EUR/USD Forecast: Volatility set to resume with US inflation figures

EUR/USD Current Price: 1.2178

- The dollar edged higher despite falling Treasury yields and ahead of US CPI.

- The ECB is likely to maintain its monetary policy unchanged, offer a cautious stance.

- EUR/USD is technically neutral in the near-term, but the consolidative phase is about to end.

The EUR/USD pair is little changed for a second consecutive day, hovering around the 1.2180 level. It peaked at 1.2217, a weekly high, as the greenback was affected by softer US government bond yields. However, the dollar managed to recover ground during the US afternoon, despite yields held near their lows. The focus is on US inflation numbers, as the country will publish this Thursday the final reading of the May Consumer Price Index, foreseen at 4.7%, above the 4.2% previously estimated.

Also, the European Central Bank will announce its latest decision on monetary policy. The ECB is widely anticipated to maintain the status quo, despite data signaling a better economic performance and progress in the battle against coronavirus. US inflation and the ECB will define the imbalance between central banks’ approaches to monetary policy and could trigger some wild moves across the board.

Data wise, Germany published the April Trade Balance, which posted a seasonally adjusted surplus of €15.9 billion, below expected. As for the US, the country published MBA Mortgage Approvals for the week ended on June 4, which came in at -3.1% better than the previous -4%. April Wholesale Inventories, which rose as expected by 0.8%.

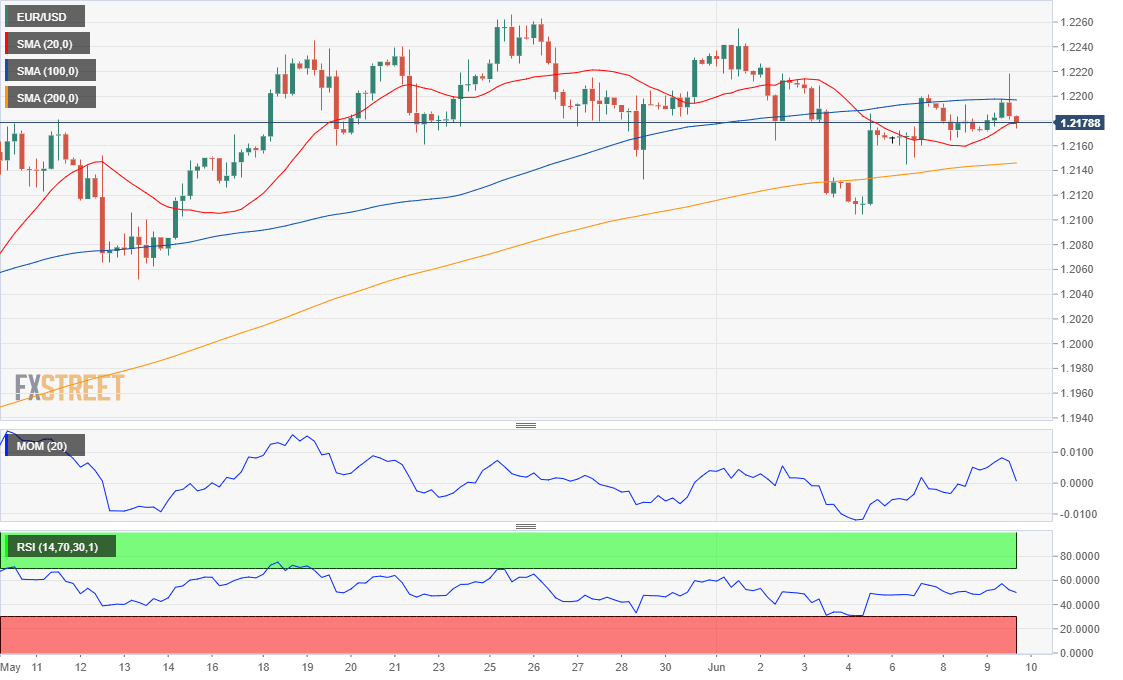

EUR/USD short-term technical outlook

The EUR/USD pair trades near a daily low at 1.2173, neutral in the near-term. The pair is currently struggling around its 20 SMA in its 4-hour chart, while the 100 SMA capped advances earlier in the day. Technical indicators head nowhere, stuck around their midlines. A break below 1.2160 should anticipate a steeper decline, while steady gains beyond 1.2200 could see the pair approach the year’s high at 1.2349.

Support levels: 1.2160 1.2120 1.2070

Resistance levels: 1.2200 1.2245 1.2280

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.