EUR/USD Forecast: Sellers defend the 1.2100 area

EUR/USD Current Price: 1.2088

- US Treasury yields reflect mounting concerns about higher inflation.

- Initial Jobless Claims in the US shrank to 473K in the week ended May 7.

- EUR/USD has bounced from intraday lows, remains below the 1.2100 level.

The EUR/USD pair fell to a fresh weekly low of 1.2051 as demand for the greenback persists on the heels of mounting US inflationary pressures. The greenback rose alongside government bond yields, as the yield on the 10-year US Treasury note reached the critical 1.70% threshold. Meanwhile, global equities trade in the red, reflecting fears of tighter monetary policies.

Data wise, the EU macroeconomic calendar had nothing to offer. As for the US, the country has just published the April Producer Price Index, which surged by more than anticipated, printing at 6.2% YoY. More relevant, Initial Jobless Claims for the week ended May 7 came in at 473K vs the 490K expected. The good news provide mild-support to equities, while the dollar shed a few pips.

EUR/USD short-term technical outlook

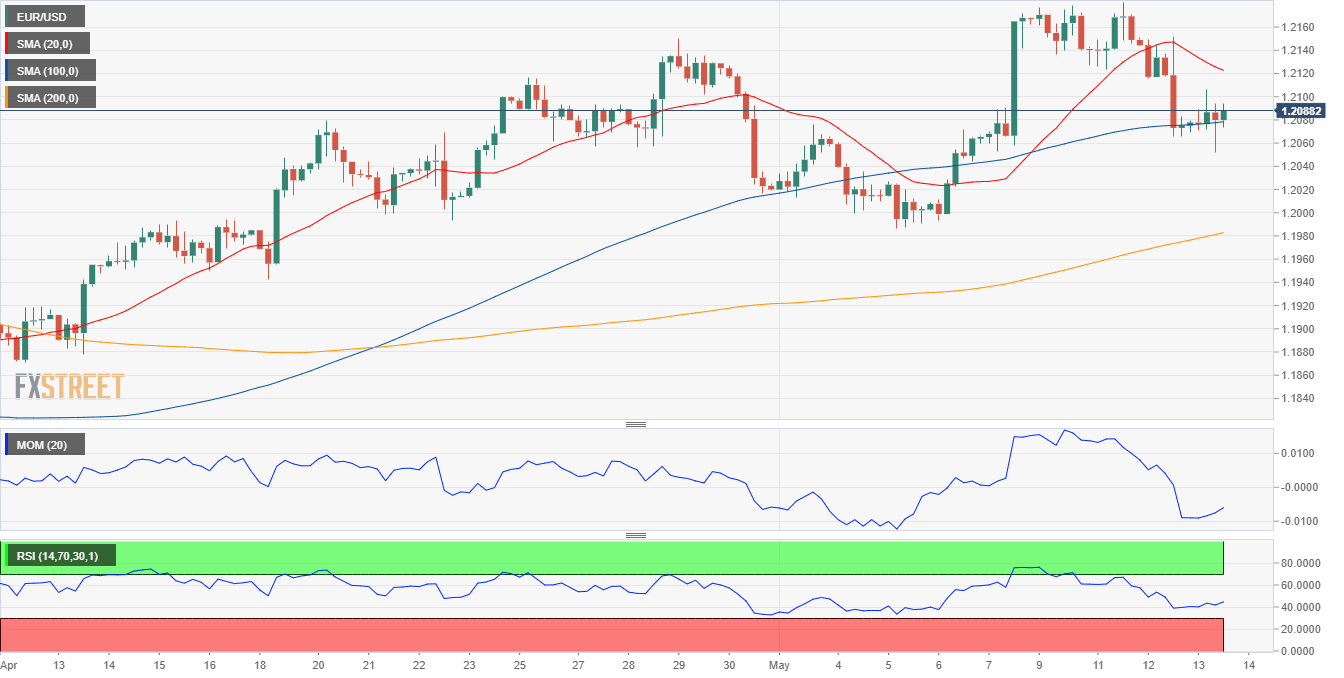

The EUR/USD pair trades near the mentioned weekly low, unable to recover the 1.2100 threshold. The 4-hour chart shows that it is seesawing around a flat 100 SMA, while the 20 SMA gains bearish traction above the current level. Meanwhile, technical indicators remain within negative levels, lacking clear directional strength. Overall, the risk is skewed to the downside, with a test of the 1.2000 mark on the cards for today.

Support levels: 1.2050 1.2000 1.1960

Resistance levels: 1.2110 1.2150 1.2190

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.