EUR/USD Forecast: Euro needs another risk rally to reclaim parity

- EUR/USD has lost its traction in the European morning on Wednesday.

- The risk-averse market environment doesn't allow the euro to gather strength.

- Eyes on US ADP private sector employment report and ISM Services PMI.

EUR/USD has turned south and declined below 0.9950 after having tested parity earlier in the day. Although the technical outlook suggests that the pair is likely to remain bullish in the short term, it could have a difficult time regaining its traction unless risk flows return to markets.

On Tuesday, the dollar faced heavy selling pressure as Wall Street's main indexes surged higher after the opening bell. In the absence of high-impact macroeconomic data releases, the risk-on market mood stayed intact and the US Dollar Index lost more than 1%.

Escalating geopolitical tensions seem to be causing investors to move away from risk-sensitive assets mid-week. In response to Washington's decision to send additional military aid to Ukraine, Russia's ambassador to the US warned that the danger of a direct clash between Russia and the west had escalated. Meanwhile, the European Union is expected to reach an agreement on new sanctions against Russia, including the oil price cap.

Reflecting the souring mood, US stock index futures are down between 0.5% and 0.6%. Later in the session, the ADP Employment Change and the ISM Services PMI data will be featured in the US economic docket.

The Employment and the Prices Paid components of the ISM survey will be watched closely by market participants. Earlier in the week, the ISM Manufacturing PMI report showed that employment in the sector contracted while price pressure continued to ease in September. In case the ISM's publication paints a similar picture regarding the service sector, the dollar could lose its footing and open the door for another leg higher in EUR/USD. On the other hand, the greenback is likely to continue to outperform its rivals in case safe-haven flows continue to dominate the markets after the data.

EUR/USD Technical Analysis

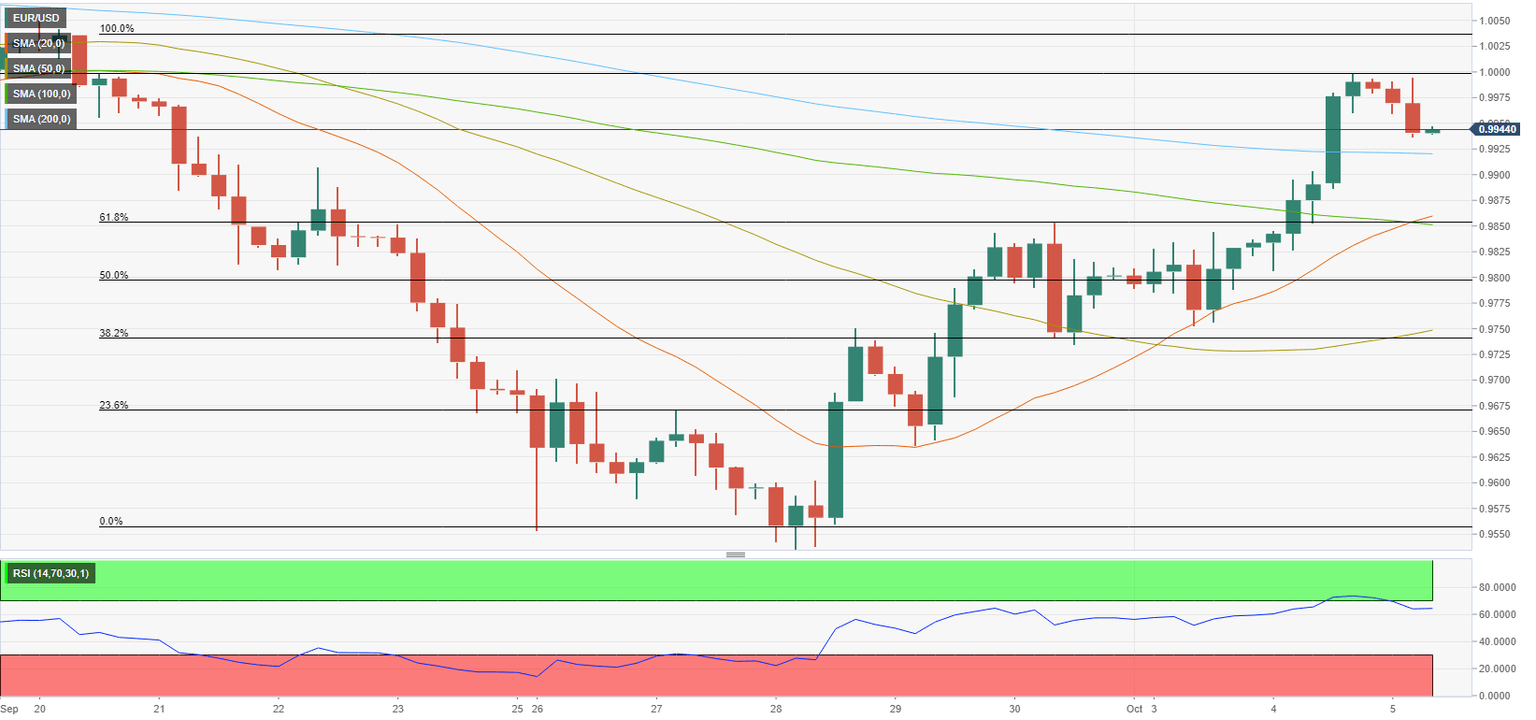

The Relative Strength Index (RSI) indicator on the four-hour chart holds above 60 and EUR/USD stays comfortably above the 200-period SMA, suggesting that buyers look to retain control of the pair's action.

On the upside, 1.0000 (psychological level) aligns as key resistance. In case EUR/USD rises above that level, it could target 1.0040 (beginning point of the latest downtrend) and 1.0100 (psychological level).

0.9950 (former resistance, static level) forms immediate support before 0.9920 (200-period SMA). A four-hour close below the latter could be taken as a significant bearish development and trigger a downward correction toward 0.9900 (psychological level) and 0.9850 (100-period SMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.