EUR/USD Forecast: Sell the rumor, buy the fact? Why US inflation data may trigger a rally

- EUR/USD has been under pressure as the dollar benefits from safe-haven flows.

- All eyes are on US inflation, which is set to spark volatility.

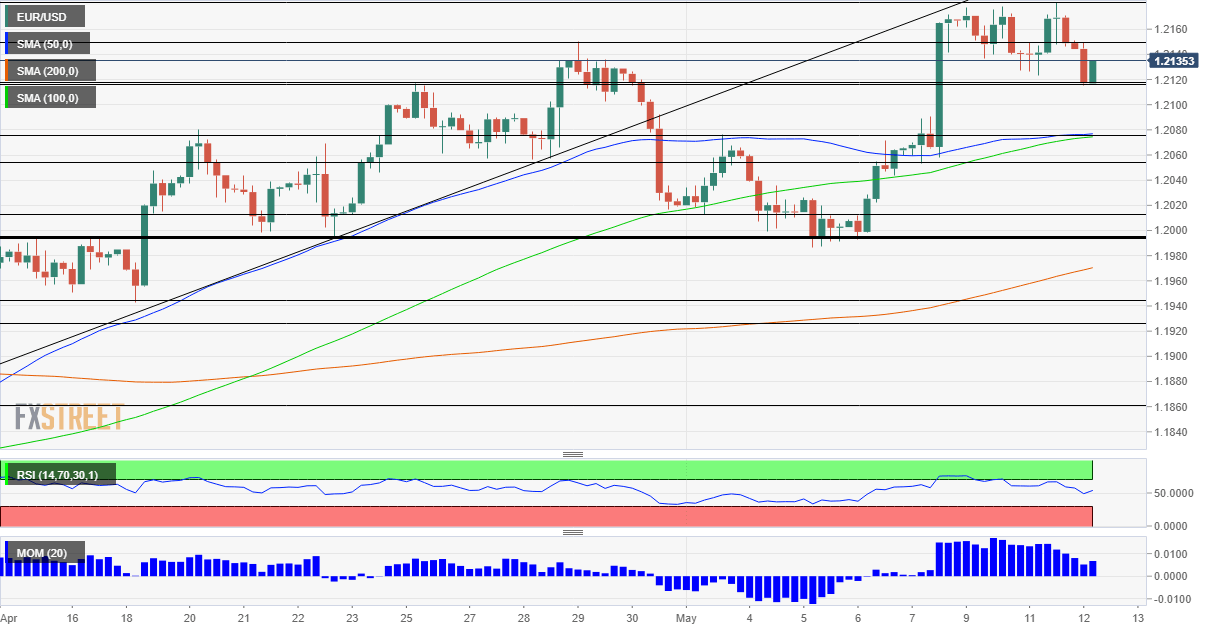

- Wednesday's four-hour chart is painting a bullish picture.

Inflation is coming – perhaps, but it could already be well in the dollar's price, resulting in traders selling the greenback and potentially sending EUR/USD to new highs.

A dark mood has gripped markets. The main reason is the fear of rising prices that would cause the Federal Reserve to raise interest. A long list of officials at the world's most powerful central bank has reiterated the message that price rises are "transitory" and would subside after a few months. Investors remain in disbelief.

The considerable increase in China's producer prices and hawkish comments from Dallas Fed President Robert Kaplan has been the latest to fuel speculation of inflation rearing its head. Concerns about the global chip shortage, soaring commodity prices, and most recently the paralysis of gasoline supplies to the US northeast have added to concerns. To top it off, escalating conflict in the Middle East adds worries and boosts the safe-haven dollar.

Have markets gone too far? The headline Consumer Price Index is set to leap to 3.6%, a multi-year high, while Core CPI – which excludes food and energy – is forecast to advance from 1.6% to 2.3% YoY. Nevertheless, that would put it pre-pandemic levels, when inflation was considered healthy.

It is also essential to note that March's CPI report provided some relief. Will recent history repeat itself?

After the publication, Fed Vice-Chair Richard Clarida and Atlanta Fed President Raphael Bostic are set to speak. They will likely repeat the bank's message that inflation is transitory, due to base effects and bottlenecks that are set to subside. That could also calm the mood.

US Consumer Price Index April Preview: The two base effects on inflation

On the other side of the pond, the EU is scheduled to publish new economic forecasts, and they will likely consist of an upgrade to previous projections. Europe's accelerating vaccination campaign has been boosting investor confidence, as last seen by figures from Germany's ZEW institute.

On both sides of the pond, the immunization efforts are bearing fruit and crushing the coronavirus wave. The old continent is catching up with its Western world peers. This factor underpins the common currency.

All in all, EUR/USD has reasons to resume its gains.

EUR/USD Technical Analysis

The Relative Strength Index (RSI) on the four-hour chart has drifted down and now maintains a considerable distance from the 70 level – thus remaining far from overbought conditions. Euro/dollar trades above the 50, 100 and 200 Simple Moving Averages (SMAs), and momentum remains to the upside.

Some resistance awaits at 1.2150, which was April's peak, and it is followed by May's high of 1.2180. Further above, the upside target is 1.2250.

Support awaits at the daily low of 1.2120, followed by 1.2075, which is where the 50 and 100 SMAs converge. Lower, 1.2055 and 1.2015 await the pair.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.