EUR/USD Forecast: Near-term selling interest picks up

EUR/USD Current Price: 1.0467

- Uncertainty about what the US Federal Reserve may do next dented the market mood.

- German macroeconomic data brought a small light of hope for the Union.

- EUR/USD has turned bearish in the near term and could pierce the 1.0400 threshold.

The EUR/USD pair trades a handful of pips below the 1.0500 mark, having accelerated its slide in the last trading session of the day. The market sentiment was generally poor, with European and American indexes spending the day in the red and providing support to the US Dollar. There was no particular catalyst behind the dismal mood, although uncertainty about the looming US Federal Reserve’s monetary decision could explain investors’ caution.

The central bank is expected to slow the pace of quantitative tightening at its December 14 meeting, while the European Central Bank will do the same one day after. The latter could deliver a 75 bps rate hike, as opposed to the Fed, the ECB has been taking a cautious approach to quantitative tightening. Nevertheless, investors fear quantitative tightening will result in a long-lasting recession, despite the latest macroeconomic figures suggesting the opposite. In fact, resilient economic performance could favor more aggressive actions from the Fed.

Data-wise, Germany published October Factory Orders, which rose 0.8% MoM, while the year decline was 3.2%, much better than the 7.5% slide expected. Across the pond, the US released the October Goods and Service Trade Balance, which posted a deficit of $78.2 billion, slightly better than the $79.1 billion anticipated.

On Wednesday, Germany will release October Industrial Production, while the Euro Area will publish the final estimate of its Q3 Gross Domestic Product, expected to be confirmed at 0.2% QoQ. The US will release Q3 Nonfarm Productivity and Unit Labor Cost for the same quarter, later followed by October Consumer Credit Change.

EUR/USD short-term technical outlook

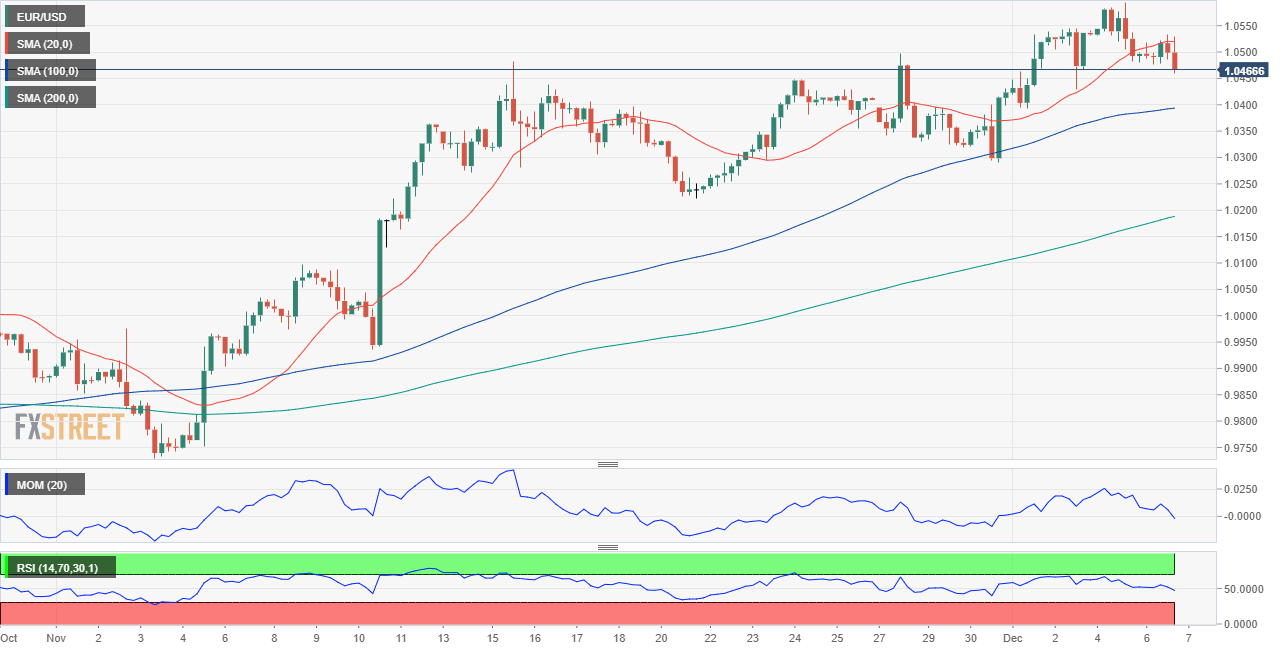

The EUR/USD pair trades near its weekly low, pretty much unchanged from its daily opening. Technical readings in the daily chart, however, are far from suggesting a bearish extension. The pair is well above bullish moving averages, with the 20 SMA crossing above the 200 SMA, both at around 1.0360. The 100 SMA, in the meantime, hovers around1.0055, while the Momentum indicator heads south, although above its midline. Finally, the RSI indicator consolidates around 64.

The risk skews to the downside in the near term, and according to the 4-hour chart. Technical indicators aim lower just below their midlines after a failed attempt to advance into positive territory. Furthermore, a flat 20 SMA capped advances throughout the day, currently providing dynamic resistance at around 1.0520.

The 4-hour chart shows that the pair is currently battling to overcome a still bullish 20 SMA while the longer moving averages maintain their upward slopes below the current level. At the same time, technical indicators turned higher within neutral levels, favoring a bullish extension without confirming it. The longer moving averages maintain their upward slopes below the current level, but there’s enough room for another leg south before buyers return to the lid.

Support levels: 1.0445 1.0400 1.0360

Resistance levels: 1.0490 1.0525 1.0560

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.