year.

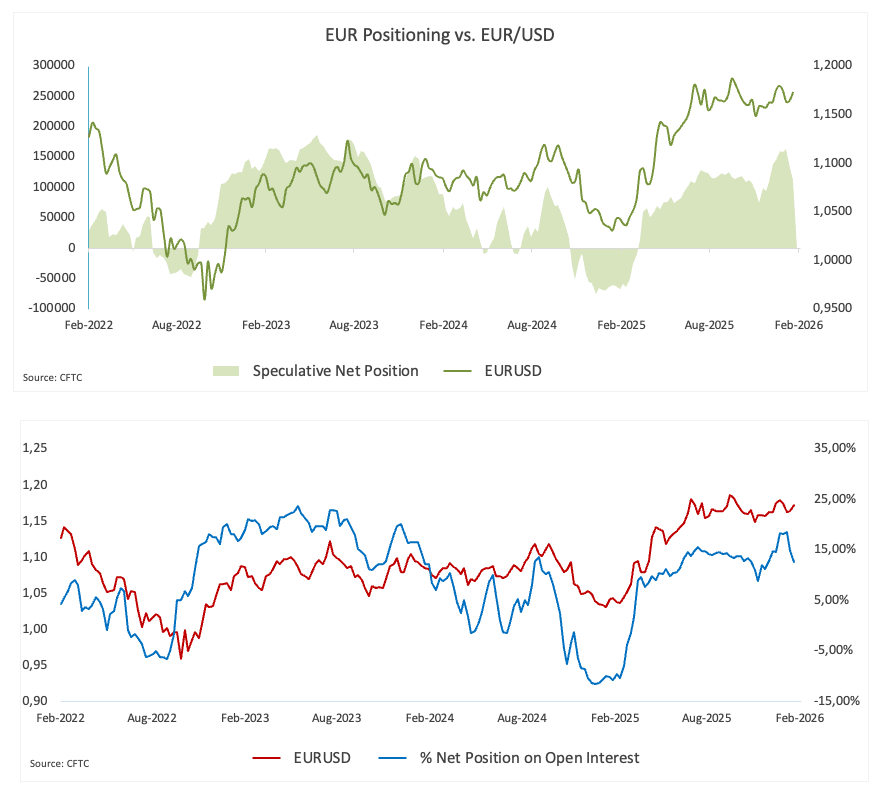

Positioning: still long, but enthusiasm fades

Speculative positioning continues to favour the Euro, although bullish conviction is starting to thin.

According to Commodity Futures Trading Commission (CFTC) data for the week ending January 20, non-commercial net long positions fell to around 111.7K contracts, the lowest level in seven weeks. Institutional players also reduced short exposure, now sitting near 155.6K contracts.

At the same time, open interest dropped to nearly 881K contracts, reversing three consecutive weekly gains, suggesting participation might be shrinking alongside bulls’ confidence.

What could change the tone

Near term: The FOMC gathering should keep investors focused on the Greenback, while flash inflation data in Germany and advanced GDP readings in the Euroland emerge as the key events on the domestic calendar later in the week.

Risk: A more hawkish shift from the Fed could quickly tilt the balance back towards sellers, renewing the Greenback’s appeal. A clear break below the 200-day Simple Moving Average (SMA) would also increase the risk of a deeper medium-term correction.

Tech corner

EUR/USD picks up pace and surpasses the 1.1900 barrier to hit fresh YTD peaks, trading at shouting distance of the 2025 ceiling at 1.1918 (September 17). Once the latter is cleared, spot could refocus on the key 1.2000 milestone.

On the flip side, there is immediate contention at the 2026 bottom at 1.1576 (January 19), which remains propped up by the key 200-day SMA. If the pair breaches below this level, it could then challenge at the November base at 1.1468 (November 5) prior to the August floor at 1.1391 (August 1).

Furthermore, momentum indicators continue to back extra advances in the short-term horizon: the Relative Strength Index (RSI) flirts with the overbought zone near 70, while the Average Directional Index (ADX) near 24 suggest quite a solid trend.

-1769453363472-1769453363473.png&w=1536&q=95)

Bottom line

For now, EUR/USD is being driven far more by developments in the US than by anything coming out of the euro area.

Until the Fed provides clearer guidance on how far it is willing to ease, or the eurozone delivers a more convincing cyclical upswing, further gains are likely to be steady and incremental, rather than the start of a decisive breakout.

Fed FAQs

Monetary policy in the US is shaped by the Federal Reserve (Fed). The Fed has two mandates: to achieve price stability and foster full employment. Its primary tool to achieve these goals is by adjusting interest rates. When prices are rising too quickly and inflation is above the Fed’s 2% target, it raises interest rates, increasing borrowing costs throughout the economy. This results in a stronger US Dollar (USD) as it makes the US a more attractive place for international investors to park their money. When inflation falls below 2% or the Unemployment Rate is too high, the Fed may lower interest rates to encourage borrowing, which weighs on the Greenback.

The Federal Reserve (Fed) holds eight policy meetings a year, where the Federal Open Market Committee (FOMC) assesses economic conditions and makes monetary policy decisions. The FOMC is attended by twelve Fed officials – the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four of the remaining eleven regional Reserve Bank presidents, who serve one-year terms on a rotating basis.

In extreme situations, the Federal Reserve may resort to a policy named Quantitative Easing (QE). QE is the process by which the Fed substantially increases the flow of credit in a stuck financial system. It is a non-standard policy measure used during crises or when inflation is extremely low. It was the Fed’s weapon of choice during the Great Financial Crisis in 2008. It involves the Fed printing more Dollars and using them to buy high grade bonds from financial institutions. QE usually weakens the US Dollar.

Quantitative tightening (QT) is the reverse process of QE, whereby the Federal Reserve stops buying bonds from financial institutions and does not reinvest the principal from the bonds it holds maturing, to purchase new bonds. It is usually positive for the value of the US Dollar.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.