EUR/USD Forecast: Market jitters to limit Euro's upside

- EUR/USD has lost its traction after having opened with a bullish gap.

- Markets remain cautious ahead of the Fed's policy announcements on Wednesday.

- The pair's near-term technical outlook paints a mixed picture.

EUR/USD has lost its traction and declined below 1.0700 despite having opened the week with a bullish gap. As investors try to understand whether major central banks will be able to contain the global financial crisis, risk flows struggle to gain traction.

Over the weekend, UBS Group AG has agreed to buy Credit Suisse Group AG. UBS will reportedly pay $3.23 billion for Credit Suisse and assume up to $5.4 billion in losses in a deal that is expected to close by the end of 2023. Moreover, the Federal Reserve (Fed) announced that it will restart offering daily swaps to the Bank of Canada (BoC), the Bank of Japan (BoJ), the Swiss National Bank (SNB) and the European Central Bank (ECB) to assist those banks with additional liquidity needs.

Although these developments helped the market mood improve at the beginning of the week, safe-haven flows seem to have returned in the European morning. As of writing, US stock index futures were down between 0.6% and 1.1% while the Euro Stoxx 50 Futures were down 1.2%.

Investors might be assessing the latest action taken by the major central banks as a sign that the liquidity issues could be deeper than initially thought. In fact, the benchmark 10-year US Treasury bond yield is already down 3% on the day and the CME Group FedWatch Tool shows that markets are pricing in a more than 50% probability of the Fed leaving its policy rate unchanged following its March meeting on Wednesday.

In the current market environment, dovish Fed bets are forcing the US Dollar to stay on the back foot. Nevertheless, EUR/USD could have a difficult time benefiting from the broad USD weakness in case investors continue to seek refuge.

EUR/USD Technical Analysis

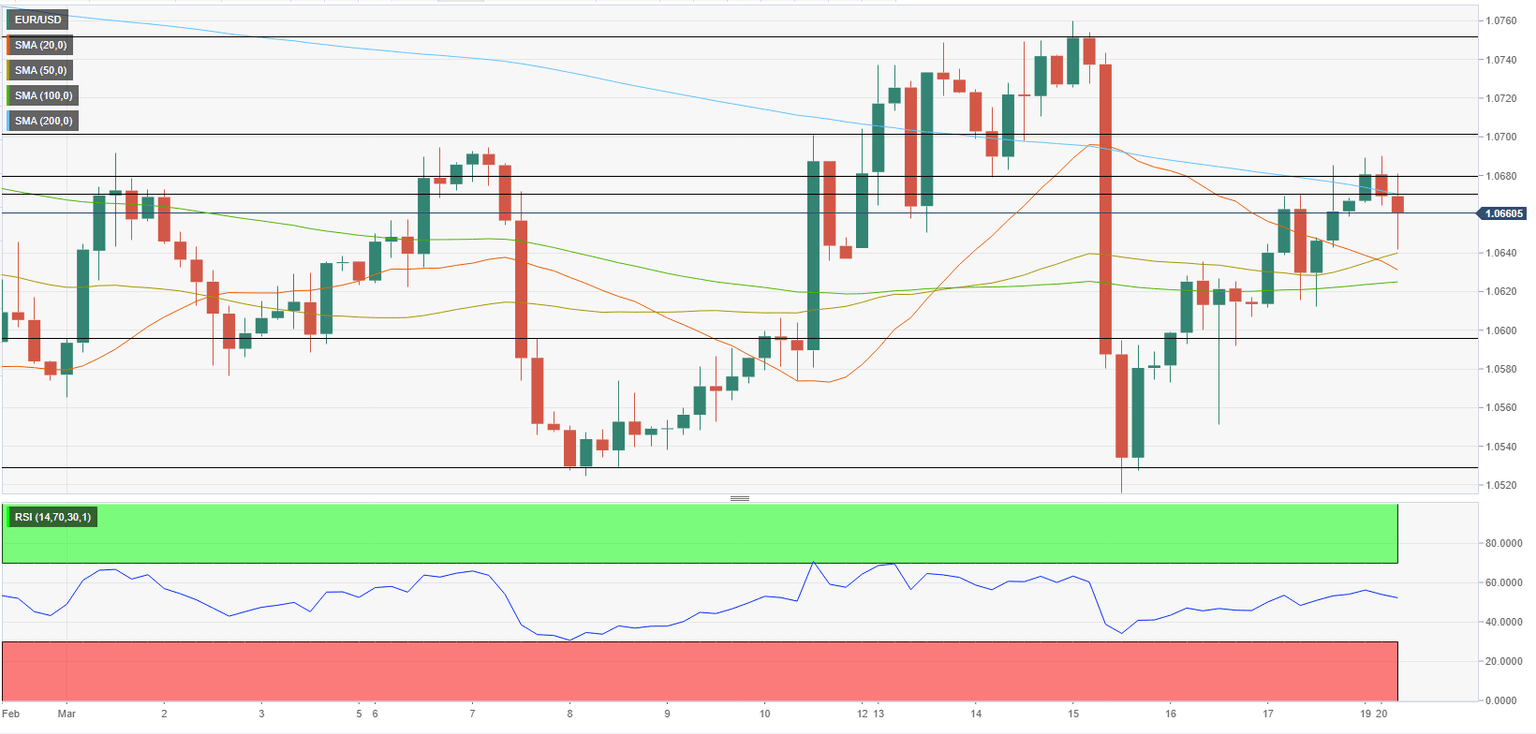

With the latest pullback, the Relative Strength Index (RSI) indicator on the four-hour chart declined toward 50, pointing to a loss of bullish momentum in the near term. On the upside, 1.0670 (200-period Simple Moving Average(SMA)) aligns as initial resistance ahead of 1.0700 (psychological level, static level). If the pair rises above that latter resistance and starts using it as support, it could target 1.0750 (static level).

On the downside, first support is located at 1.0640 (static level, 50-period SMA) before 1.0620 (100-period SMA) and 1.0600 (psychological level, static level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.