EUR/USD Forecast: US PCE should dictate near-term price action

- EUR/USD rebounded to the 1.0870 region.

- The Dollar traded in a vacillating mood amidst mixed yields.

- US flash Q2 GDP surprised to the upside.

EUR/USD managed to regain some composure after two daily drops in a row and advanced to two-day peaks around 1.0870 following an earlier test of the area near the critical 200-day SMA (1.0818). The daily gain in spot came in tandem with the broad-based weak tone in US and German yields.

On the other side of the equation, the US Dollar (USD) traded without clear direction on Thursday, recouping part of the ground lost, especially vs. the Japanese yen, and encouraging the USD Index (DXY) to maintain its business around the 104.30 zone.

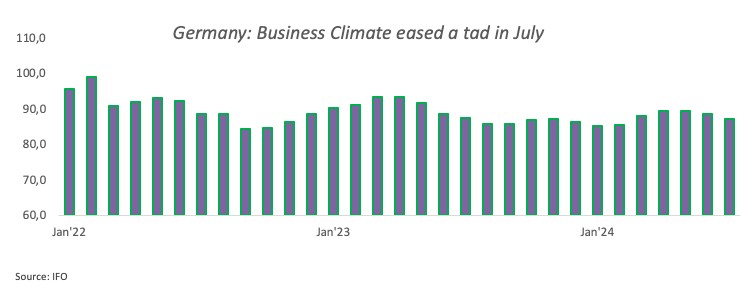

Furthermore, the European currency seems to have by-passed a drop in Germany’s Business Climate tracked by the IFO institute in July, which added to recent discouraging results from advanced Manufacturing and Services PMIs in the region.

Back to monetary policy, a September interest rate cut by the Federal Reserve (Fed) appears fully anticipated, with investors also expecting another reduction by year-end. In this context, market participants might shift their focus to the US political scene, especially after current Vice President K. Harris garnered significant support to face Republican candidate D. Trump in the November 5 elections.

A glimpse at the ECB shows the central bank appears to be en route to another interest rate cut after the summer break, as per recent comments by Vice President Luis de Guindos.

Meanwhile, the policy divergence between the Fed and the ECB is expected to remain almost unchanged going forward, as both central banks are forecast to cut rates after the summer break. However, the steady view of a soft landing in the US economy seems to contrast with some loss of momentum in the Eurozone's economic recovery, all morphing into potential extra weakness in EUR/USD in the next few months.

Looking ahead, the release of the key US PCE data on Friday is expected to inject some volatility into the markets and may carry the potential to reinforce the case for lower rates as soon as September.

EUR/USD daily chart

EUR/USD short-term technical outlook

Next on the downside for EUR/USD is the crucial 200-day SMA of 1.0818, followed by the June low of 1.0666 (June 26). The breach of the May low of 1.0649 (May 1) might lead to a possible visit to the 2024 bottom of 1.0601 (April 16).

On the other hand, early resistance is seen at the July high of 1.0948 (July 17), followed by the March top of 1.0981 (March 8) and the key 1.1000 threshold.

Looking at the larger picture, the positive bias should continue if the pair remains above the critical 200-day SMA.

So far, the four-hour chart suggests that the slump may have faced some decent support. Nonetheless, the 55-SMA at 1.0886 is the initial resistance, followed by 1.0948, then 1.0981, and finally 1.1000. On the other hand, 1.0825 comes first, followed by the 200-SMA at 1.0794, and then 1.0709. The relative strength index (RSI) dropped to about 44.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.