EUR/USD Price Forecast: A move past 1.1600 should not be ruled out

- EUR/USD added to the recent recovery above the 1.1500 hurdle.

- The US Dollar sold off despite rising geopolitical concerns in the Middle East.

- Business activity in Germany, the euro area, and the US remained strong in June.

On Monday, the Euro (EUR)made significant gains against the US Dollar (USD), prompting EUR/USD to reverse course and reclaim the 1.1500 level and beyond as investors weighed the escalating tensions in the Middle East, particularly in light of the US attacks on Iranian nuclear facilities over the weekend and Iran's retaliatory attack on US military bases in the UAE on Monday.

Geopolitical headwinds meet trade uncertainty

The escalating tension between Israel and Iran has injected new volatility into currency markets, eroding the fragile gains from recent US-China trade talks.

Market players are also preparing for the July 9 "Liberation Day" tariff deadline, with growing concerns about a broader Middle Eastern war and Iran's threat to close the Strait of Hormuz adding to the global instability.

Divergent monetary outlooks

At its June policy meeting, the Federal Reserve (Fed) maintained its target range at 4.25–4.50% but raised its forecasts for unemployment and inflation to reflect tariff-driven pressures. Fed officials remain split: while the median dot plot anticipates 50 basis points of rate cuts by year-end, two policymakers see only a single 2025 reduction, seven expect no cuts, and eight envisage rates concluding the year between 3.75% and 4.00%.

In contrast, the European Central Bank (ECB) trimmed its Deposit Facility Rate to 2.00% earlier this month. ECB President Christine Lagarde struck a cautious tone, warning that further easing hinges on a significant downturn in external conditions.

