EUR/USD Forecast: Pressure mounts ahead of Powell

EUR/USD Current Price: 1.1887

- Turmoil in Turkey keeps fueling risk-aversion across financial markets.

- US Federal Reserve chief Powell set to testify on the CARES Act.

- EUR/USD holds at the lower end of its latest range with a bearish stance.

The dollar returned with a vengeance this Tuesday, as risk aversion rules. The dollar appreciated against high yielding rivals and fell against safe-haven ones, as equities turned south and US Treasury yields retreated further. The EUR/USD pair fell to 1.1876, bouncing just modestly ahead of Wall Street’s opening. Turkey stocks, particularly bank-related ones are still in sell-off mode after President Erdogan fired the central bank’s chief over the weekend. European indexes felt the pain, although trading away from intraday lows.

The macroeconomic calendar has been empty in Europe, while the US has minor figures scheduled for today. The country already published the Q4 Current Account, which printed a deficit of $-188.5 billion as expected. It will later release February New Home Sales, foreseen down by 6.5%.

More relevant, US Federal Reserve chief Jerome Powell and Treasury Secretary Janet Yellen will testify on the CARES Act. Powell’s prepared remarks have already been published, but questions from lawmakers are expected.

EUR/USD short-term technical outlook

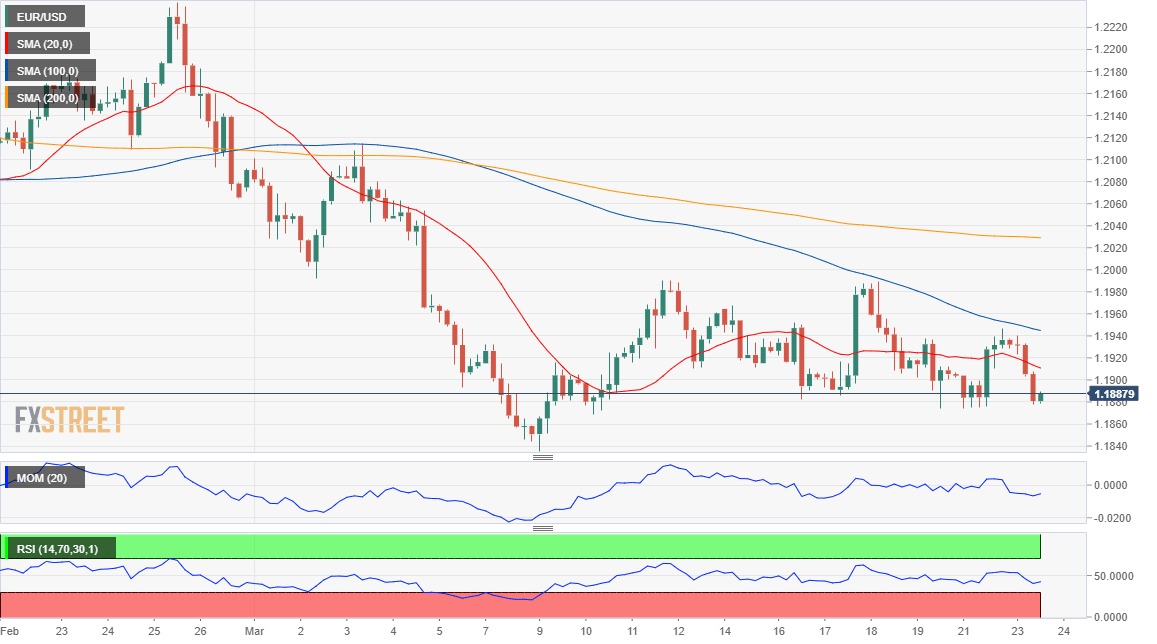

The EUR/USD pair trades in the 1.1880 price zone, maintaining its negative tone in the near-term. The 4-hour chart shows that the pair is back below its 20 SMA, which gains bearish strength. Technical indicators gyrated south, with the Momentum and the RSI supporting additional declines, mainly on a break below 1.1871, the weekly low.

Support levels: 1.1870 1.1830 1.1790

Resistance levels: 1.1970 1.2010 1.2050

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.