EUR/USD Forecast: Euro's recovery prospects diminish

- EUR/USD has turned bearish following Wednesday's sharp decline.

- Risk-averse market atmosphere doesn't allow the euro to find demand.

- 1.0380 aligns as the next bearish target for the pair.

EUR/USD has failed to stage a convincing rebound after having closed the previous two days deep in negative territory. The pair is likely to stay on the back foot with safe-haven flows dominating the financial markets on Thursday.

While speaking at the European Central Bank's (ECB) annual Forum on Central Banking on Wednesday, ECB President Christine Lagarde refrained from offering any fresh insights regarding the bank's next policy move. On the other hand, FOMC Chairman Jerome Powell reiterated that they will remain committed to taming inflation even if that were to result in a slowdown in economic growth. Powell further noted that the dollar strength was "disinflationary at the margins."

Reflecting the positive impact of Powell's comments on the greenback's market valuation, the US Dollar Index (DXY) climbed to its strongest level in two weeks above 105.00.

Ahead of the Personal Consumption Expenditures (PCE) Price Index data, the Fed's preferred gauge of inflation, from the US, the DXY stays relatively quiet, allowing EUR/USD to stay in its daily range.

Nevertheless, the Euro Stoxx 600 is down 1.5% and US stock index futures are losing between 1.0% and 1.4% in the European session. In case markets remain risk-averse in the second half of the day, the pair is likely to stay on the back foot.

Meanwhile, the data from Germany showed that the Unemployment Rate unexpectedly rose to 5.3% in June from 5% in May with the number of unemployed increasing by 133,000 during that period. The disappointing German jobs report seems to be weighing on the euro as well.

Unless there is a significant positive shift in market mood, sellers are likely to retain control of EUR/USD action.

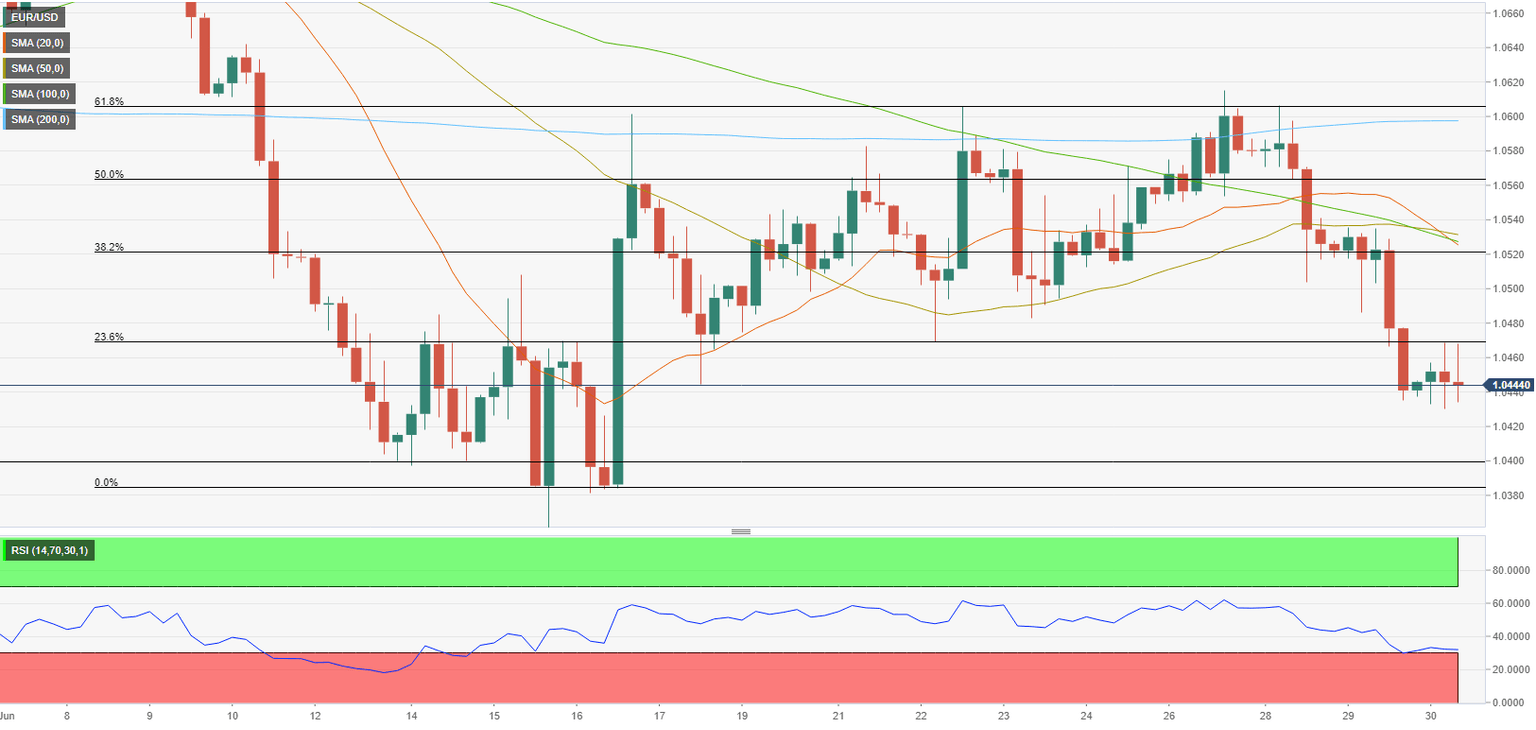

EUR/USD Technical Analysis

The pair is facing immediate resistance at 1.0470 (Fibonacci 23.6% retracement of the latest downtrend). In case the pair fails to reclaim that level, it is likely to extend its slide toward 1.0400 (psychological level), 1.0380 (end-point of the latest downtrend) and 1.0360 (June 15 low). The key 1.0340-50 multi-month lows will be key battlegrounds for bulls and bears.

On the upside, the pair could recover toward 1.0500 (psychological level) and 1.0520 (Fibonacci 38.2% retracement, 50-period SMA, 100-period SMA on the four-hour chart) if buyers managed to flip 1.0470 into support.

It's worth noting that the Relative Strength Index (RSI) indicator holds above 30 for now, suggesting that the pair has more room on the downside before turning technically oversold.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.