EUR/USD Forecast: Euro could correct lower before targeting new multi-week highs

- EUR/USD has gone into a consolidation phase following last week's upsurge.

- Immediate resistance for the pair is located at 1.0750.

- The near-term technical outlook points to overbought conditions.

EUR/USD rose 1.5% last week and touched its highest level since mid-September near 1.0750 on Friday as the US Dollar (USD) remained under selling pressure. The pair fluctuates in a tight channel above 1.0700 early Monday. The economic docket will not offer any high-tier data releases and the technical outlook points to overbought conditions.

Euro price today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the Australian Dollar.

| USD | EUR | GBP | CAD | AUD | JPY | NZD | CHF | |

| USD | -0.02% | -0.05% | -0.06% | 0.17% | 0.16% | 0.13% | -0.15% | |

| EUR | 0.02% | -0.03% | -0.03% | 0.18% | 0.17% | 0.15% | -0.13% | |

| GBP | 0.05% | 0.03% | -0.01% | 0.19% | 0.18% | 0.20% | -0.09% | |

| CAD | 0.06% | 0.04% | 0.01% | 0.22% | 0.21% | 0.18% | -0.10% | |

| AUD | -0.16% | -0.18% | -0.21% | -0.22% | 0.00% | -0.04% | -0.31% | |

| JPY | -0.15% | -0.19% | -0.44% | -0.19% | -0.02% | -0.05% | -0.31% | |

| NZD | -0.13% | -0.15% | -0.17% | -0.18% | 0.02% | 0.02% | -0.29% | |

| CHF | 0.15% | 0.13% | 0.10% | 0.10% | 0.31% | 0.31% | 0.28% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the Japanese Yen, the percentage change displayed in the box will represent EUR (base)/JPY (quote).

The USD suffered heavy losses ahead of the weekend as the October jobs report unveiled loosening conditions in the labor market. Nonfarm Payrolls rose by 150,000, less than the market expectation of 180,000, and the Unemployment Rate edged higher to 3.9% from 3.8% in September. According to the CME Group FedWatch Tool, markets are currently pricing in a 90% probability that the Federal Reserve will leave its policy rate unchanged for the third consecutive meeting in December.

Earlier in the day, the data from Germany showed that Factory Orders rose by 0.2% on a monthly basis in September. This reading came in better than analysts' estimate for a decrease of 1% and helped the Euro hold its ground.

In the meantime, US stock index futures trade modestly higher on the day. In case risk flows drive the action in the financial markets in the American session, the USD could have a hard time finding demand.

EUR/USD Technical Analysis

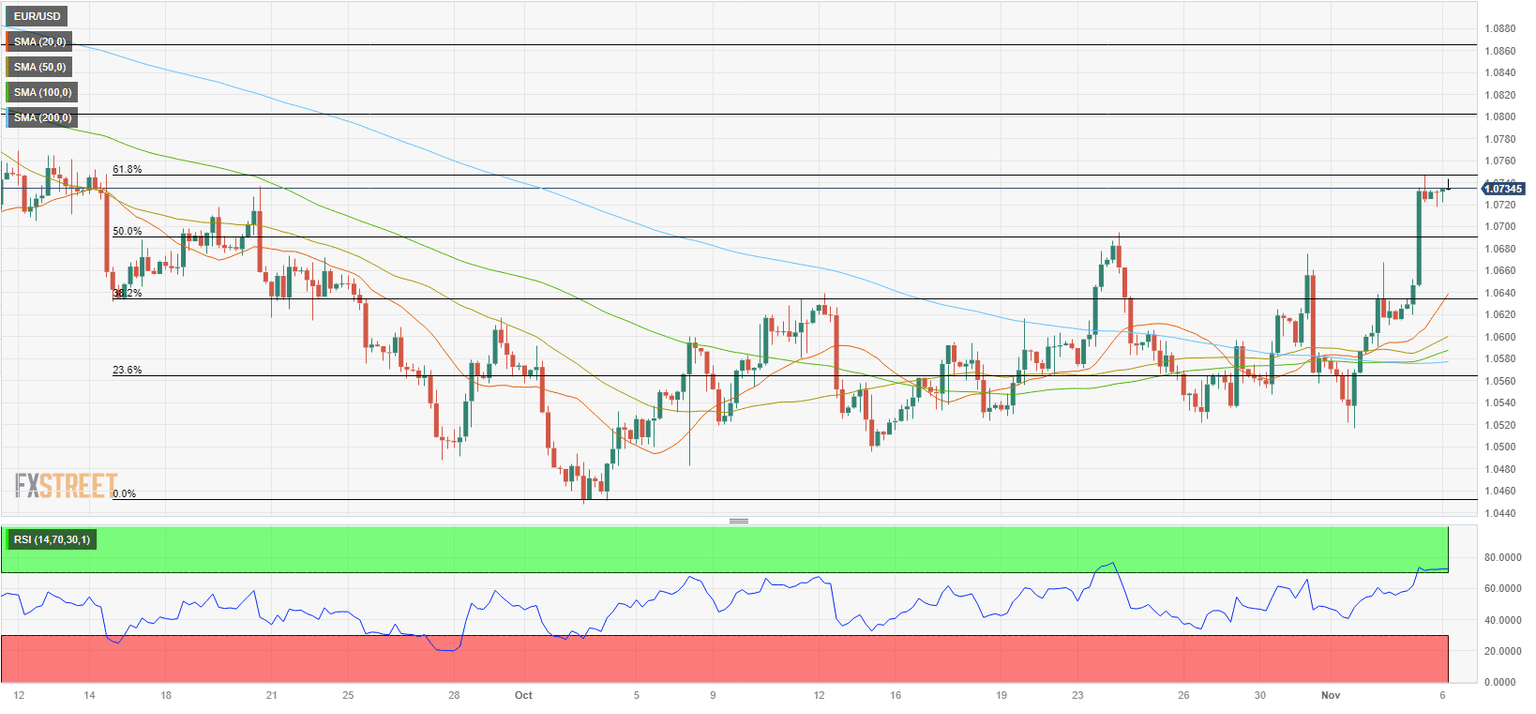

Following Friday's upsurge, the Relative Strength Index (RSI) indicator on the four-hour chart climbed above 70, highlighting overbought conditions for the pair in the near term. On the upside, 1.0750 (Fibonacci 61.8% retracement of the latest downtrend) aligns as immediate resistance before 1.0800 (psychological level, static level) and 1.0860 (static level).

If 1.0750 stays intact, buyers could start booking profits. In this scenario, 1.0700 (psychological level, Fibonacci 50% retracement) could be seen as first support before 1.0640 (Fibonacci 38.2% retracement).

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.