EUR/USD Forecast: Euro could remain directionless ahead of key data releases

- EUR/USD stabilized near 1.0800 at the beginning of the week.

- Improving risk mood could help the pair limit its losses.

- The economic calendar will feature several high-impact data releases this week.

EUR/USD has gone into a consolidation phase near 1.0800 early Monday after posting losses for the sixth straight week last week. The pair's near-term technical outlook doesn't yest point to a buildup of recovery momentum and investors could refrain from taking large positions ahead of this week's critical macroeconomic data releases from the Euro area and the US.

Federal Reserve (Fed) Chair Jerome Powell reiterated that they are prepared to raise rates further if appropriate in his opening remarks at the annual Jackson Hole Economic Symposium on Friday. He further noted that they will proceed carefully when deciding to hike again or hold the interest rate steady. Although the US Dollar (USD) gathered strength with the initial reaction to these comments, the risk-positive market atmosphere caused the currency to erase its gains, allowing EUR/USD to stage a rebound ahead of the weekend.

Euro price in the last 7 days

The table below shows the percentage change of Euro (EUR) against listed major currencies in the last 7 days. Euro was the weakest against the US Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | 0.69% | 1.31% | 0.43% | 0.09% | 0.84% | 0.42% | 0.21% | |

| EUR | -0.68% | 0.63% | -0.25% | -0.60% | 0.16% | -0.30% | -0.48% | |

| GBP | -1.33% | -0.63% | -0.89% | -1.29% | -0.47% | -0.94% | -1.12% | |

| CAD | -0.44% | 0.26% | 0.88% | -0.41% | 0.41% | -0.05% | -0.23% | |

| AUD | -0.08% | 0.66% | 1.29% | 0.39% | 0.80% | 0.36% | 0.18% | |

| JPY | -0.84% | -0.14% | 0.48% | -0.41% | -0.82% | -0.43% | -0.64% | |

| NZD | -0.38% | 0.27% | 0.89% | 0.01% | -0.33% | 0.43% | -0.20% | |

| CHF | -0.22% | 0.48% | 1.10% | 0.23% | -0.18% | 0.63% | 0.18% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

In the meantime, European Central Bank President Christine Lagarde didn't offer any fresh insights regarding the near-term policy outlook. Lagarde said late Friday that the ECB will set interest rates at "sufficiently restrictive levels for as long as necessary" to ensure price stability.

During the European trading hours, US stock index futures trade in positive territory and the Euro Stoxx 50 Index rises more than 0.5%, pointing to an upbeat risk mood. In case risk flows start to dominate the action in the second half of the day, the USD is likely to have a hard time finding demand.

Consumer Confidence and JOLTS Job Openings data from the US will be watched closely by market participants ahead of German inflation and ADP's US private sector employment report on Wednesday. Later in the week, inflation data from the Euro area, PCE inflation readings from the US and the US August jobs report could significantly influence EUR/USD's action.

EUR/USD Technical Analysis

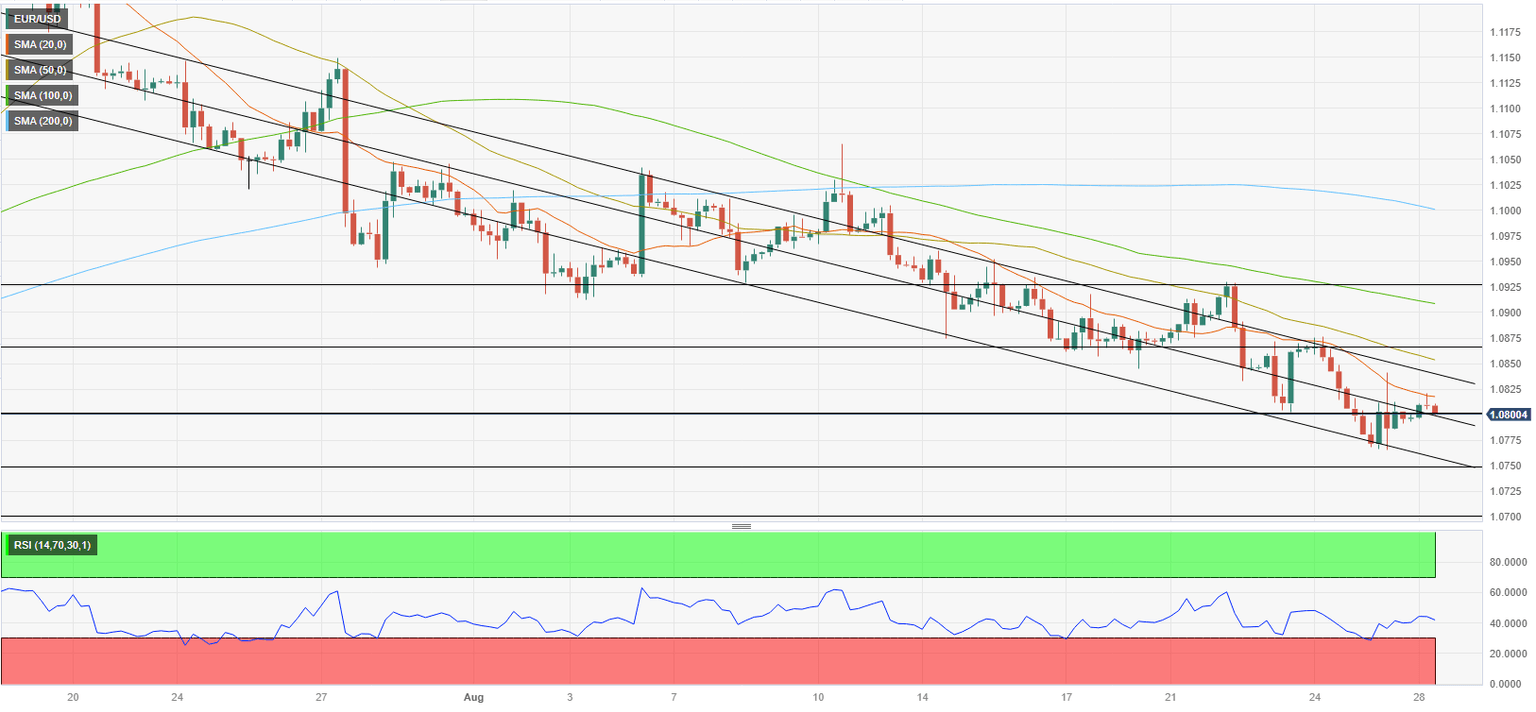

EUR/USD stays within the descending regression channel and the Relative Strength Index (RSI) indicator on the 4-hour chart stays flat below 50, pointing to a slightly bearish bias in the near term.

1.0800 (psychological level, static level, mid-point of the descending channel) aligns as a key pivot level. In case EUR/USD falls below that level and confirms it as resistance, it could continue to stretch lower toward 1.0770 (static level) and 1.0740 (static level, lower limit of the descending channel).

On the upside, 1.0850 (50-period Simple Moving Average (SMA), upper limit of the descending channel) could be set as next recovery target before 1.0900 (psychological level, 100-period SMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.