EUR/USD on its way to recovery

The major currency pair remains optimistic and intends to continue its recovery. On Monday 23 May, EUR/USD is trading at 1.0590; investors are trying to buy.

After the previous meeting of the US Fed, market concerns about the regulator’s future fiscal moves smoothed a little bit. It’s clear that the Fed will continue raising the benchmark interest rate quite aggressively, but that’s all. This allows to reduce investors’ interest in the “greenback” and helps other traded currencies to correct.

This week is not going to ring a lot of important statistics for EUR/USD. Still, market players should pay attention to reports on the Durable Goods Orders and the Q1 GDP from the US. The ECB Financial Stability Review might also be interesting. Moreover, heads of European and American regulators are scheduled to speak.

As a rule, the last week of the month is not very rich in macroeconomic statistics and allows investors to prepare for the numbers to be published early in the upcoming month.

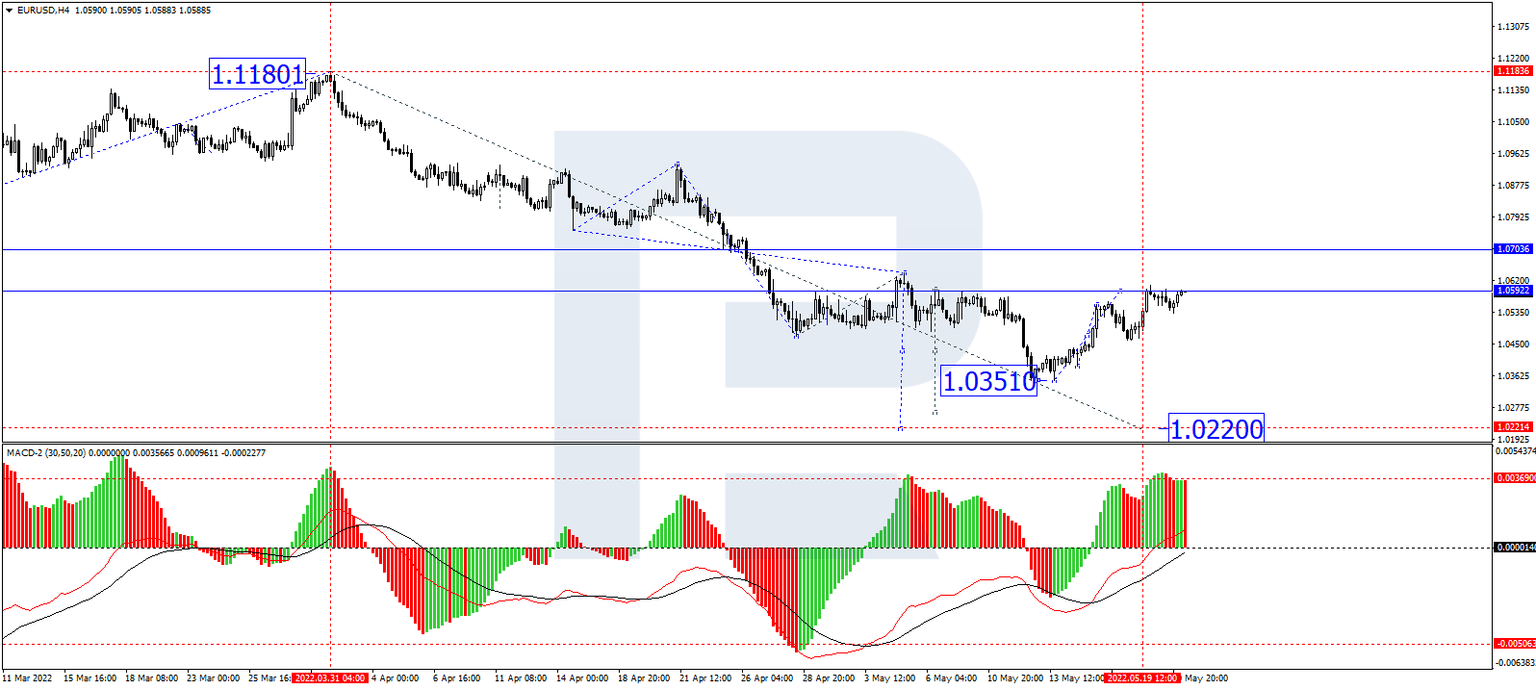

In the H4 chart, after rebounding from 1.0350 and then completing the correction at 1.0590, EUR/USD is expected to consolidate near the highs. Later, the market may break the range to the downside and resume falling with the target at 1.0300. From the technical point of view, this scenario is confirmed by MACD Oscillator: its signal line is moving below 0 and may continue falling to update the lows.

As we can see in the H1 chart, having completed the ascending wave at 1.0600 along with the correction down to 1.0460, EUR/USD is growing towards 1.0610. Later, the market may fall to return to 1.0460 and break it. After that, the instrument may continue trading downwards with the target at 1.0300. From the technical point of view, this idea is confirmed by the Stochastic Oscillator: after reaching 80, its signal line is expected to fall to break 50 and then continue its decline towards 20.

Author

Andrey Goilov

RoboForex

Higher economic education. Andrey Goilov has been working on the Forex market since 2005. A financial analyst and successful trader. Preference in trading is highly volatile instruments.