EUR/USD outlook: Holds grip but recovery still requires confirmation

EUR/USD

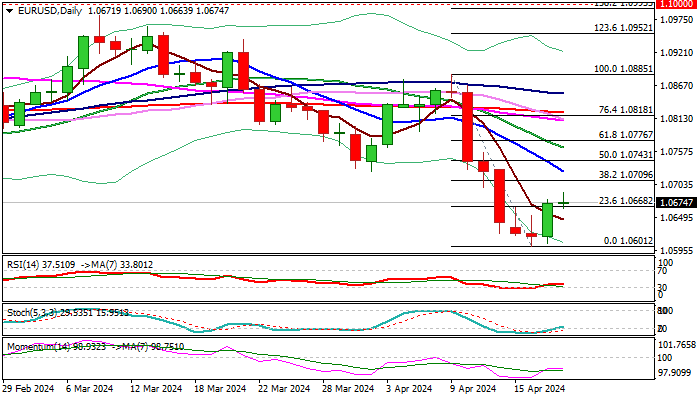

The Euro remains constructive and ticks higher in early Thursday after Wednesday’s 0.5% bounce from new multi-month low, but initial reversal signal still needs more evidence to be validated, as daily studies are predominantly bearish.

Another strong bullish daily close is needed to keep in play hopes of stronger recovery, with close above pivots at 1.0710/25 (Fibo 38.2% of 1.0885/1.0601 / falling 10DMA) to confirm signal.

Conversely, failure to register a clear break higher would generate initial signal of recovery stall and keep the downside vulnerable of fresh drop towards key 1.0600 support zone.

Res: 1.0690; 1.0710; 1.0725; 1.0743.

Sup: 1.0663; 1.0645; 1.0602; 1.0516.

Interested in EUR/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.