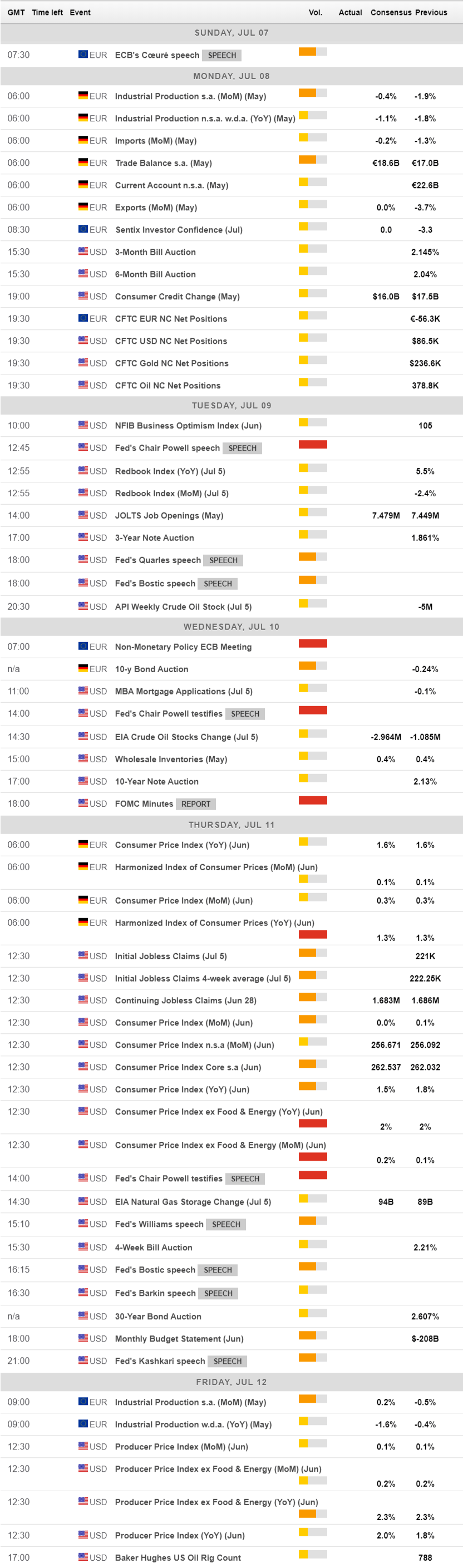

- US Federal Reserve Chief Powell scheduled to testify before the Congress next week.

- EUR/USD resumed its decline, fresh yearly lows at sight amid central banks’ imbalances.

Little happened across the FX board these last few days, with a US holiday in the middle and a scarce macroeconomic calendar exacerbating the lack of action. Such picture changed Friday with the release of the US Nonfarm Payroll report.

Ahead of it, the market was convinced that the global economic slowdown would mean easy money coming. Stocks soared, with Wall Street flirting with record highs, while safe-haven assets benefited from those fears, and government bond yields fell to multi-year lows.

The NFP changed it all. The US economy added 224K new jobs in June, largely surpassing the 160K expected. The unemployment rate ticked up to 3.7%, but the increase in the participation rate partially offset its negativeness by raising to 62.9%. Wages were up by 0.2% MoM and by 3.1% YoY, missing the market’s expectations, but in-line with the yearly highs.

The dollar soared with the report, as the market understood it took of pressure from the US Federal Reserve. The central bank is now expected to cut rate just once this year by 25bps, as a “preventive” move. Stocks are retreating amid decreased hopes of “easy money,” while government bond yields recovered sharply. As for the EUR/USD pair, it´s heading into the weekly close a handful of pips above the 1.1200 figure.

