EUR/USD Forecast: US Dollar firms up ahead of Powell

EUR/USD Current Price: 1.0671

- Market players await Federal Reserve Chair Jerome Powell's words.

- Tepid European data and a cautious mood undermine demand for the Euro.

- EUR/USD trades with a sour tone, but the bearish potential remains limited.

The EUR/USD pair remains on the back foot, down on the day after an early test of the 1.0700 price zone. The US Dollar benefits from a cautious mood and an uptick in government bond yields in the absence of other relevant news.

Stock markets struggle for direction after Wall Street closed in the green on Tuesday, with Asian shares losing ground and European indexes hovering around their opening levels. Market participants try balancing Federal Reserve (Fed) speakers' words as policymakers aim to temper speculation of a rate cut next year without putting pressure on equities.

United States (US) data indicating economic resilience alongside signs of a loosening labor market lifted hopes the Fed is done with monetary tightening while boosting speculation the economy could dodge a recession. Soaring government bond yields, however, become a concern for households. Nevertheless, US Treasury yields stabilized at the lower end of their latest range, far from their multi-year peaks recently posted. Yields are ticking higher on Wednesday, providing modest intraday support to the USD.

Fed's speakers will remain active through the rest of the week. Chairman Jerome Powell is due to deliver opening remarks at the Division of Research and Statistics Centennial Conference today and to participate in a panel discussion titled "Monetary Challenges in a Global Economy" on Thursday. Additionally, European Central Bank (ECB) President Christine Lagarde will be on the wires on Thursday.

Meanwhile, Germany published the final estimate of the October Harmonized Index of Consumer Prices (HICP), which was confirmed at 3% YoY. The Euro Zone reported that Retail Sales contracted 0.3% MoM in September, worse than anticipated, falling from a year early by 2.9%. The tepid figures prevented the Euro from turning north during European trading hours.

The United States (US) reported MBA Mortgage Applications for the week ended November 3, which brought good news. The report showed applications for home loan refinancing increased 2% from the previous week. More relevantly, the 30-year fixed rate for mortgages with conforming loan balances decreased to 7.61% from 7.86%.

EUR/USD short-term technical outlook

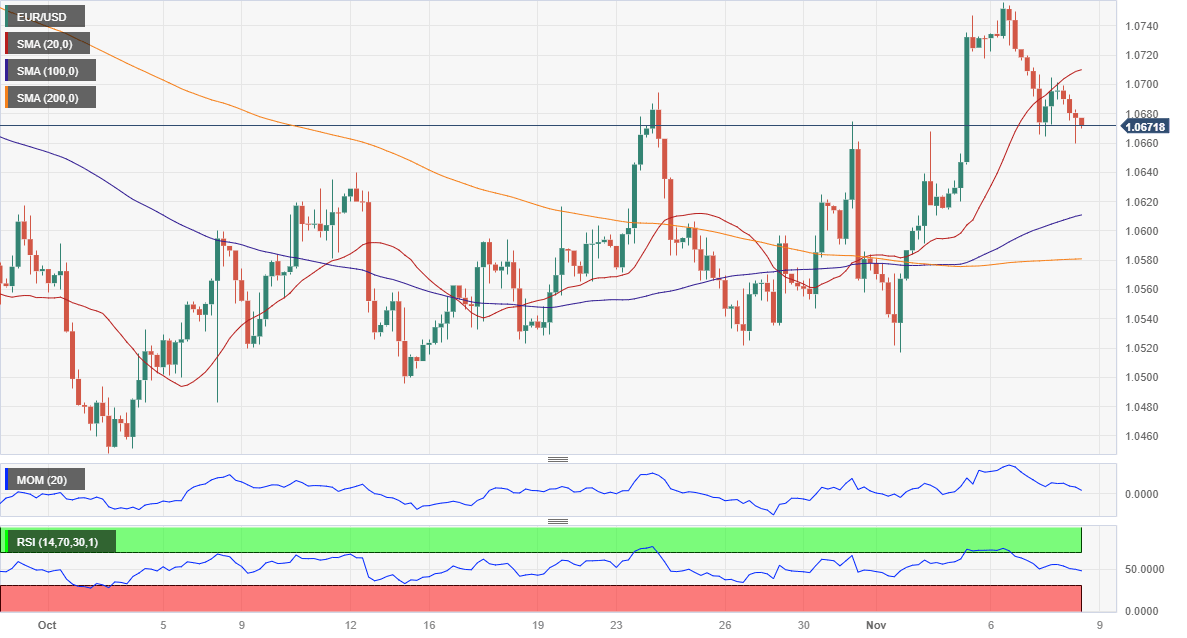

The daily chart for the EUR/USD pair shows it is down for a third consecutive day but barely trimmed half of its Friday's gains. The pair holds well above a mildly bullish 20 Simple Moving Average (SMA), providing dynamic support at around the 1.0600 threshold. At the same time, the 100 and 200 SMAs maintain modest downward slopes, converging around 1.0805. Finally, technical indicators head firmly south, although still within positive levels, limiting the risk of sustained slide.

In the near term, and according to the 4-hour chart, EUR/USD bearish potential seems limited. The pair develops below a still bullish 20 SMA while the 100 SMA advances far below the current level. Finally, technical indicators have lost their downward strength and turned flat, with the Relative Strength Index (RSI) indicator standing at neutral levels.

Support levels: 1.0655 1.0620 1.0590

Resistance levels: 1.0710 1.0760 1.0805

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.