EUR/USD Forecast: Retreating from a critical resistance level

EUR/USD Current Price: 1.2116

- The German ZEW survey indicated an improvement in Economic Sentiment in February.

- Wall Street is set to open lower after reaching all-time highs in futures trading.

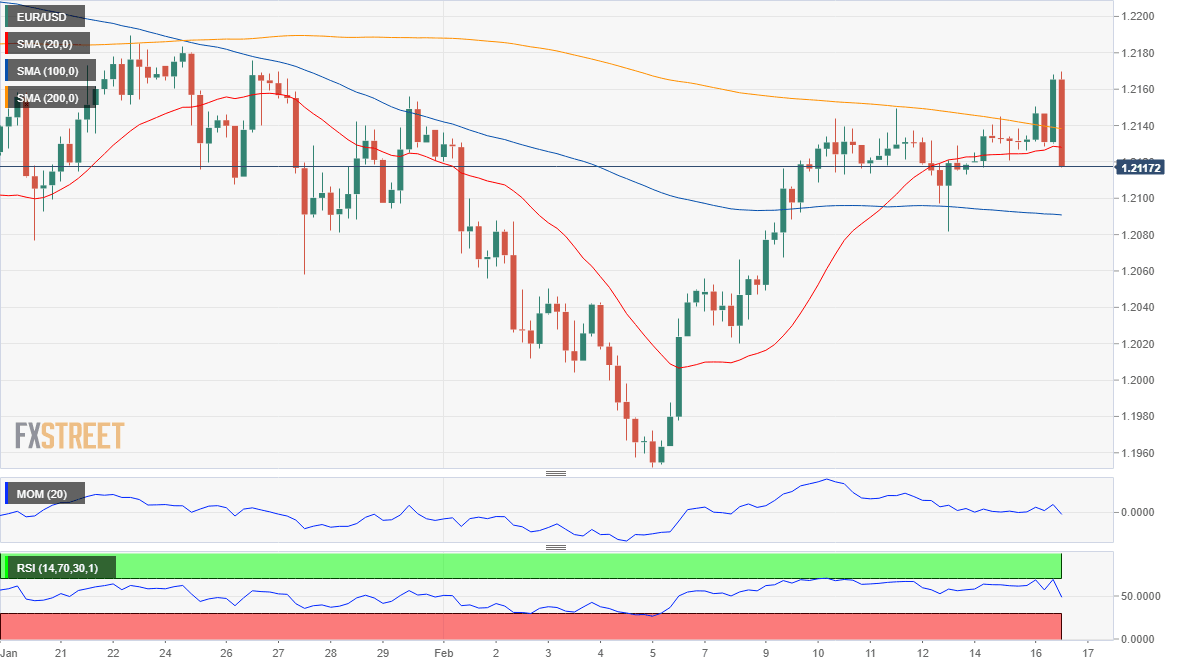

- EUR/USD retreated from around 1.2170, a Fibonacci resistance level.

The EUR/USD pair hit a one-week high of 1.2169, as an upbeat market’s mood pressured the greenback. Investors are waiting for updates from US Congress on President Joe Biden’s stimulus package. Progress in coronavirus immunization added to the positive sentiment, although demand for the American currency returned ahead of Wall Street’s opening.

Meanwhile, data coming from the Union was better than anticipated. The German ZEW survey showed that Economic Sentiment in the country improved in February to 71.2, while for the whole EU, it surged to 69.6 from 58.3. Also, the EU Gross Domestic Product was upwardly revised from -0.7% to -0.6% in Q4. As for the US, the country published the NY Empire State Manufacturing Index for February, which improved to 12.1 from 3.5, beating the expected 6.

EUR/USD short-term technical outlook

The EUR/USD pair retreated from its daily high ahead of the US opening, now trading in the red for the day and nearing the 1.2100 level. In the 4-hour chart, the pair is gaining bearish traction, as it’s breaking below its 20 SMA, as technical indicators pierce their midlines. Nevertheless, moving averages remain directionless, reflecting the ongoing range-trading. The pair retreated from around the 23.6% retracement of its November/January rally, with the next Fibonacci support and probable bearish target at 1.2065.

Support levels: 1.2100 1.2065 1.2020

Resistance levels: 1.2170 1.2215 1.2260

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.