EUR/USD Forecast: Euro could stay in consolidation in near term

- EUR/USD moves sideways near 1.0550 after closing the previous week virtually unchanged.

- Investors could refrain from taking large positions ahead of the ECB meeting.

- The near-term technical outlook fails to offer a direction clue.

EUR/USD touched its highest level since mid-November above 1.0600 on Friday but lost its traction to end the week virtually unchanged. The pair holds steady at around 1.0550 in the European morning on Monday.

Euro PRICE Last 7 days

The table below shows the percentage change of Euro (EUR) against listed major currencies last 7 days. Euro was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.13% | -0.19% | 0.42% | 1.20% | 1.37% | 1.37% | -0.17% | |

| EUR | -0.13% | -0.36% | 0.32% | 1.08% | 1.32% | 1.24% | -0.28% | |

| GBP | 0.19% | 0.36% | 0.65% | 1.44% | 1.71% | 1.61% | 0.06% | |

| JPY | -0.42% | -0.32% | -0.65% | 0.78% | 0.98% | 0.98% | -0.65% | |

| CAD | -1.20% | -1.08% | -1.44% | -0.78% | 0.32% | 0.17% | -1.37% | |

| AUD | -1.37% | -1.32% | -1.71% | -0.98% | -0.32% | -0.09% | -1.61% | |

| NZD | -1.37% | -1.24% | -1.61% | -0.98% | -0.17% | 0.09% | -1.50% | |

| CHF | 0.17% | 0.28% | -0.06% | 0.65% | 1.37% | 1.61% | 1.50% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

The upbeat labor market data for November helped the US Dollar (USD) stay resilient against its rivals heading into the weekend and made it difficult for EUR/USD to hold its ground.

The US Bureau of Labor Statistics (BLS) announced on Friday that Nonfarm Payrolls (NFP) in the US rose by 227,000 in November. This reading followed the 36,000 increase reported in October (revised from 12,000) and surpassed the market expectation of 200,000. On a negative note, the Unemployment Rate edged higher to 4.2% from 4.1% in the same period. Finally, the annual wage inflation, as measured by the change in the Average Hourly Earnings, held steady at 4%, coming in above analysts' estimate of 3.9%.

The economic calendar will not offer any high-impact data releases that could influence EUR/USD's action on Monday. Later in the week, November Consumer Price Index (CPI) data from the US could trigger a big reaction in the pair. On Thursday, the European Central Bank (ECB) will announce its policy decisions after the last meeting of the year.

EUR/USD Technical Analysis

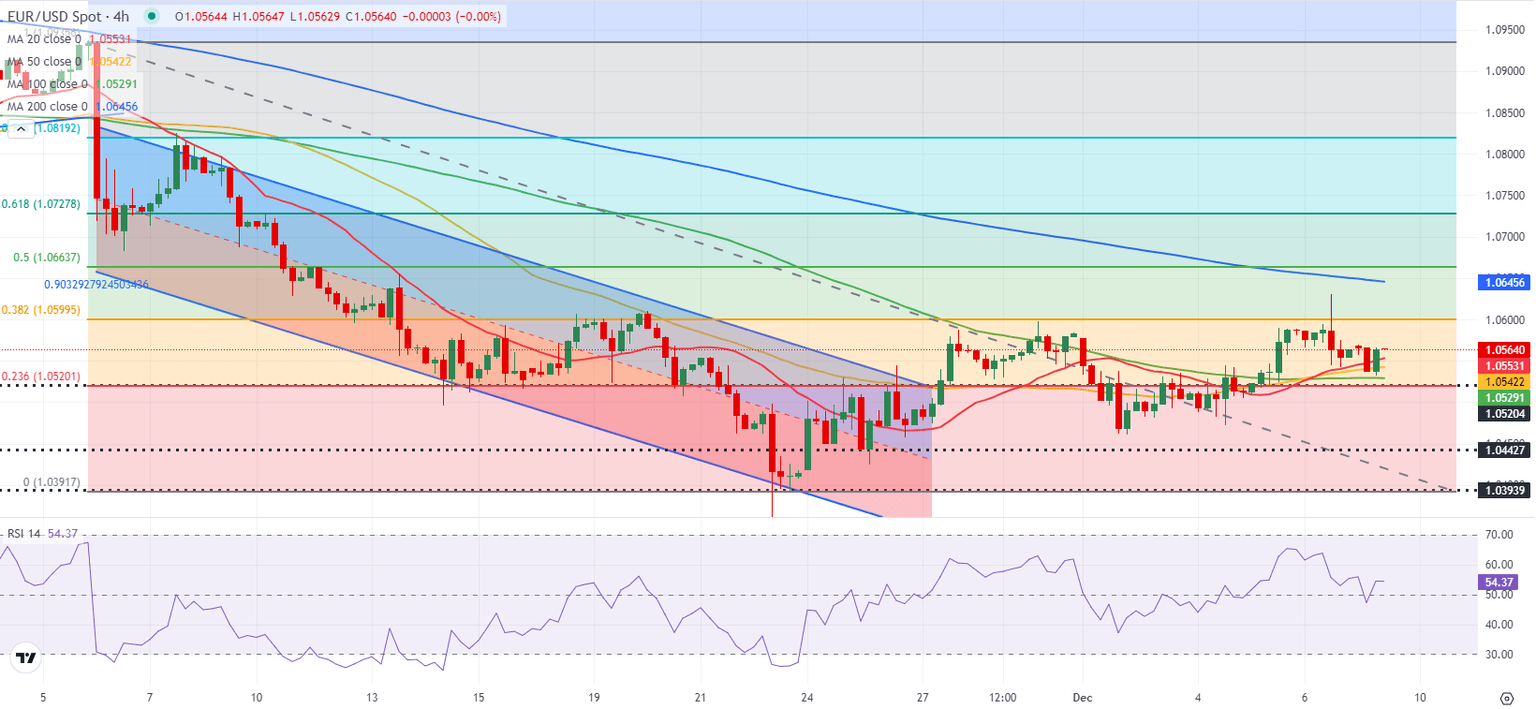

The Relative Strength Index (RSI) indicator on the 4-hour chart stays slightly above 50 and EUR/USD holds steady above the 100-period Simple Moving Average (SMA), reflecting sellers' hesitancy.

On the upside, first resistance is located at 1.0600 (Fibonacci 38.2% retracement of the latest downtrend) ahead of 1.0650-1.0660 (200-period Simple Moving Average (SMA), Fibonacci 50% retracement) and 1.0730 (Fibonacci 61.8% retracement).

Looking south, supports could be spotted at 1.0520-1.0530 (100-period SMA, 50-period SMA, 20-period SMA, Fibonacci 23.6% retracement), 1.0500 (psychological level, static level) and 1.0440 (static level).

Euro FAQs

The Euro is the currency for the 20 European Union countries that belong to the Eurozone. It is the second most heavily traded currency in the world behind the US Dollar. In 2022, it accounted for 31% of all foreign exchange transactions, with an average daily turnover of over $2.2 trillion a day, according to data from the Bank of International Settlements. EUR/USD is the most heavily traded currency pair in the world, accounting for an estimated 30% of all transactions, followed by EUR/JPY (4%), EUR/GBP (3%) and EUR/AUD (2%).

(This story was corrected on December 9 at 08:41 GMT to say EUR/USD holds steady at around 1.0550 in the European morning on Monday, not Friday.)

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.