EUR/USD Forecast: Euro set to surrender to Nonfarm Payrolls, levels to watch

- EUR/USD has extended its falls as investors price in tighter Fed policy.

- US Nonfarm Payrolls are set to show strong job and wage growth in the US.

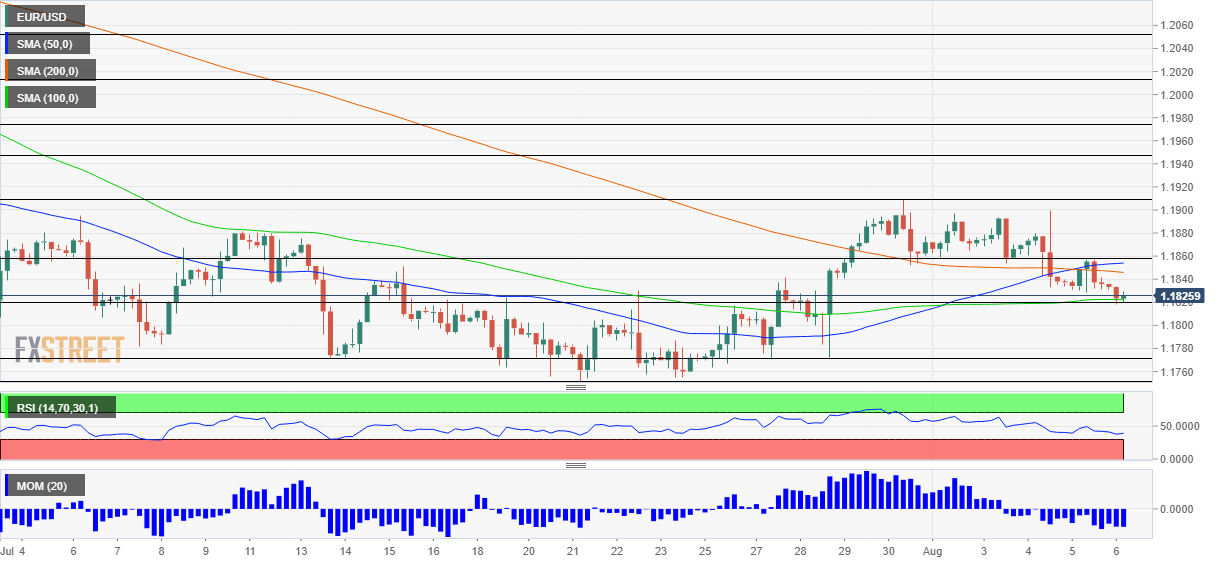

- Friday's four-hour chart is showing bears are gaining momentum.

Is 1.18 in danger? The Federal Reserve's hawkishness has ended EUR/USD's advance – and Nonfarm Payrolls could send it further down.

The dollar has extended its upward march in an extended response to upbeat comments by Fed Vice-Chair Richard Clarida and several of his colleagues. Clarida foresees an announcement on tapering coming this year and sees inflation risks to the upside. The bank buys $120 billion worth of bonds every month and prospects of printing fewer greenbacks are boosting the currency.

The Federal Reserve Sets the Pace: The world's central bank prepares to taper

Other colleagues at the Fed such as Mary Daly and Christopher Waller also moved in that direction, while only uber-dove Neel Kashkari painted a gloomy picture of nine million Americans out of work. Markets are focusing on the growing voices of the hawks. Returns on 10-year Treasury yields have risen to 1.24%, adding to dollar strength.

Kashkari's comments on employment will come to a test on Friday. All eyes are on July's Nonfarm Payrolls report, which is projected to show an increase of 870,000 jobs, a robust increase and more than that seen in June. However, estimates range from 350,000 to 1.2 million and leading indicators have been mixed, adding to the confusion.

Apart from the headline number, Average Earnings are of growing importance with the focus on inflation. The Fed assesses that rising prices are transitory – related to the rapid reopening. However, if costs creep into wages, it could make inflation more persistent. Annual earnings are forecast to rise from 3.6% to 3.8%.

Nonfarm Payrolls Preview: Why the dollar could surge in (almost) any scenario

US July Nonfarm Payrolls Preview: Analyzing major pairs' reaction to NFP surprises

Coronavirus cases continue rising in the US and also in Europe, albeit to a lesser extent. Worries about covid in China – where restrictions are more severe – seem to have been brushed off for now, and so has progress on an infrastructure bill in Washington.

All eyes are on Nonfarm Payrolls. Strong figures would send the dollar higher on expectations that the Fed would have to act sooner than later, while a disappointment would weigh on the greenback. Momentum is with the dollar, and even a small miss could keep it underpinned.

EUR/USD Technical Analysis

Euro/dollar has slipped toward 1.18, the lowest level in over a week. It has begun setting lower lows after recording lower highs earlier in the week. Moreover, momentum on the four-hour chart has turned to the downside and the pair is about to slip below the 100 Simple Moving Average.

Support awaits at the daily low of 1.1820. It is followed by the swing low of 1.1775 recorded last week and then by the July low of 1.1750. Close by, 1.1740, 1.1717 and the round 1.17 level are the next lines to watch – all played a role early in the year.

Resistance is at 1.1860, which was the peak of a recovery attempt this week. It is followed by 1.1910, the July high, and then by 1.1945 and 1.1975.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.