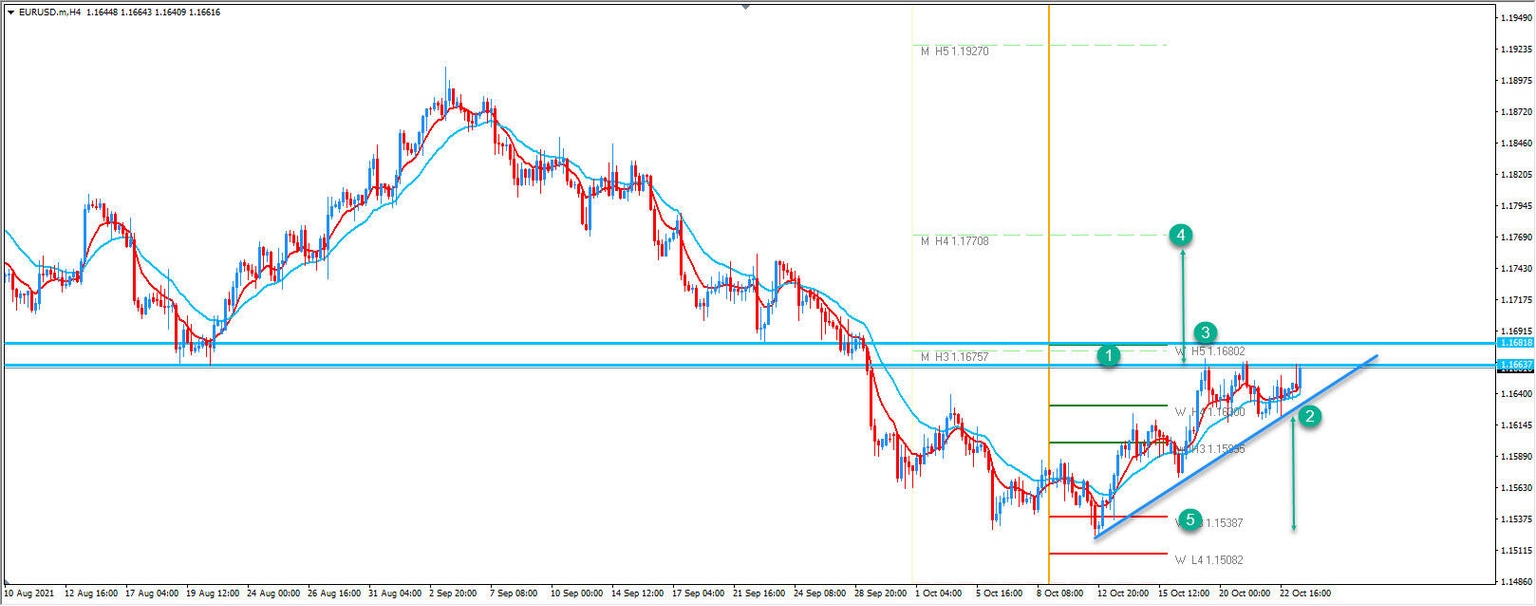

EUR/USD order block zone: The price is at the crossroads

EUR/USD technical analysis

-

EUR/USD is close to the ordering block zone.

-

It will be either a bounce or a drop.

-

1.1770 is an upside target.

-

1.1538 is a downside target.

1. Order block zone.

2. Trend line breakout.

3. Order block breakout.

4. Upside target.

5. Downside target.

The price is on the verge of a possible move up or down. We can clearly see the structure here which is showing us possible move up or break of the trend line lower. The EUR/USD is still bearish and this looks like a retracement. If the market starts to drop on H4/D1 timeframe we should definitely see the move down in the main trend direction. The target for the move up is 1.1770 and for the move down it's 1.1538. Watch for price action today.

Author

Nenad Kerkez

Top-XE