EUR/USD Forecast: Euro closes in on key resistace

- EUR/USD has extended its rebound at the start of the week.

- 1.0170 aligns as the next critical technical resistance.

- Risk perception should impact continue to impact the market action on Monday.

EUR/USD has gathered recovery momentum at the beginning of the week and climbed above 1.0100. The pair faces important resistance at 1.0170 and a four-hour close above that level could open the door for additional gains.

The broad-based dollar weakness fuels EUR/USD's upside early Monday. After the University of Michigan's Consumer (UoM) Sentiment Survey showed on Friday that the long-run inflation expectation declined to 2.8% in July's flash estimate from 3.1% in June, investors started to reassess the Fed's rate outlook.

According to the CME Group's FedWatch tool, the probability of a 100 basis points rate hike in July declined below 30% from nearly 90% on Thursday. In addition to the UoM data, cautious comments from Fed officials caused the greenback to continue to lose interest.

Regarding the July rate decision, "moving too dramatically could undermine positive aspects of the economy, add to the uncertainty," said Atlanta Fed President Raphael Bostic. Similarly, San Francisco Fed President Mary Daly noted that they are not looking to raise rates to extreme highs. Reflecting the negative impact of the repricing of the Fed's July rate decision, the US Dollar Index is already down more than 1% from the multi-decade high it set at 109.29 last Thursday.

There won't be any high-tier data releases featured in the economic docket on Monday and the greenback could stay on the back foot if risk flows continue to dominate the market action. As of writing, US stock index futures were up between 0.7% and 1%.

EUR/USD Technical Analysis

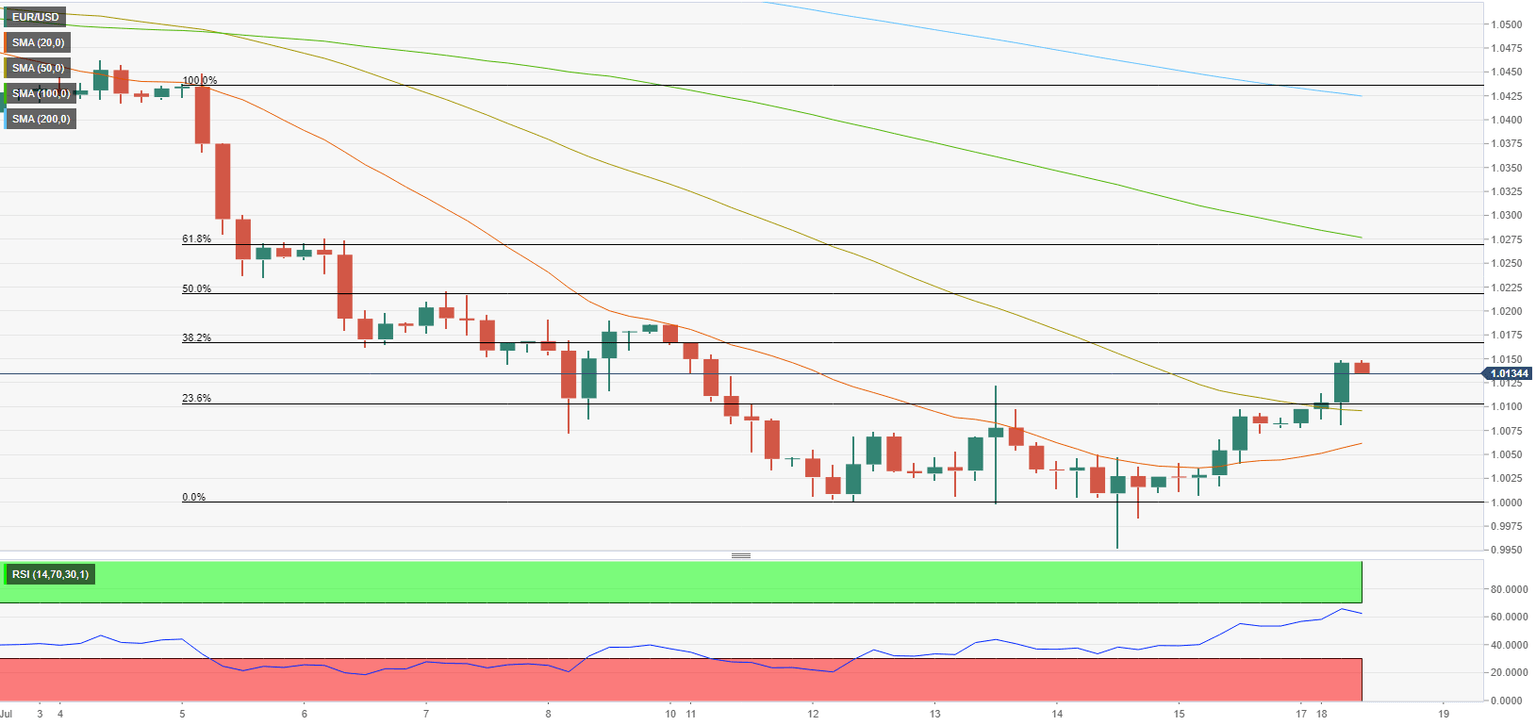

EUR/USD broke above the 20 and the 50-period SMAs on the four-hour chart. Confirming the bullish tilt, the Relative Strength Index (RSI) indicator on the same chart climbed toward 60. On the upside, 1.0170 (Fibonacci 38.2% retracement of the latest downtrend) aligns as key resistance. In case buyers manage to flip that level into support, additional gains toward 1.0200 (psychological level), 1.0225 (Fibonacci 50% retracement) and 1.0275 (Fibonacci 61.8% retracement) could be witnessed.

1.0100 (50-period SMA, Fibonacci 23.6% retracement, psychological level) forms key support before 1.0060 (20-period SMA) and 1.0000.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.