EUR/USD Forecast: Euro bulls take over as risk flows return

- EUR/USD trades in positive territory, well above 1.0400 early Thursday.

- The US Dollar (USD) struggles to find demand as risk mood improves.

- The pair could reverse its direction in case Trump announces reciprocal tariffs.

EUR/USD gathers bullish momentum and rises toward 1.0450 in the European morning on Thursday. The broad-based selling pressure surrounding the US Dollar (USD) fuels the pair's leg higher as risk flows dominate the action in financial markets.

Euro PRICE Today

The table below shows the percentage change of Euro (EUR) against listed major currencies today. Euro was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.42% | -0.40% | -0.23% | -0.19% | -0.16% | -0.19% | -0.20% | |

| EUR | 0.42% | 0.02% | 0.21% | 0.24% | 0.24% | 0.23% | 0.22% | |

| GBP | 0.40% | -0.02% | 0.15% | 0.22% | 0.27% | 0.21% | 0.20% | |

| JPY | 0.23% | -0.21% | -0.15% | 0.03% | 0.08% | 0.00% | 0.03% | |

| CAD | 0.19% | -0.24% | -0.22% | -0.03% | 0.04% | -0.02% | -0.01% | |

| AUD | 0.16% | -0.24% | -0.27% | -0.08% | -0.04% | -0.03% | -0.04% | |

| NZD | 0.19% | -0.23% | -0.21% | 0.00% | 0.02% | 0.03% | -0.01% | |

| CHF | 0.20% | -0.22% | -0.20% | -0.03% | 0.01% | 0.04% | 0.01% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Euro from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent EUR (base)/USD (quote).

In the early trading hours of the American session on Wednesday, EUR/USD declined toward 1.0300 as the USD gathered strength on January inflation data. The US Bureau of Labor Statistics reported that the annual Consumer Price Index (CPI) rose by 3%, coming in above the market expectation and December's increase of 2.9%. Additionally, the core CPI, which excludes volatile food and energy prices, rose by 0.4% on a monthly basis, following the 0.2% rise recorded in the previous month.

Later in the day, the improving risk mood made it difficult for the USD to preserve its strength and opened the door for a decisive rebound in EUR/USD. US President Donald Trump said that he had a "lengthy and highly productive" phone call with Russian President Vladimir Putin to begin negotiations to end the war in Ukraine. In the meantime, Trump refrained from announcing reciprocal tariffs.

In the second half of the day, the risk perception could continue to drive the pair's action amid a lack of high-tier data releases. At the time of press, US stock index futures were rising between 0.2% and 0.5%.

According to CNBC, Trump could still unveil his reciprocal tariff plan before he meets with Indian Prime Minister Narendra Modi on Thursday. In case Trump does so, the USD could regain its traction and cause EUR/USD to turn south. On the other hand, the pair could build on its daily gains if markets don't get any new headlines on Trump's reciprocal tariffs.

