EUR/USD Forecast: Sellers remain interested as Euro struggles to hold near 1.0800

- EUR/USD has lost its traction following a consolidation phase near 1.0800.

- Cautious ECB commentary doesn't allow the Euro to gain momentum.

- Investors await S&P Global PMIs from the US.

EUR/USD has been having a hard time stabilizing near 1.0800 and the near-term technical outlook shows that sellers look to continue to dominate the pair's action in the short term.

On Monday, European Central Bank (ECB) policymaker Francois Villeroy de Galhau said that he was expecting to reach the terminal rate "not later than by summer." In addition to these cautious comments, the risk-averse market environment amid a lack of progress in US debt-ceiling negotiations made it difficult for EUR/USD to shake off the bearish pressure on Monday.

HCOB PMI surveys revealed on Tuesday that business activity in the private sector in Germany and in the Eurozone continued to expand at a healthy pace in early May. Commenting on the surveys' findings, "a welcome development for the people of the Eurozone is that companies continue to hire more workers," said Dr Cyrus de la Rubia, chief economist at Hamburg Commercial Bank. Nevertheless, Euro Stoxx 50 opened in the red and continued to push lower, suggesting that this report failed to help the risk sentiment improve.

Reflecting the souring mood, US stock index futures turned negative on the day after having moved sideways during the Asian session.

In the second half of the day, S&P Global Manufacturing and Services PMIs from the US will be looked upon for fresh impetus. In case these data come in below 50, the US Dollar (USD) could come under renewed selling pressure and help EUR/USD stage a rebound. Unless there is a noticeable recovery in risk sentiment, however, the potential negative impact of weak PMIs on the USD's performance should remain short-lived.

EUR/USD Technical Analysis

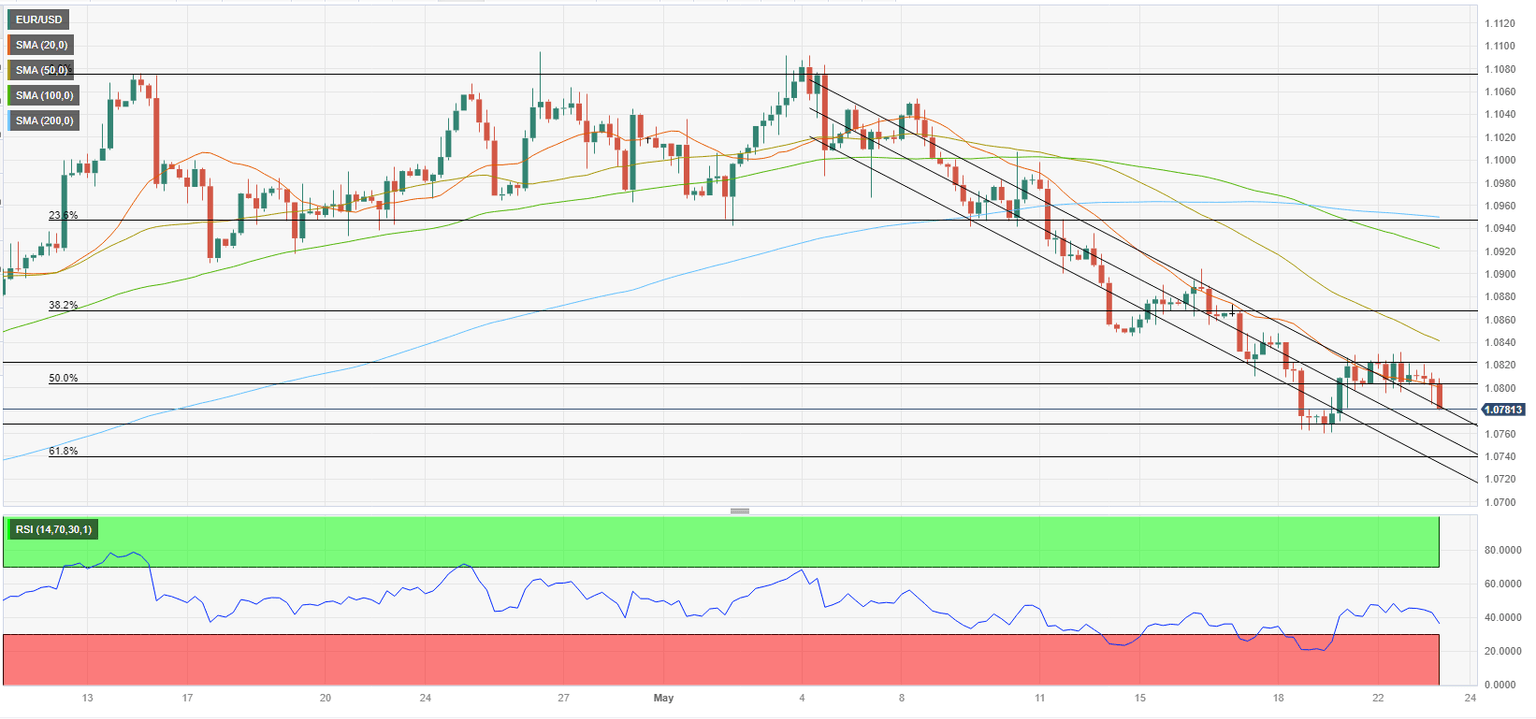

The Relative Strength Index (RSI) indicator on the four-hour chart stays below 50 and EUR/USD trades below the 20-period Simple Moving Average (SMA) after having closed the previous three four-hour candles above that level, highlighting the bearish bias.

In case EUR/USD starts using 1.0780 (upper-limit of the descending regression channel) as resistance, it could extend its slide toward 1.0760 (static level) and 1.0740 (lower-limit of the descending channel, Fibonacci 61.8% retracement of the latest uptrend).

On the upside, sellers could move to the sidelines in case EUR/USD flips 1.0800 (psychological level, 20-period SMA, Fibonacci 50% retracement) into support. In that scenario, 1.0820 (static level) aligns as interim resistance before 1.0840 (50-period SMA) and 1.0870 (Fibonacci 38.2% retracement).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.