EUR/USD Forecast: Euro could extend rally after 1.0700 is confirmed as support

- EUR/USD has managed to build on Monday's gains and broke above 1.0700.

- ECB President Lagarde's hawkish comments fuel the euro's rally.

- Near-term technical outlook suggests that the pair could make a technical correction.

EUR/USD has gathered bullish momentum and advanced beyond 1.0700 after having moved sideways in the Asian session. The pair remains technically overbought in the near term, suggesting that there could be a technical correction before the next leg higher.

European Central Bank (ECB) President Christine Lagarde said earlier in the day that the policy rate was likely to be positive at the end of the third quarter and provided a boost to the shared currency. This comment suggests that the ECB could opt for a 50 basis points (bps) rate hike in September after going for a 25 bps rate hike in July. In fact, Bloomberg claimed in a recently published report that some ECB policymakers were annoyed that ECB President Lagarde planning to rule out double-does rate increases.

The data from the eurozone showed the business activity in the private sector expanded at a softer pace than expected in early May with the S&P Global Composite PMI coming in at 54.9, compared to the market forecast of 55.3.

Meanwhile, the souring market mood helps the dollar limit its losses on Tuesday and caps EUR/USD's upside for the time being. The Euro Stoxx 600 Index is down nearly 1% on the day and US stock index futures are losing between 0.8% and 1.9%.

Beijing's decision to extend the work-from-home order and escalating US-China tensions with regard to Taiwan and trade relations seem to be causing investors to stay away from risk-sensitive assets.

In the second half of the day, the S&P PMI surveys from the US will be looked upon for fresh impetus. Investors will pay close attention to underlying details on supply chain issues and labour shortages. In case these reports remind investors that inflation in the US is likely to continue to push higher in the coming months, the dollar could gather strength and vice versa.

The US economic docket will feature April New Home Sales data as well and FOMC Chairman Jerome Powell will be delivering a speech at 16:20 GMT.

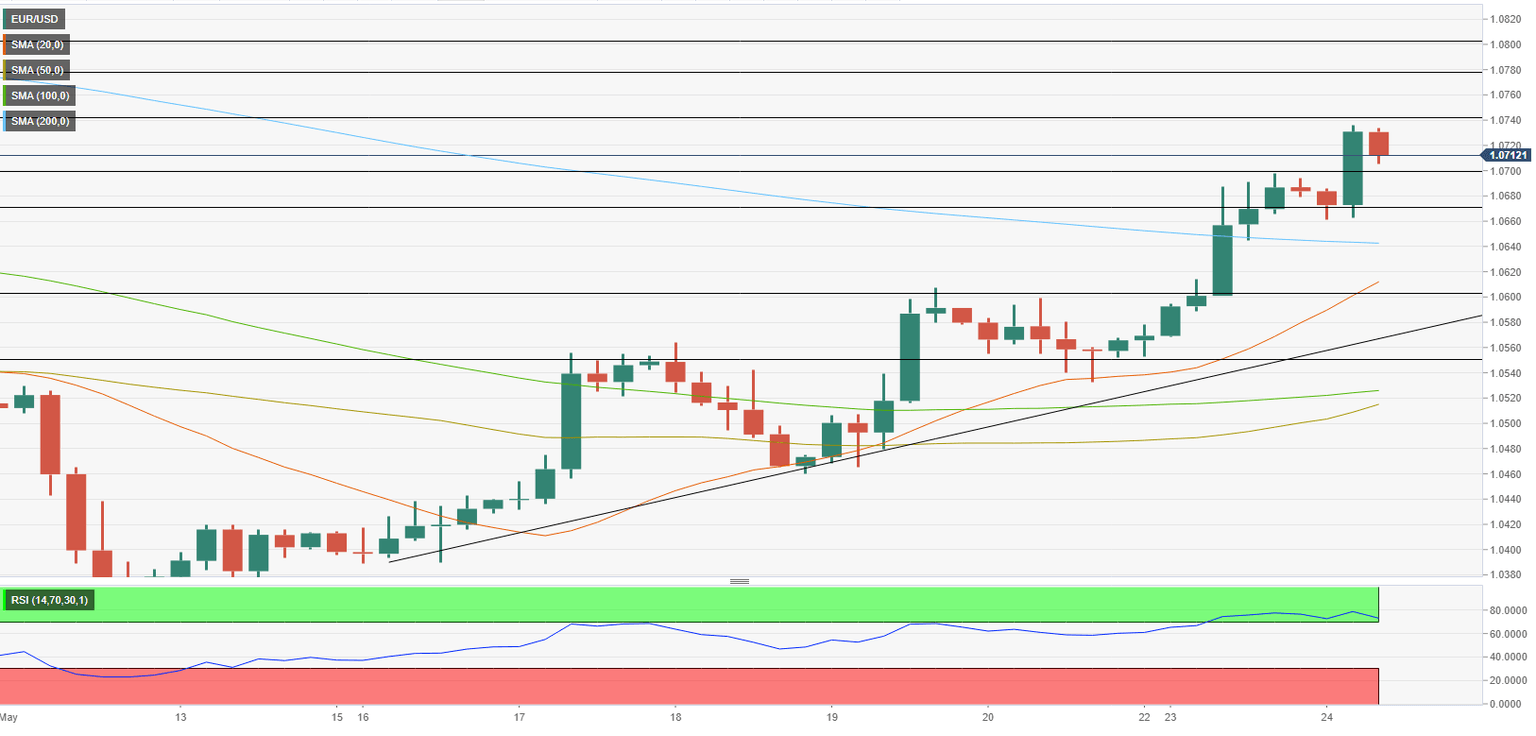

EUR/USD Technical Analysis

Despite the modest retreat witnessed during the Asian trading hours on Tuesday, the Relative Strength Index (RSI) indicator on the four-hour chart stays in the overbought territory above 70. Hence, buyers might wait for the pair to correct its overbought conditions before adding to long euro positions.

On the downside, 1.0700 (psychological level, static level) aligns as first support. If buyers manage to defend this level, the pair could regain its traction and test 1.0740 (daily high, static level) before targeting 1.0780 (static level) and 1.0800 (psychological level).

With a four-hour close below 1.0700, the pair could extend its correction toward 1.0670 (static level) and 1.0640 (200-period SMA).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.