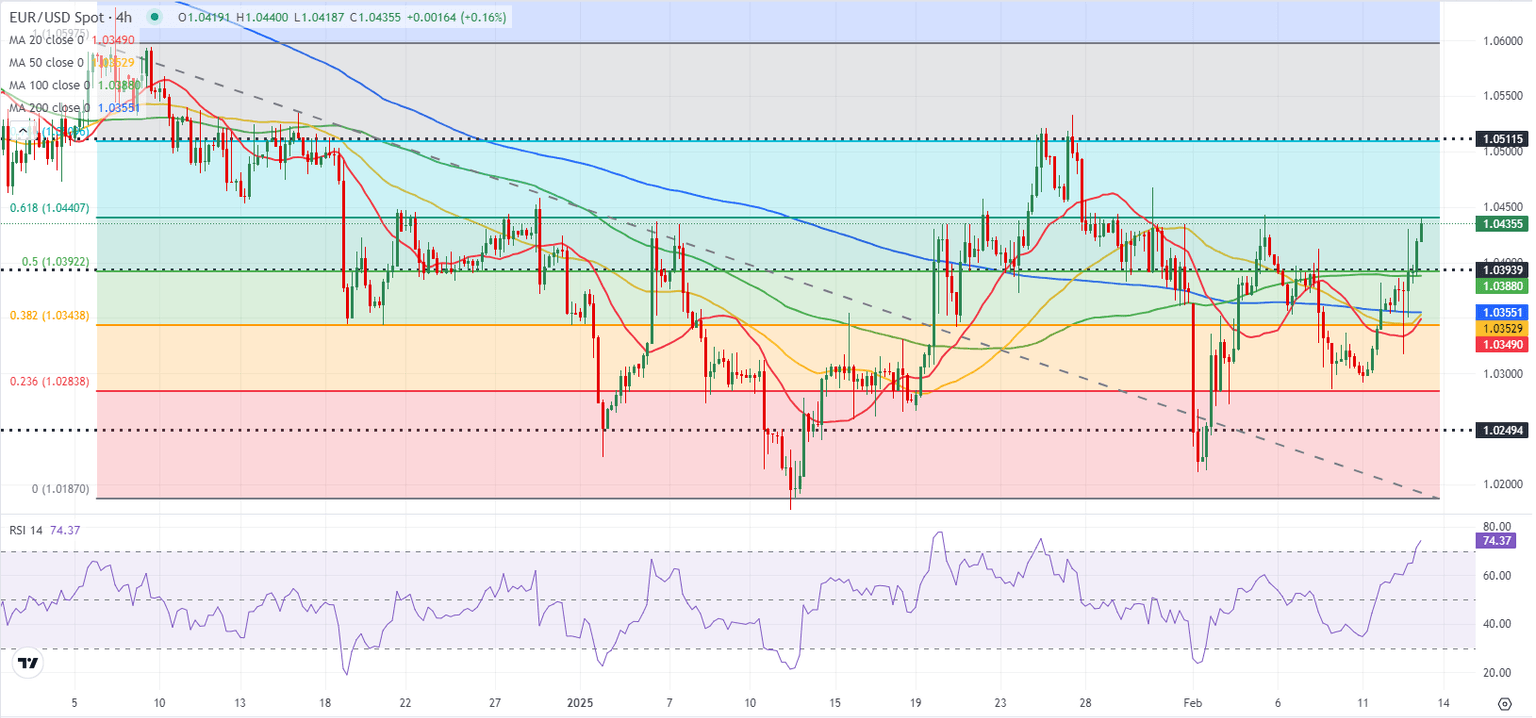

EUR/USD Technical Analysis

The Relative Strength Index (RSI) indicator on the 4-hour chart climbed above 70, suggesting that EUR/USD could correct lower before extending its uptrend. On the upside, 1.0440 (Fibonacci 61.8% retracement of the latest downtrend) aligns as immediate resistance. If the pair rises above this level and starts using it as support, it could target 1.0500-1.0510 (round level, Fibonacci 78.6% retracement) and 1.0550 (static level) next.

Looking south, the first support level could be spotted at 1.0400 (100-period Simple Moving Average (SMA), Fibonacci 50% retracement) ahead of 1.0355-1.0350 (Fibonacci 38.2% retracement, 200-period SMA).

Tariffs FAQs

Tariffs are customs duties levied on certain merchandise imports or a category of products. Tariffs are designed to help local producers and manufacturers be more competitive in the market by providing a price advantage over similar goods that can be imported. Tariffs are widely used as tools of protectionism, along with trade barriers and import quotas.

Although tariffs and taxes both generate government revenue to fund public goods and services, they have several distinctions. Tariffs are prepaid at the port of entry, while taxes are paid at the time of purchase. Taxes are imposed on individual taxpayers and businesses, while tariffs are paid by importers.

There are two schools of thought among economists regarding the usage of tariffs. While some argue that tariffs are necessary to protect domestic industries and address trade imbalances, others see them as a harmful tool that could potentially drive prices higher over the long term and lead to a damaging trade war by encouraging tit-for-tat tariffs.

During the run-up to the presidential election in November 2024, Donald Trump made it clear that he intends to use tariffs to support the US economy and American producers. In 2024, Mexico, China and Canada accounted for 42% of total US imports. In this period, Mexico stood out as the top exporter with $466.6 billion, according to the US Census Bureau. Hence, Trump wants to focus on these three nations when imposing tariffs. He also plans to use the revenue generated through tariffs to lower personal income taxes.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Eren Sengezer

FXStreet

As an economist at heart, Eren Sengezer specializes in the assessment of the short-term and long-term impacts of macroeconomic data, central bank policies and political developments on financial assets.