EUR/USD Forecast: Euro remains fragile ahead of key inflation data

- EUR/USD consolidates losses below 1.0900 following Thursday's drop.

- Inflation data from the EU and the US will be watched closely by market participants.

- Quarter-end flows could ramp up market volatility later in the day.

EUR/USD suffered large losses on Thursday as the US Dollar continued to gather strength against its rivals on robust macroeconomic data releases. The pair trades below 1.0900 early Friday as investors stay on the sidelines while waiting for key inflation data.

The Core Harmonized Index of Consumer Prices (HICP) in the Eurozone is forecast to rise 0.7% in June, up sharply from the 0.2% increase recorded in May. Following the hot inflation figures from Spain and Germany earlier this week, a strong HICP growth in the Eurozone shouldn't be surprising. Hence, the Euro could continue to weaken on a smaller-than-forecast increase but could find it difficult to rebound unless there is a significant upside surprise in the monthly Core HICP.

In the second half of the day, the Personal Consumption Expenditures (PCE) Price Index, the Fed's preferred gauge of inflation, will be featured in the US economic docket.

On Thursday, the annualized Gross Domestic Product (GDP) growth for the first quarter got revised higher to 2% from 1.3% in the US Bureau of Economic Analysis' previous estimate. Additionally, the number of first-time applications for unemployment benefits fell nearly 30,000.

As data from the US highlight the resilience of the economy, the Federal Reserve (Fed) could continue to stay focused on taming inflation. The CME Group FedWatch Tool shows that markets are currently pricing in a less than 40% probability of the Fed raising the policy rate by a total of 50 basis points in the remainder of the year. Hence, an increase of 0.5% or higher in the monthly Core PCE Price Index could attract hawkish Fed bets and provide a boost to the USD.

It's also worth mentioning that the market volatility could rise toward the end of the European session amid quarter-end flows. Inter-market correlations could weaken heading into the weekend, distorting the impact of the data releases on the pair.

EUR/USD Technical Analysis

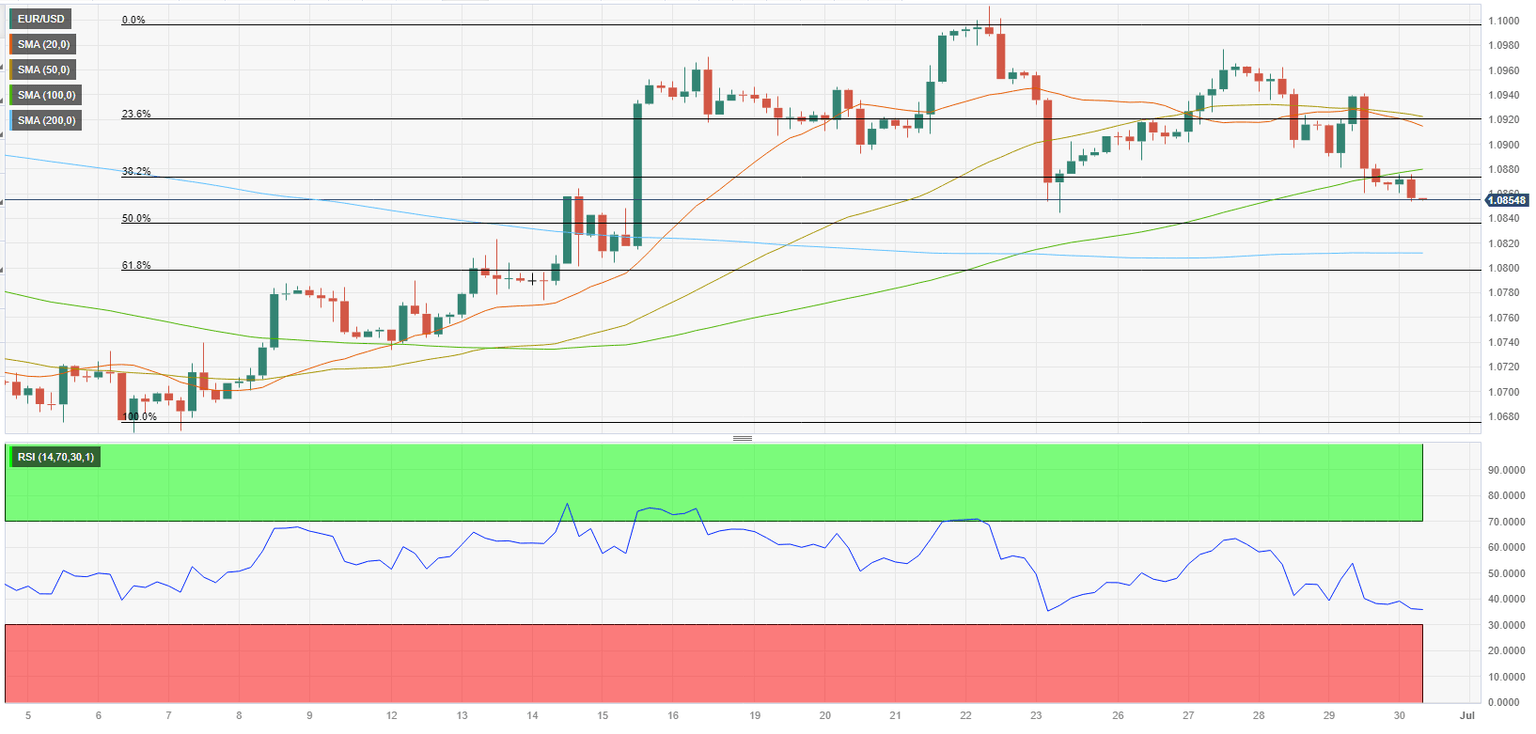

EUR/USD stays below 1.0870, where the Fibonacci 23.6% retracement of the latest uptrend and the 100-period Simple Moving Average (SMA) on the 4-hour chart are located. Meanwhile, the Relative Strength Index (RSI) indicator on the same chart stays well below 50, reflecting the bearish bias.

1.0840 (Fibonacci 50% retracement) aligns as next support before 1.0815 (200-period SMA) and 1.0800 (psychological level, Fibonacci 61.8% retracement).

In case EUR/USD manages to stabilize above 1.0870, it could face next resistance at 1.0900 (psychological level) before 1.0920/30 (Fibonacci 23.6% retracement, 20-period SMA, 50-period SMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.