EUR/USD Forecast: Further gains look likely above 1.1000

- EUR/USD faltered once again around 1.1000.

- The dollar gathered pace on dwindling rate cut bets.

- US inflation surprised to the upside in December.

EUR/USD failed to revisit or surpass the psychological 1.1000 barrier on Thursday, sparking a marked corrective move soon after US inflation figures rose more than expected in December.

Indeed, a firmer-than-estimated US CPI in the last month of 2023 lent support to the greenback as investors trimmed their expectations that the Federal Reserve might start cutting its FFTR in Q2.

The daily downtick in the pair also came amidst the mixed performance of US yields across different maturities as investors repriced their bets on potential rate cuts.

Speaking about the Fed, L. Mester (Cleveland) conveyed that the Fed has not reached the point of considering rate cuts; she emphasized the need for additional evidence indicating the economy's progress as anticipated. Mester added that the current assessment by the Fed revolves around determining the duration for which high interest rates and restrictive policies should be maintained, while she highlighted that a sustained decline in inflation is a prerequisite for any discussion about a potential rate cut. Furthermore, she highlighted the importance of the Fed fine-tuning its policy to achieve a soft landing.

Absent data releases in the domestic calendar, the US docket saw headline CPI rise 3.4% in the year to December and 3.9% from a year earlier when it comes to Core CPI. In addition, weekly Initial Claims rose by 202K in the week to January 6.

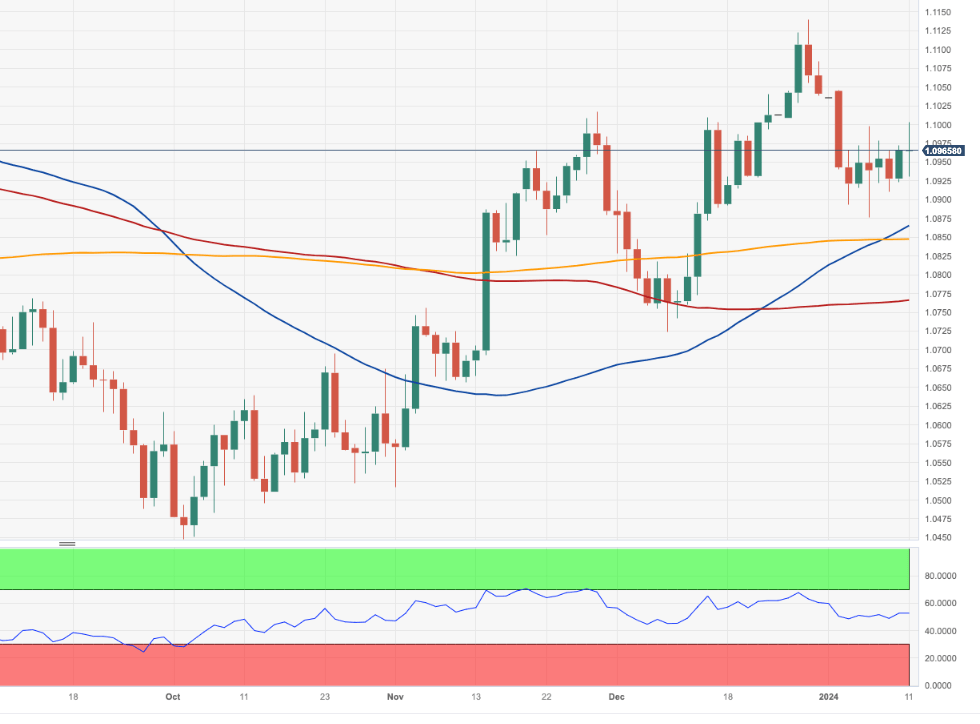

EUR/USD daily chart

EUR/USD short-term technical outlook

If the EUR/USD continues to decline and breaks through the 2024 low of 1.0876 (January 5), it may come into contact with the 200-day SMA at 1.0846. If the latter is lost, the December 2023 low of 1.0723 (December 8) may return ahead of the weekly low of 1.0495 (October 13, 2023), which is followed by the 2023 low of 1.0448 (October 3) and the round level of 1.0400. SO far, the pair's optimistic outlook is predicted to remain unchanged above the 200-day SMA.

The 4-hour chart continues to show some short-term consolidation. The breakout of this theme exposes the area of recent tops at 1.0998. This region being surpassed indicates that 1.1139 will most likely be visited. The MACD has largely recovered, indicating a short-term bounce, while the RSI has advanced past 53.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.