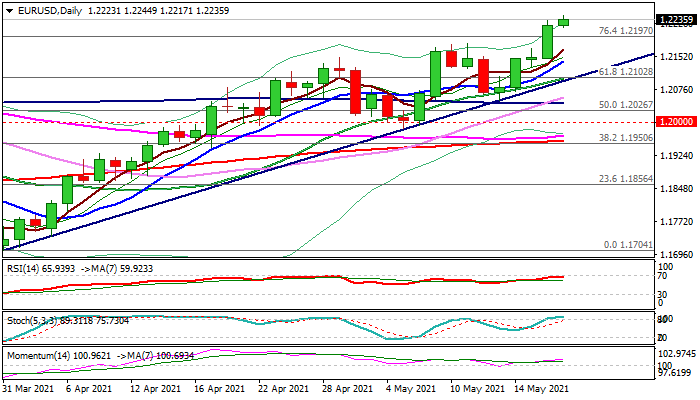

EUR/USD outlook: Break of key Fibo barrier adds to strong bullish stance

EUR/USD

Bulls are fully in control and extend advance on Wednesday to test levels last traded in early January.

Tuesday’s 0.63% rally closed above important Fibo barrier at 1.2197 (76.4% of 1.2349/1.1704) generated fresh bullish signal, with today’s probe through 1.2242 (Feb 25 spike high) confirming strong bullish stance and bringing in focus 2021 high at 1.2349 (Jan 6).

Bullish technical studies on daily chart support the action with adjustments on overbought conditions expected to offer better opportunities to re-join bullish market.

Broken Fibo resistance at 1.2197 reverted to initial support, followed by previous high at 1.2181(May 11), with extended dips expected to find ground above rising 10DMA (1.2140) and keep bulls in play.

Res: 1.2244; 1.2300; 1.2349; 1.2413.

Sup: 1.2197; 1.2181; 1.2140; 1.2112.

Interested in EUR/USD technicals? Check out the key levels

Author

Slobodan Drvenica

Windsor Brokers

Industry veteran with over 22 years’ experience, Slobodan Drvenica joined Windsor Brokers in 1995 when he was an active trader for more than 10 years, managing the trading desk and own account departments.