EUR/USD Forecast: ECB’s announcement left EUR depressed

EUR/USD Current Price: 1.1089

- ECB’s Lagarde pretty much repeated her December speech, announces a strategic review.

- Risk-related sentiment sour amid persistent concerns about a global virus outbreak.

- A weak dollar seems to be providing mild-support to EUR/USD, anyway bearish.

The American dollar remained weak throughout the first half of the day, although that didn’t benefit the shared currency, ahead of the ECB Monetary Policy decision. The pair was consolidating below the 1.1100 ahead of the central bank decision. As expected, policymakers left rates unchanged, while the accompanying statement was quite similar to that of the December meeting, resulting in a non-event. The central bank, however, announced the start of a strategic review, which details will be provided after Mrs Lagarde press conference.

The ECB’s head started her speech with optimistic comments, bringing EUR/USD back to life, as it managed to regain the 1.1100 level. Among other things, she said that accommodative policy is needed to support inflation, although there are signs of an increase, in line with expectations.

Meanwhile, the US has just released weekly unemployment data. Initial Jobless Claims for the week ended January 17 beat expectations, down to 211K. Still pending of release are the EU January Consumer Confidence preliminary estimate and the US Kansas Fed Manufacturing Activity Index for the same month.

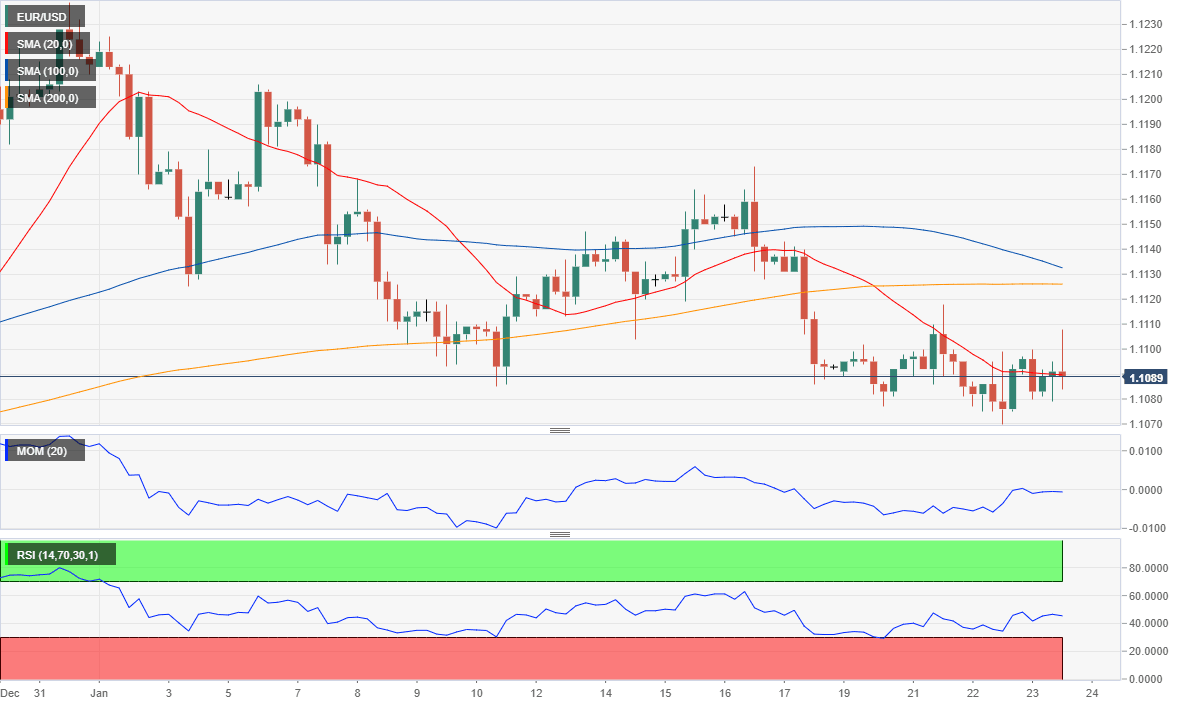

EUR/USD short-term technical outlook

The EUR/USD pair is retreating after surpassing 1.1100 figure, with a decreased bearish potential, but still unable to confirm additional gains ahead. In the 4-hour chart, the pair is moving around a flat 20 SMA, while technical indicators head north, although within neutral levels. The 100 and 200 SMA in the mentioned chart remain far above the current level and turning lower, further limiting the upside. A break below 1.1065, the immediate support, should confirm the bearish case.

Support levels: 1.1065 1.1020 1.0980

Resistance levels: 1.1110 1.1145 1.1180

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.