EUR/USD Forecast: Euro could have a hard time clearing 1.0750

- EUR/USD has regained its traction in the European morning.

- Improving risk mood seems to be helping the pair edge higher.

- Investors could remain reluctant to bet on further Euro strength ahead of Fed.

Following a consolidation phase at around 1.0700 in the Asian session, EUR/USD has regained its traction and climbed to a weekly highs above 1.0730 in the European morning. Although the positive shift witnessed in risk sentiment could help the pair keep its footing, investors could refrain from betting on a steady uptrend ahead of the US Federal Reserve's (Fed) policy announcements.

While testifying before the European Parliament on Monday, European Central Bank (ECB) President Christine Lagarde noted that they would have indicated that further rate hikes will be needed if there were no tensions in markets. She also repeated that inflation in the Eurozone is projected to remain too high for too long. These comments failed to trigger a noticeable market reaction but allowed the Euro to stay resilient against its major rivals.

Reflecting the upbeat market mood, Euro Stoxx 50 is up more than 1.5% in the early European session. Moreover, US stock index futures are up around 0.3%.

ZEW Survey's Economic Sentiment Index for Germany and the Eurozone will be featured in the European economic docket. The survey is forecast to reveal a deterioration in sentiment in March due to the Silicon Valley Bank and Credit Suisse turmoil. In case the decline is more severe than expected, the Euro could lose some interest with the immediate reaction.

In the second half of the day, Existing Home Sales from the US will be looked upon for fresh impetus. As mentioned above, however, markets are unlikely to take large positions before the Fed's rate decision on Wednesday.

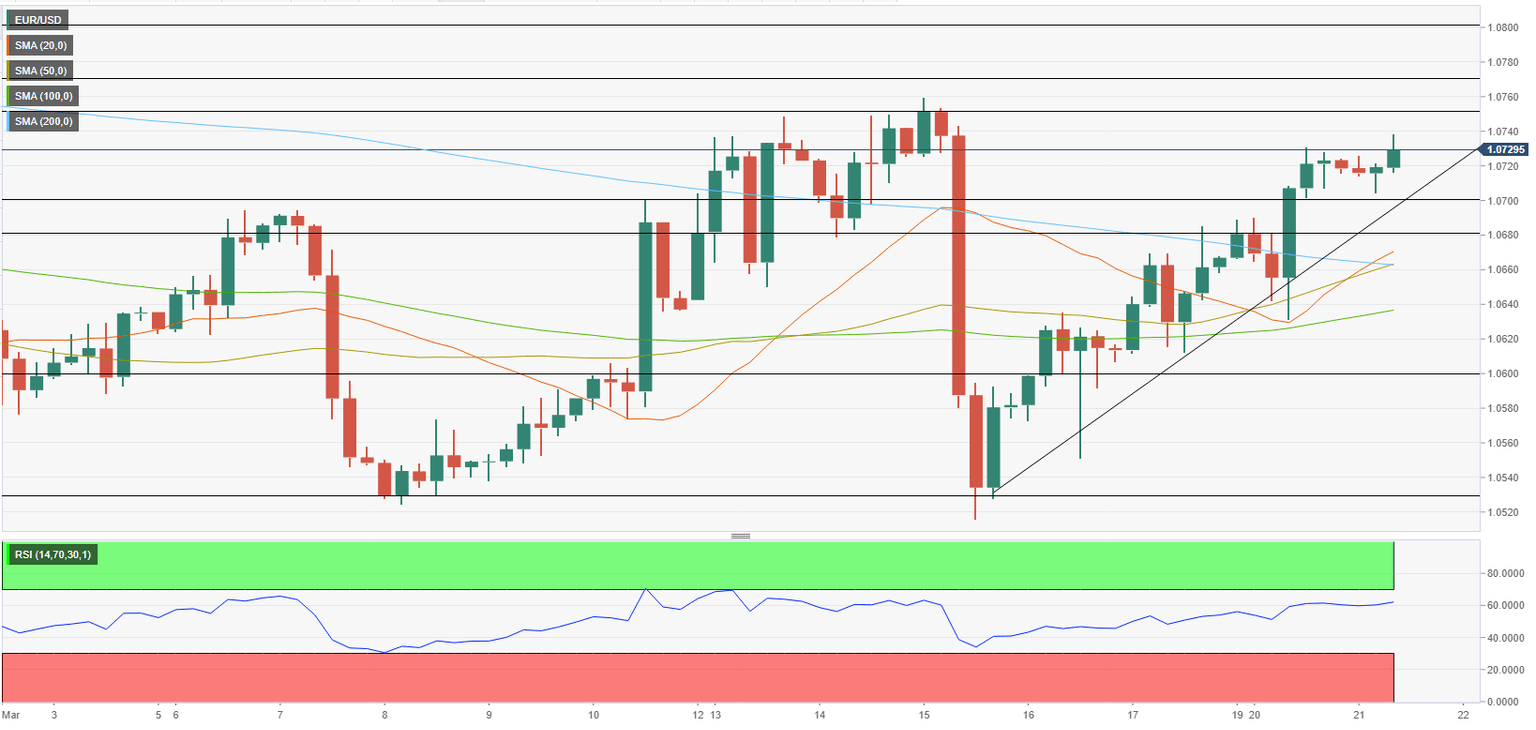

EUR/USD Technical Analysis

The Relative Strength Index (RSI) indicator on the four-hour chart holds comfortably above 50, suggesting that buyers remain in control. On the upside, 1.0750 (static level) aligns as key resistance. In case the pair manages to flip that level into support, it could target 1.0770 (static level) and 1.0800 (static level, psychological level) next.

First support is located at 1.0700 (psychological level, static level, ascending trend line) before 1.0660 (200-period Simple Moving Average (SMA)) and 1.0640 (100-period SMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.