Technical levels

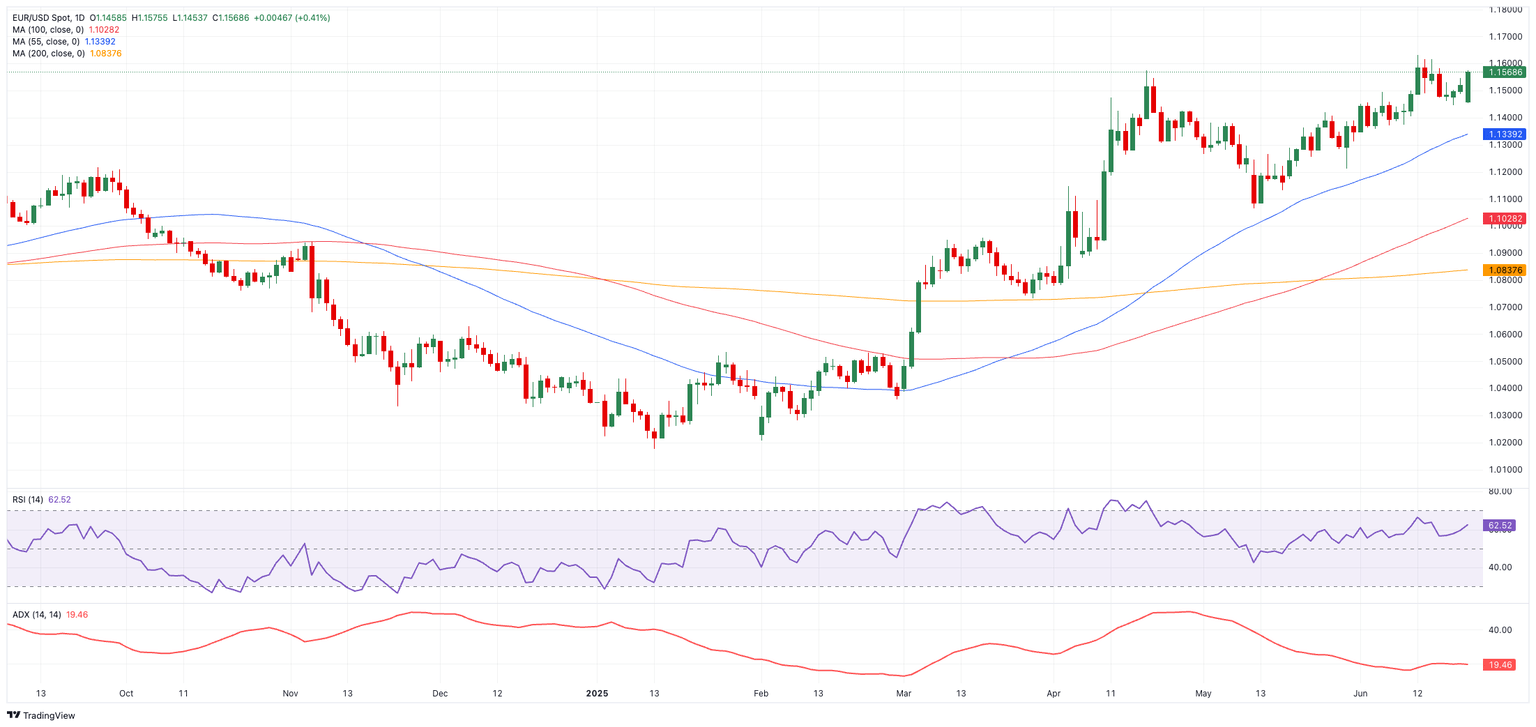

Next on the upside for EUR/USD sits June’s peak of 1.1631 (June 12), followed by the October 2021 high of 1.1692 (October 28) and the 1.1700 round level.

Interim support, on the other hand, is seen at the 55-day simple moving average (SMA) at 1.1345, with further cushions at the weekly trough of 1.1210 (May 29) and the May base of 1.1064 (May 12).

Momentum indicators favour the Euro: the Relative Strength Index (RSI) sits near 63, hinting at upside potential, while the Average Directional Index (ADX) is around 20 points, indicating only modest trend strength.

EUR/USD daily chart

What’s ahead

Traders will turn to the German Business Climate on June 24, ahead of Germany’s GfK Consumer Confidence on June 26, and the final print of the Consumer Confidence in the euro bloc and the ECB’s Consumer Inflation Expectations survey, all on June 27.

Euro FAQs

The Euro is the currency for the 19 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% off all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

The European Central Bank (ECB) in Frankfurt, Germany, is the reserve bank for the Eurozone. The ECB sets interest rates and manages monetary policy. The ECB’s primary mandate is to maintain price stability, which means either controlling inflation or stimulating growth. Its primary tool is the raising or lowering of interest rates. Relatively high interest rates – or the expectation of higher rates – will usually benefit the Euro and vice versa. The ECB Governing Council makes monetary policy decisions at meetings held eight times a year. Decisions are made by heads of the Eurozone national banks and six permanent members, including the President of the ECB, Christine Lagarde.

Eurozone inflation data, measured by the Harmonized Index of Consumer Prices (HICP), is an important econometric for the Euro. If inflation rises more than expected, especially if above the ECB’s 2% target, it obliges the ECB to raise interest rates to bring it back under control. Relatively high interest rates compared to its counterparts will usually benefit the Euro, as it makes the region more attractive as a place for global investors to park their money.

Data releases gauge the health of the economy and can impact on the Euro. Indicators such as GDP, Manufacturing and Services PMIs, employment, and consumer sentiment surveys can all influence the direction of the single currency. A strong economy is good for the Euro. Not only does it attract more foreign investment but it may encourage the ECB to put up interest rates, which will directly strengthen the Euro. Otherwise, if economic data is weak, the Euro is likely to fall. Economic data for the four largest economies in the euro area (Germany, France, Italy and Spain) are especially significant, as they account for 75% of the Eurozone’s economy.

Another significant data release for the Euro is the Trade Balance. This indicator measures the difference between what a country earns from its exports and what it spends on imports over a given period. If a country produces highly sought after exports then its currency will gain in value purely from the extra demand created from foreign buyers seeking to purchase these goods. Therefore, a positive net Trade Balance strengthens a currency and vice versa for a negative balance.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.