EUR/USD Forecast: Euro buoyed by hawkish ECB commentary

- EUR/USD has managed to pull away from session lows on hawkish ECB commentary.

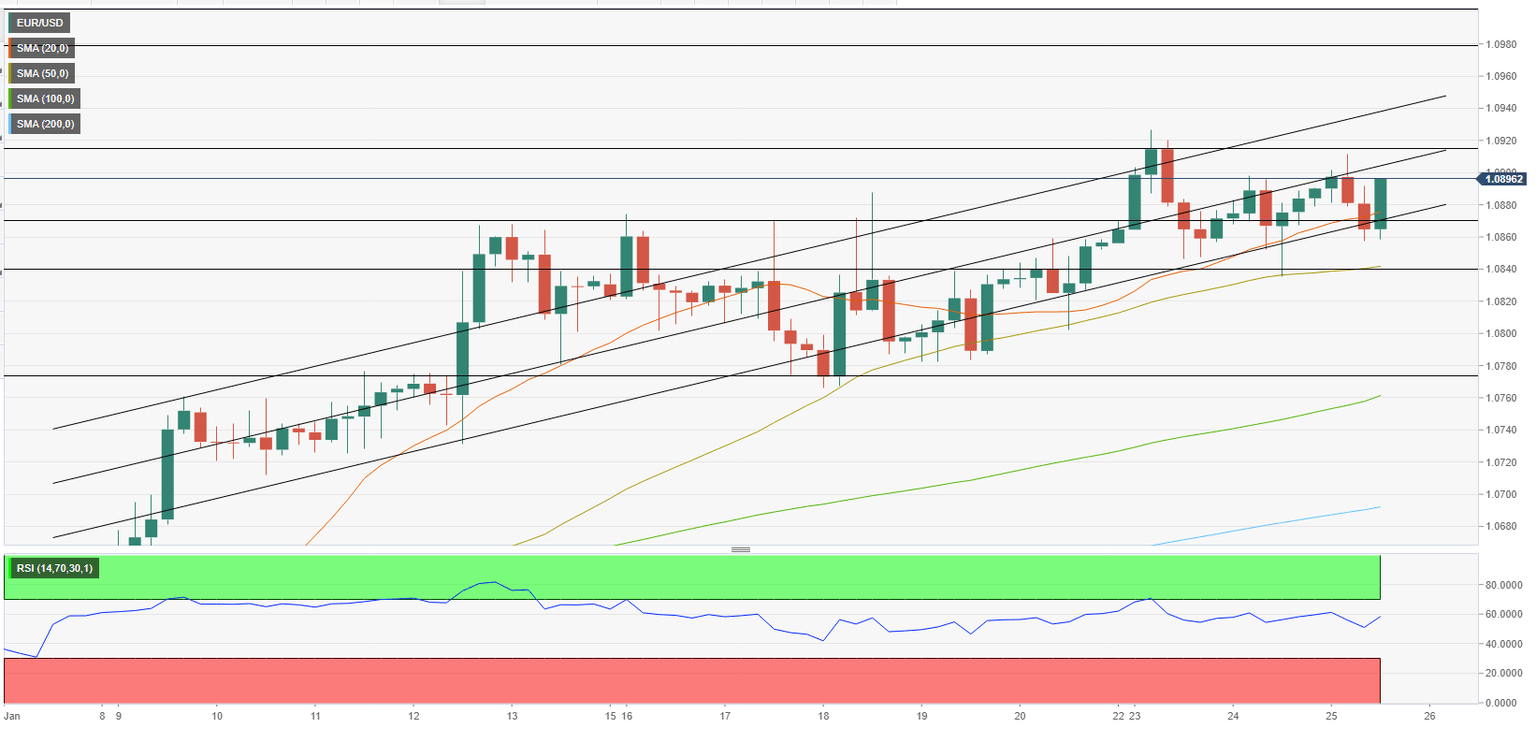

- The pair continues to trade with an ascending regression channel.

- Souring sentiment could limit the pair's potential gains.

EUR/USD has regained its traction and climbed toward 1.0900 after having dropped to the 1.0850 area during the European trading hours on Wednesday. The negative shift witnessed in risk sentiment, however, could make it difficult for the pair to gather bullish momentum in the short term.

The modest recovery witnessed in the US Dollar Index weighed on EUR/USD in the first half of the day. With several European Central Bank (ECB) policymakers delivering hawkish remarks ahead of the bank's 'quiet period' that will start on Thursday, the Euro managed to hold its ground.

"We need to continue to increase rates at our meeting next week – by taking a similar step to our December decisions," European Central Bank (ECB) Governing Council member Gabriel Makhlouf said on Wednesday. Echoing ECB President Christine Lagarde's comments, Makhlous further added that interest rates will have to rise significantly at a steady pace to reach levels sufficiently restrictive.

On a similar note, ECB policymaker Bostjan Vasle noted that it would be appropriate to hike rates by 50 basis points at the next two meetings.

Meanwhile, Wall Street's main indexes opened deep in negative territory and the S&P 500 and the Nasdaq Composite indexes were last seen losing more than 1% on the day. In case the US stock indices' correction deepens later in the day, the US Dollar could find demand as a safe haven and limit EUR/USD's upside.

EUR/USD Technical Analysis

EUR/USD returned within the ascending regression channel after briefly dropping below it earlier in the day. Moreover, the Relative Strength Index (RSI) indicator on the four-hour chart rose above 50, suggesting that sellers are struggling to dominate the pair's action.

Initial resistance is located at 1.0900 (mid-point of the ascending channel, psychological level). If EUR/USD rises above that level and starts using it as support, it could stretch higher toward 1.0940 (upper limit of the ascending channel) and 1.0980 (former support, static level).

On the downside, a four-hour close below 1.0860 (lower limit of the ascending channel) could bring in additional sellers and open the door for an extended slide to 1.0840 (50-period SMA) and 1.0800 (psychological level) afterward.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.