EUR/USD Price Forecast: A challenge to 1.1000 looms closer

- EUR/USD collapsed to multi-week lows near 1.1070.

- The US Dollar regained strength on promising US-China trade talks.

- Investors will now closely follow the release of US inflation readings.

The Euro (EUR) extended its monthly retreat on Monday, with EUR/USD slipping toward the 1.1070 region as the US Dollar (USD) gathered fresh and intense momentum. The move followed renewed optimism surrounding US-China trade relations, all in response to the constructive tone from the meeting between US and Chinese officials over the weekend.

The US Dollar Index (DXY) advanced to five-week tops near the 102.00 hurdle, with broad-based gains reflecting increased optimism on the trade front as well as a re-pricing of Fed policy expectations

Cautious optimism on trade front

Investor sentiment improved markedly following auspicious talks between US and Chinese officials over the weekend. Indeed, under the agreement, reciprocal tariffs between the United States and China will be slashed from over 100% to just 10%, marking a significant de-escalation in trade tensions. However, the Trump administration will maintain a 20% tariff on fentanyl-related imports from China, leaving the overall US tariff burden at 30% during the 90-day pause period.

The upbeat tone added to last week’s announcement of a US-UK trade deal as well as bullish remarks from President Trump, who signalled readiness for further agreements.

Monetary policy paths diverge sharply

Diverging central bank stances are also shaping the EUR/USD narrative. The Fed opted to hold rates steady this week, while maintaining a hawkish tone, in contrast with the European Central Bank (ECB), which cut its benchmark rate by 25 basis points last month to 2.25%.

Markets are now pricing in the possibility of another ECB cut as early as June, deepening the policy divergence and casting doubt over the euro’s ability to hold recent gains if the Fed stays on a tighter trajectory.

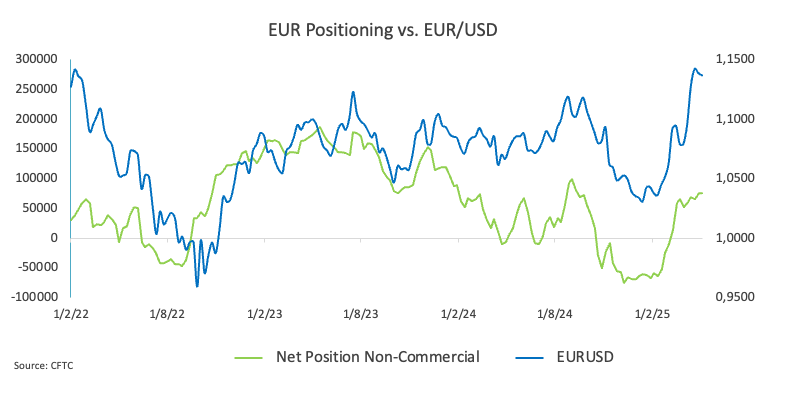

Speculative support for the Euro persists

Speculative interest in the Euro remains firm. CFTC data as of May 6 showed net long positions almost unchanged around 75.7K contracts, hovering around multi-month high. Open interest rose again, approaching the 738K, levels last seen in September 2024.

Still, commercial hedgers stayed net short, reflecting continued corporate caution amid an uncertain outlook.

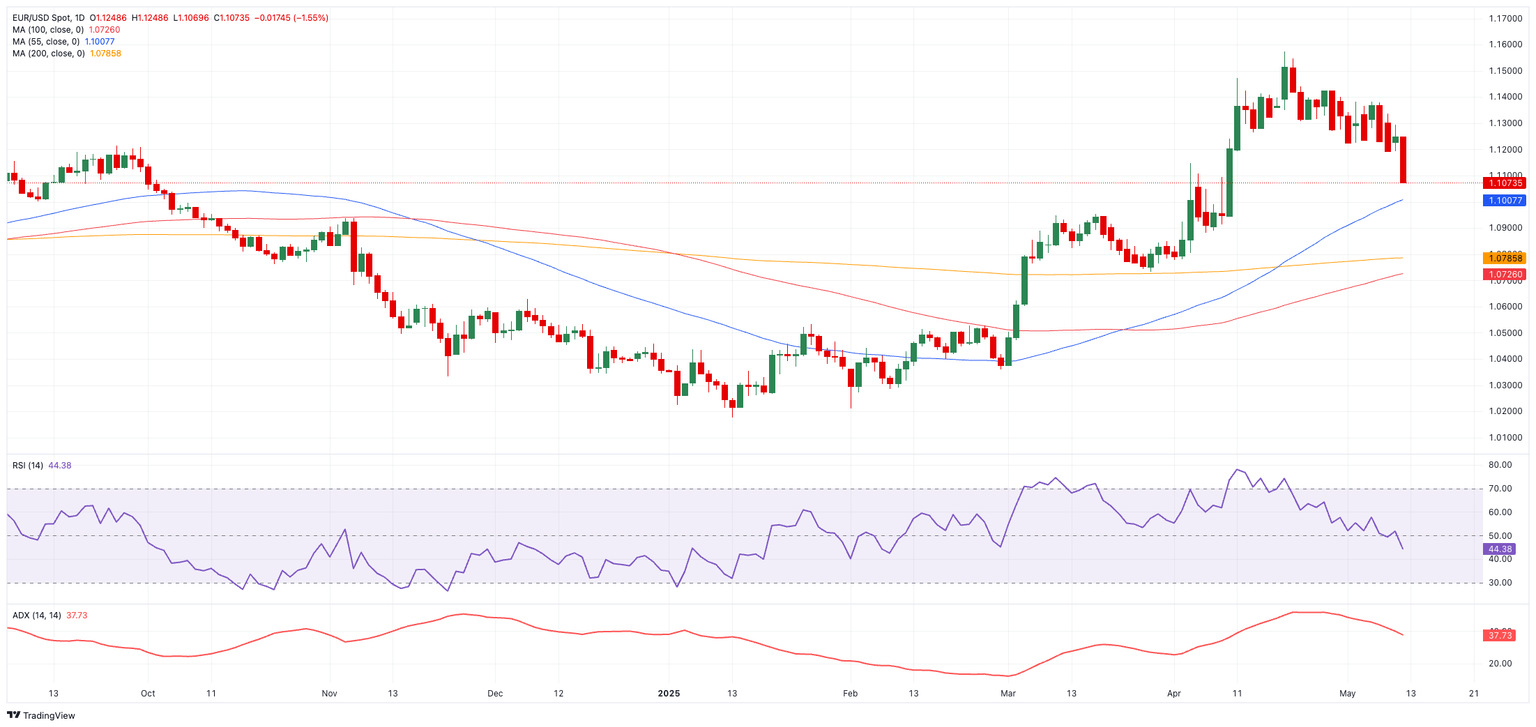

Technical Picture: Strong resistance ahead

EUR/USD remains capped below its 2025 peak of 1.1572 (April 21), with the 1.1600 level and the October 2021 high at 1.1692 acting as key resistance zones.

Initial contention comes at the May trough of 1.1067 (May 12), prior to the interim 55-day SMA at 1.1015, and the 200-day SMA at 1.0793.

Momentum indicators suggest possible near-term consolidation. The Relative Strength Index (RSI) has slipped to the 40 zone, while the Average Directional Index (ADX) at 39 points to a sustained trend, albeit with diminishing strength.

EUR/USD daily chart

Outlook: Volatility likely to persist

EUR/USD is being pulled in opposing directions. The Euro’s resilience is underpinned by speculative interest and political developments, but the growing divergence in monetary policy—and shifting trade dynamics—may keep the pair headline-driven and volatile in the near term.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.