EUR/USD in focus – All eyes on ECB decision and forward guidance

As markets await the European Central Bank’s interest rate decision today, the EUR/USD pair hovers near 1.1400, with traders bracing for increased volatility. While no change is expected in the main refinancing rate (currently at 4.50%), the spotlight will be on the ECB's press conference and its tone regarding inflation, economic growth, and potential rate cuts in Q3 2025. Given the current macro landscape, the euro could swing sharply—either rallying toward the 1.1575–1.1600 resistance zone on a hawkish stance or falling below 1.1345 if the central bank signals a more dovish outlook.

Event risk today – European central bank (ECB) interest rate decision

- Expected Outcome: No change in main refinancing rate (4.50%).

- Focus: ECB press conference and commentary on inflation trajectory, growth risks, and rate cut guidance for Q3 2025.

Market Sensitivity

- The EUR/USD is likely to be highly volatile around the ECB decision.

- A hawkish tone could push EUR/USD into the 1.1575–1.1600 resistance zone, setting up a possible reversal.

- A dovish stance or indication of future rate cuts could pressure the pair toward 1.1345 and lower.

US Data Later Today

- Jobless Claims and Non-Farm Productivity (13:30 GMT).

- Likely to influence USD strength and post-ECB market direction.

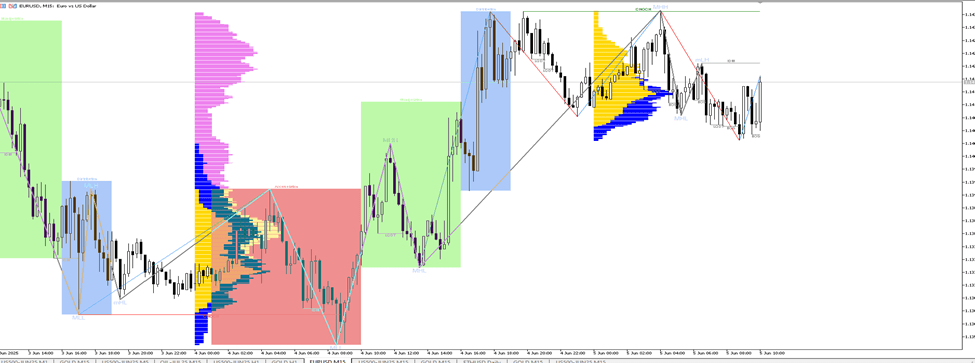

Hourly chart Euro/USD

The EUR/USD pair is consolidating within a corrective structure after declining from 1.1462 to 1.1352. This decline is being interpreted as part of a larger Wave 2 correction within an impulsive Wave 5 rally. The price has recently filled a fair value gap (FVG) between 1.1382–, which is now acting as a short-term support area.

A Change of Character (CHoCH) has been observed near 1.1435, indicating a potential shift to bullish intraday momentum. However, the major bearish Order Flow Break of Structure (BOS) remains intact below 1.1535, suggesting that bullish positions are still countertrend unless that level is reclaimed.

An internal liquidity sweep will triggered near 1.1475, with a short-term upward liquidity target forming above this level. The 1.1575–1.1602 range aligns with a higher timeframe bearish FVG and is also a Mars 23° zone, creating a potential trap area for a short setup.

Fair value gaps (FVG) zones

- Bullish FVG (support)

-

- 1.1348–1.1362 (secondary support if lower support breaks).

- Bearish FVG (resistance)

-

- 1.1572–1.1605 (resistance + trap zone due to planetary influence).

Trade setups

Buy Setup (Intraday Long)

- Entry: 1.1372 (from lower end of bullish FVG).

- Stop-Loss: 1.1345.

- Target 1: 1.1492.

- Target 2 (extension): 1.1575–1.1605.

- Justification: Bounce from filled FVG and internal CHoCH above suggests short-term bullish potential.

Sell Setup (Spike Reversal Post-ECB)

- Entry: 1.1575–1.1602.

- Stop: 1.1655.

- Target: Open downside structure.

- Justification: Mars at 23° (1.1572) and Jupiter at 88° can be 1.1608 create major resistance confluence. ECB news spike into this zone could generate a reversal.

Planetary and Harmonic confluences

- Resistance Confluence Zones

-

- 1.1572–1.1602: Mars 23° resistance zone.

- 1.1652: Venus–Uranus midpoint.

- 1.1706: Mercury degree resistance.

- 1.1720: Jupiter resistance.

- 1.1768: 33rd Harmonic projection level.

- Support Levels

-

- 1.1348–1.1362: Next support if breakdown occurs.

- 1.1272: Harmonic base support.

- 1.1220: Outer wave projection base (if extended downside).

The EUR/USD is currently positioned at a key technical and time-sensitive junction. Price is testing a bullish FVG support near 1.1380 with signs of intraday bullish structure. The ECB event could trigger an expansion move either toward 1.1492 (short-term) or a spike toward the planetary resistance at 1.1575 – 1.1600. A reversal from this zone offers a high-probability short setup, especially under a dovish ECB narrative or soft US data.

Author

Faysal Amin

Mind Vision Traders

Faysal Amin is a seasoned financial analyst and market strategist with over a decade of experience in global markets, including equities, forex, and commodities.