EUR/USD outlook: Thick daily ichimoku cloud continues to limit recovery

EUR/USD

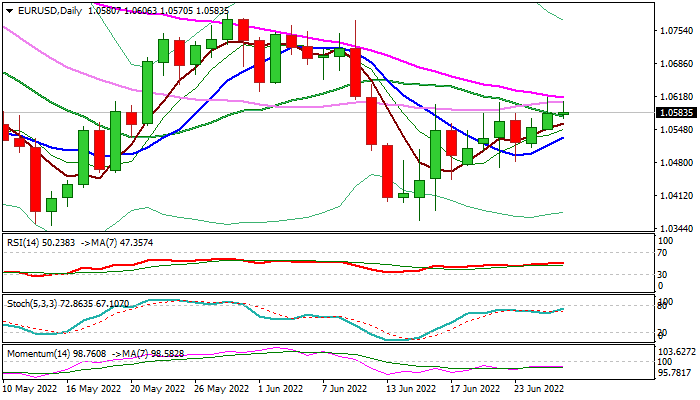

Although the Euro stands at the front foot and continues to attempt higher, the recovery remains questioned, as thick daily cloud continues to limit the action for the sixth straight day, while falling 55 DMA (1.0614) additionally weighs.

Technical studies on a daily chart show still strong bearish momentum and mixed setup of moving averages (5,10,20,55), while daily cloud, spanned between 1.0596 and 1.0767, continues to strongly pressure the action that adds to stall signals.

Expect initial negative signal on return and close below 10DMA (1.0533), with drop below1.0469/56 (June 22 spike low/Fibo 61.8% of 1.0358/1.0614) to confirm lower top and shift focus towards key supports at 1.0358/49/40 (lows of June 15/May 13/2017).

Only sustained break above 55DMA would strengthen near-term structure and generate initial signal of bullish continuation of recovery leg from 1.0358.

Res: 1.0614; 1.0623; 1.0685; 1.0700.

Sup: 1.0577; 1.0533; 1.0517; 1.0486.

Interested in EUR/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.