Things in the US, however, are far from rosy. The ISM Non-Manufacturing PMI came in at 55.1 in June, well below the previous 56.9 and missing the market’s expectations of 55.9. Also, Factory Orders decreased in May by more than anticipated. The final versions of the Markit PMI for both economies showed a modest improvement in June, having a limited effect on currencies. Once again, dismal German data weighed on the shared currency, with Retail Sales falling by 0.6% in May, and Factory Orders collapsing in the same month, down by 2.2% MoM and by 8.6% YoY. EU Retail Sales were also disappointing, falling a 0.3% monthly basis.

The upcoming week will bring more clarity about the Fed’s path. Chief Jerome Powell is due to testify before the Congress, while the central bank will release the Minutes of its latest meeting. The US will also publish CPI data for June, with core inflation seen steady at 2.0%.

Concerns about a global economic slowdown are still driving the financial world, but the US continues being the cleanest shirt in the laundry’s dirt pile. As long as the market keeps believing that the Fed will pull the trigger just once this year, the dollar will likely keep rallying.

Whether the pair could break lower will depend solely on Powell. Will the Fed’s head maintain its confident outlook and down talk chances of aggressive rate cuts? Will he succumb to Trump’s pressure, to cut rates further? The first scenario seems more likely than the second one.

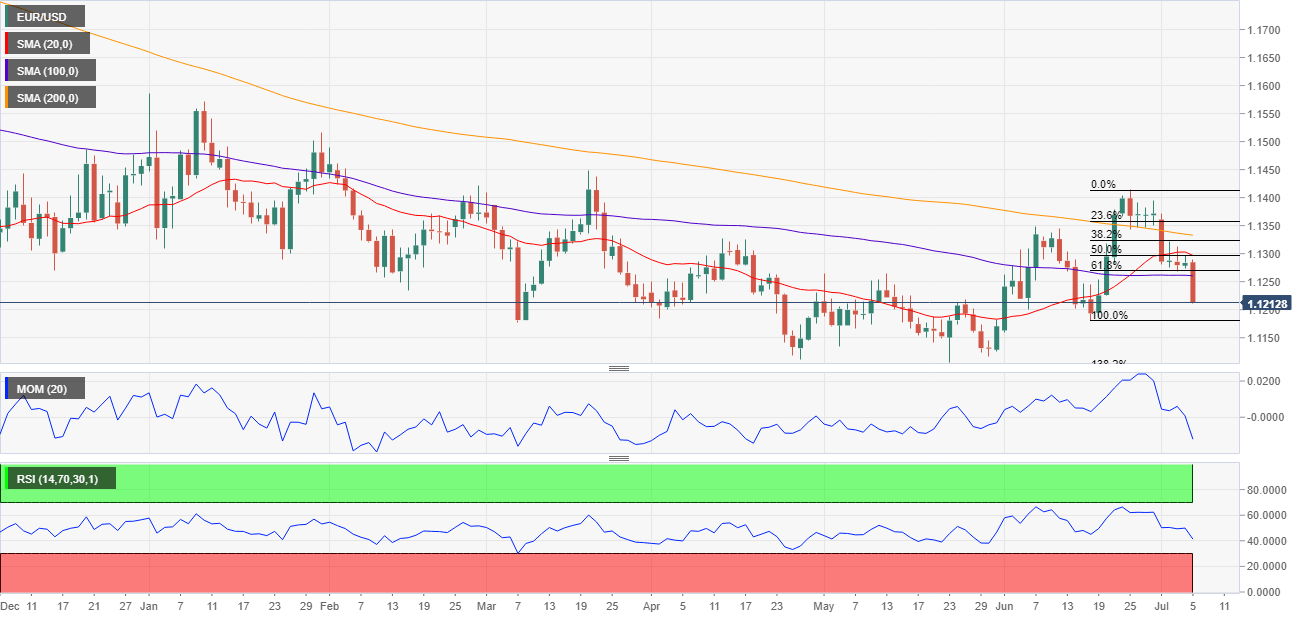

EUR/USD technical outlook

The EUR/USD pair has lost its bullish potential after giving back most of June gains. The weekly chart shows that it was unable to extend gains beyond a flat 200 SMA later breaking below the 20 SMA, now below all of its moving averages. The Momentum indicator turned modestly lower but holds within neutral levels, while the RSI indicator anticipates additional declines, accelerating south at around 45.

