EUR/USD Forecast: Fresh multi-month lows at sight

EUR/USD Current Price: 1.1884

- EU June Economic Sentiment Indicator improved to 117.9 from 114.5.

- US Consumer Confidence expected to have improved in June.

- EUR/USD is technically bearish and could lose the 1.1800 level.

The EUR/USD pair fell to a fresh one-week low of 1.1882 amid a firmer greenback helped by higher US Treasury yields, up ahead of critical employment data. European stocks are currently advancing, trimming early losses and providing support to Wall Street.

The EU published the June Economic Sentiment Indicator, which improved to 117.9 from 114.5 in the previous month. The German Consumer Price Index edged lower in June, according to preliminary estimates, printing at0.4% MoM and 2.3% YoY. The focus during the American session will be on June CB Consumer Confidence, foreseen at 118.9 from the previous 117.2.

EUR/USD short-term technical outlook

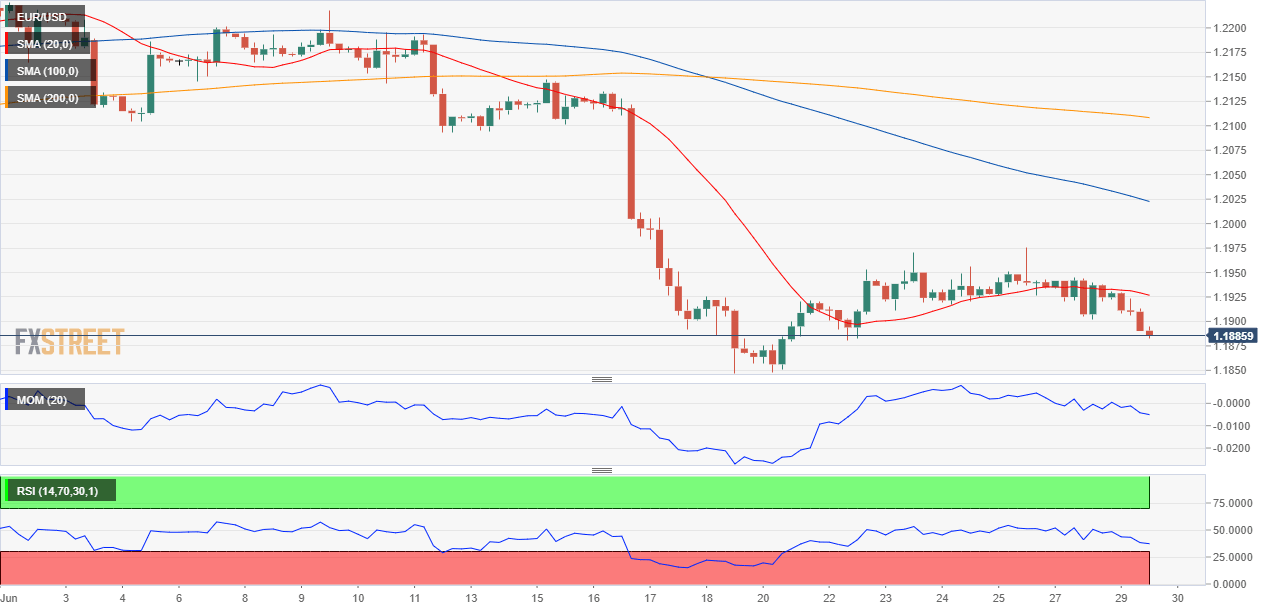

The EUR/USD pair is poised to extend its decline, after losing the 1.1920 level where the pair has the 61.8% retracement of its March/Mary advance. The 4-hour chart shows that a mildly bearish 20 SMA stands a few pips above the mentioned Fibonacci level, while the longer moving averages head firmly lower, far above the current level. Technical indicators accelerated their slides within negative levels, favoring a break through the recent lows in the 1.1840 price zone.

Support levels: 1.1840 1.1795 1.1750

Resistance levels: 1.1920 1.1960 1.2000

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.