EUR/USD Forecast: Euro defines consolidation range before next breakout

- EUR/USD continues to fluctuate in a tight channel above 1.1200.

- Sharp upsurge seen in EUR/GBP helps the Euro stay resilient against its rivals.

- An extended risk rally could allow the pair to stretch higher.

EUR/USD dropped a few pips below 1.1200 in the early European session but managed to erase its losses. The pair stays in the 1.1200 to 1.1250 consolidation range as investors await the next catalyst.

The renewed US Dollar (USD) strength caused EUR/USD to edge lower in the European morning. However, the softer-than-expected inflation data from the UK triggered a bullish rally in the EUR/GBP pair, suggesting that the Euro captured some of the capital outflows out of Pound Sterling. In turn, EUR/USD didn't have a hard time finding support.

In the second half of the day, Housing Starts and Building Permits data will be featured in the US economic docket. Following May's impressive 21.7% increase, Housing Starts are forecast to rise 7.2% in June. A bigger-than-forecast increase could reaffirm the steady improvement in the housing market conditions and provide a boost to the US Dollar (USD).

The European Central Bank's (ECB) quiet period will start on Thursday. Hence, market participants will keep a close eye on comments from ECB policymakers. Markets fully price in a 25 basis points increase in ECB's key rates in July, and investors will try to figure out whether one more hike will be required in September.

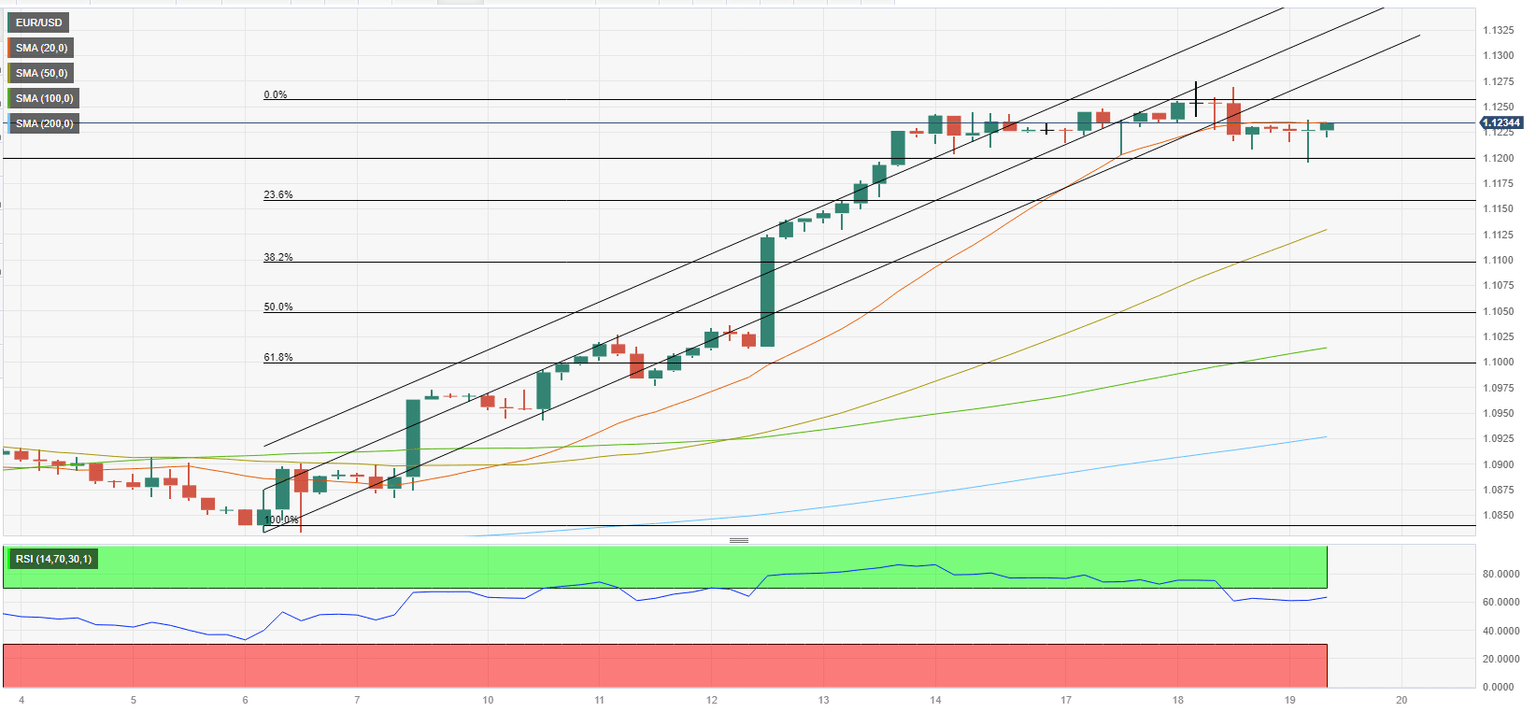

EUR/USD Technical Analysis

EUR/USD broke below the ascending regression channel coming from early July and the Relative Strength Index (RSI) indicator on the 4-hour chart declined to 60, reflecting a loss of bullish momentum. Moreover, the last four 4-hour candles closed below the 20-period Simple Moving Average (SMA).

On the downside, 1.1200 (daily low, psychological level) aligns as first support ahead of 1.1160 (Fibonacci 23.6% retracement level of the latest uptrend) and 1.1130 (50-period SMA).

The upper-limit of the consolidation channel forms stiff resistance at 1.1250 before 1.1270 (static level from March 2022, multi-month high set on Tuesday, lower limit of the ascending channel) and 1.1300 (psychological level).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.