The daily picture also favors additional declines for the upcoming sessions, as the pair started the week above the 200 DMA, now ending it below all of its moving averages, which offer downward slopes. The Momentum indicator turned sharply lower currently piercing its mid-line, while the RSI indicator heads firmly south around 41.

More relevantly, the pair has broken below the 61.8% retracement of its latest daily advance at around 1.1270, now poised to test the base of the range at 1.1142. A break below this last exposes the yearly low at 1.1106, while beyond this last, an approach to the 1.1000 figure is on the cards for the next few days.

Bulls would need to push the price beyond 1.1325 to actually recover control of the pair, but a rally up to 1.1400 is now out of sight.

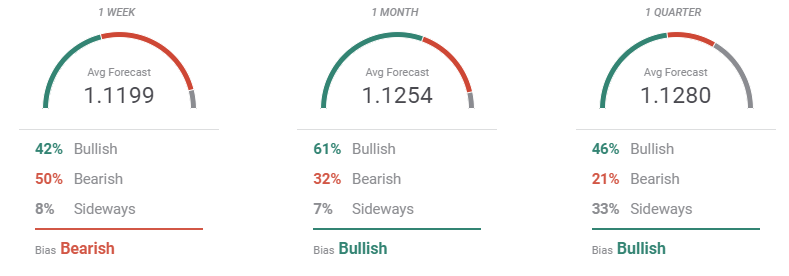

EUR/USD sentiment poll

The FXStreet Forecast Poll this week offers a mixed picture for the greenback in the short-term, although, in the case of the EUR/USD pair, most experts are expecting a decline, with the largest accumulation of possible targets between 1.10 and 1.11, although a few bullish exceptions lift the average to 1.1199 weekly basis.

Bulls hold the grip in the monthly and quarterly perspectives, although the outcome of the NFP report may force analysts to re-think it next week. Nevertheless, the pair is seen on average holding below 1.1300.

The Overview chart is more in-line with what happened this Friday as moving averages lost their bullish slopes. In the one-month perspective, however, most likely targets are above it, clustered in the 1.12/1.14 region. Longer term, however, the most significant accumulation of targets is below the media, although between 1.10 and 1.14, somehow signaling uncertainty about the future trend.

Related Forecasts:

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD fluctuates in daily range above 1.0600

EUR/USD struggles to gather directional momentum and continues to fluctuate above 1.0600 on Tuesday. The modest improvement seen in risk mood limits the US Dollar's gains as investors await Fed Chairman Jerome Powell's speech.

GBP/USD stabilizes near 1.2450 ahead of Powell speech

GBP/USD holds steady at around 1.2450 after recovering from the multi-month low it touched near 1.2400 in the European morning. The USD struggles to gather strength after disappointing housing data. Market focus shifts to Fed Chairman Powell's appearance.

Gold retreats to $2,370 as US yields push higher

Gold stages a correction on Tuesday and fluctuates in negative territory near $2,370 following Monday's upsurge. The benchmark 10-year US Treasury bond yield continues to push higher above 4.6% and makes it difficult for XAU/USD to gain traction.

XRP struggles below $0.50 resistance as SEC vs. Ripple lawsuit likely to enter final pretrial conference

XRP is struggling with resistance at $0.50 as Ripple and the US Securities and Exchange Commission (SEC) are gearing up for the final pretrial conference on Tuesday at a New York court.

US outperformance continues

The economic divergence between the US and the rest of the world has become increasingly pronounced. The latest US inflation prints highlight that underlying inflation pressures seemingly remain stickier than in most other parts of the world.