EUR/USD Forecast: Dollar’s gains limited despite the risk-off mood

EUR/USD Current Price: 1.2134

- Brexit-related headlines trigger demand for safe-haven assets.

- German’s Industrial Production rose by 3.2% MoM in October.

- EUR/USD recovering its bullish potential after correcting extreme overbought conditions.

The EUR/USD pair extended its decline this Monday to 1.2078, as the dollar surged on risk aversion. News that UK Prime Minister Boris Johnson is willing to turn his back to the EU and leave the negotiation table spurred the dismal sentiment. The pair bounced from the mentioned low as demand for the dollar remains weak, with EUR/USD heading into the US opening, trading around 1.2130. Fears cooled down on market talks suggesting that Brexit trade talks could continue until Wednesday.

Germany published October Industrial Production, which provided support to the shared currency as it rose by 3.2% MoM, beating expectations. The US session will be light in terms of macroeconomic data, as the country will only release October Consumer Credit Change.

EUR/USD short-term technical outlook

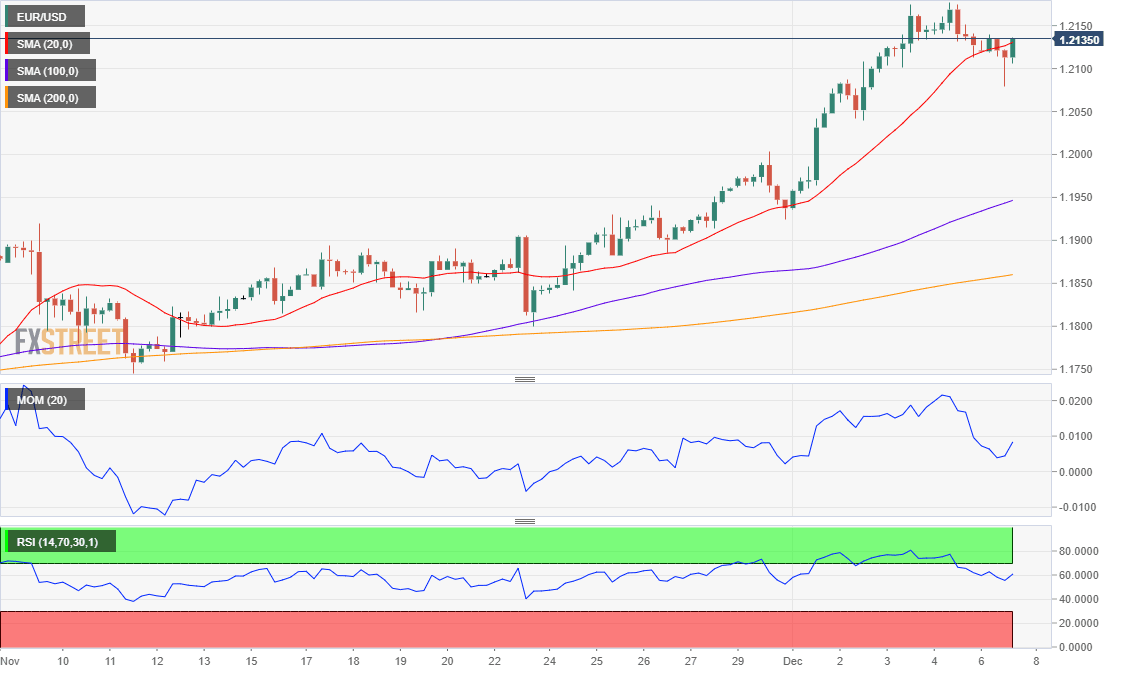

The EUR/USD pair has corrected oversold conditions in the short-term and is slowly recovering its bullish potential. The 4-hour chart shows that the price is back above a bullish 20 SMA, while technical indicators are bouncing from around their midlines. At the time being, the bullish potential seems limited, with risk-averse headlines providing opportunities to buy at lower levels.

Support levels: 1.2110 1.2070 1.2020

Resistance levels: 1.2175 1.2230 1.2280

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.