EUR/USD Price Forecast: 200-SMA on H4 holds the key for bulls ahead of US CPI report

- EUR/USD rebounds from a multi-week low amid easing worries about Trump's tariff threats.

- A positive risk tone undermines the safe-haven USD and lends additional support to the pair.

- Traders now look to the US CPI report for Fed rate-cut cues and some meaningful impetus.

The EUR/USD pair gains some positive traction on Tuesday and moves away from over a two-week low touched the previous day in reaction to US President Donald Trump's tariff threat. In a further escalation of trade wars, Trump said on Saturday that he would slap a 30% tariff on goods imported from the European Union (EU) starting August 1. In response, European leaders said that they would still work to strike an agreement with the US before the deadline. The EU also delayed countermeasures, though it warned that preparations for additional retaliatory moves were underway.

Meanwhile, Trump softened his stance on Monday and showed a willingness to engage in trade negotiations. Speaking to reporters at the White House, Trump added that Europe has expressed interest in pursuing a different kind of agreement, fueling hopes for a US-EU trade deal, and that a global trade war would be averted. This, in turn, offers some support to the shared currency and boosts the global risk sentiment. Furthermore, the upbeat market mood drags the safe-haven US Dollar (USD) away from its highest level since June 24 and also lends support to the EUR/USD pair.

The USD downtick could further be attributed to some repositioning trade ahead of the US consumer inflation figures, due for release later during the North American session. The crucial US Consumer Price Index (CPI) report will influence expectations about the Federal Reserve's (Fed) rate-cut path, which, in turn, should drive the USD demand in the near term and provide some meaningful impetus to the EUR/USD pair. Nevertheless, traders are still assigning a 60% probability of a rate cut move by the Fed in September and at least 50 basis points worth of policy easing by the end of this year.

Hence, a softer US CPI print could revive bets for an early interest rate cut by the Fed and weigh heavily on the USD. In contrast, the European Central Bank (ECB) is widely expected to stick to its plans for a pause in rate cuts at next week's policy meeting despite concerns about the negative impact of higher US tariffs on the Eurozone economy. This, in turn, suggests that immediate market reaction to stronger US consumer inflation figures is more likely to be short-lived and backs the case for some meaningful recovery for the EUR/USD pair.

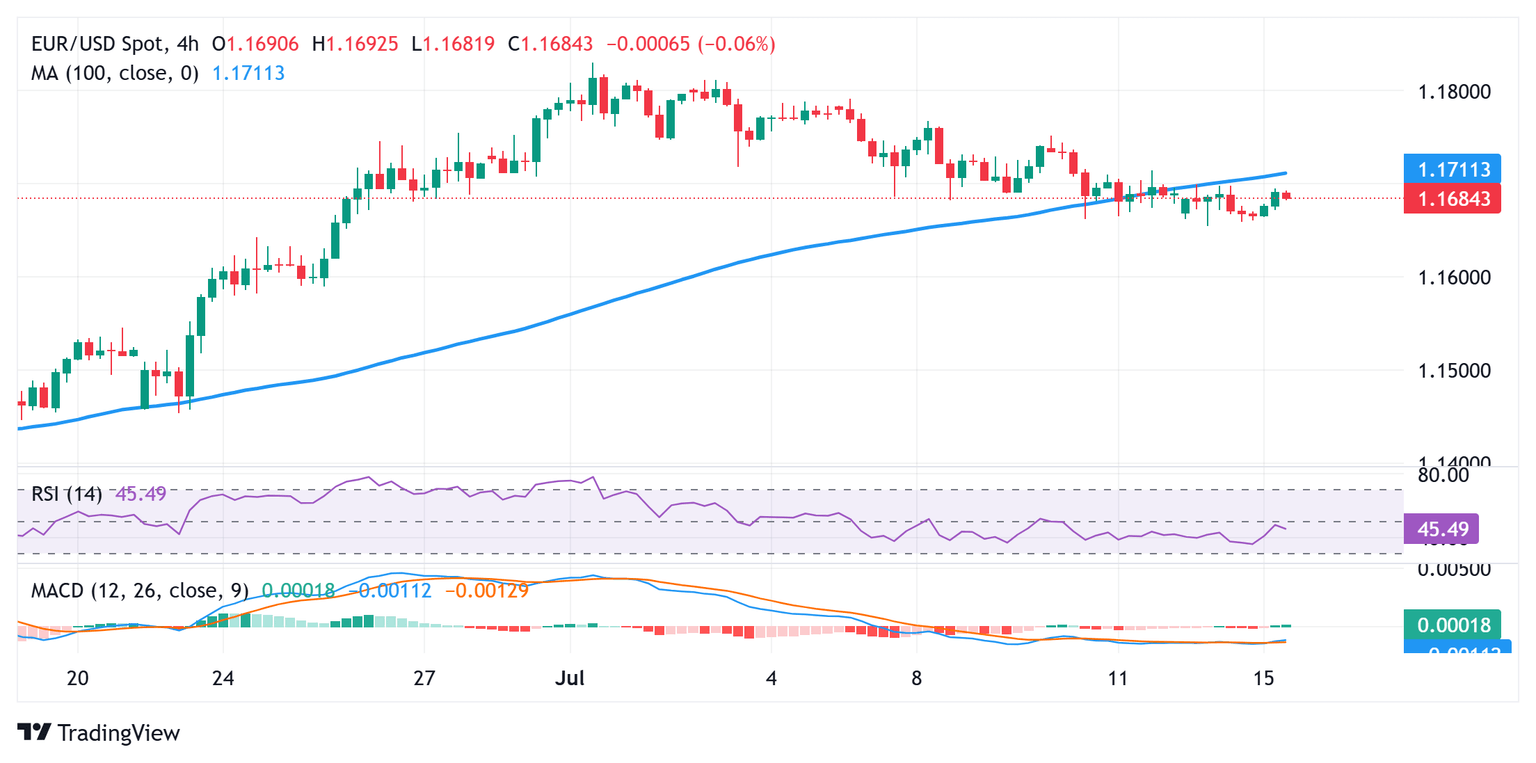

EUR/USD 4-hour chart

Technical Outlook

The recent breakdown and acceptance below the 100-period Simple Moving Average (SMA) on the 4-hour chart, for the first time since late May, could be seen as a key trigger for the EUR/USD bears. Moreover, oscillators on the said chart have been gaining negative traction. However, the daily Relative Strength Index (RSI, 14) remains above 50, while the Moving Average Convergence Divergence (MACD) histogram and the signal line are holding in bullish territory. This, in turn, backs the case for a move beyond the 1.1700 round figure, towards the next relevant hurdle near the 1.1740-1.1745 region. The recovery momentum could extend further towards the 1.1800 mark en route to the 1.1830 area, or the highest level since September 2021 touched earlier this month, and the 1.1900 round figure.

On the flip side, the 1.1660-1.1655 area, or the multi-week low, now seems to protect the immediate downside. The subsequent fall is likely to find decent support near the 1.1600 mark, which if broken decisively will be seen as a fresh trigger for bearish traders and pave the way for deeper losses. The EUR/USD pair might then weaken to the 1.1535-1.1530 zone before dropping to the 1.1500 psychological mark en route to the 1.1455-1.1450 support.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.