EUR/USD Forecast: Dollar backed by fears

EUR/USD Current Price: 1.1809

- US Federal Reserve chief Powell reiterated its dovish message.

- US data came in mixed, maintaining the upside limited for high-yielding assets.

- EUR/USD meeting sellers on spikes, lower lows at sight.

The American currency managed to recover some ground on Thursday, ending the day up against most major rivals. The EUR/USD pair topped 1.1850, pulling back towards the 1.1800 price zone following the release of mixed US macroeconomic figures and extending its slide through the rest of the US session. US Federal Reserve chief Powell testified before Congress for a second consecutive day, adding nothing new to its conservative stance.

Data wise, the US published the July NY Empire State Manufacturing Index, which improved to 43 from 17.4, although the Philadelphia Fed Manufacturing Survey contracted from 30.7 to 21.9 in the same period. In addition, Initial Jobless Claims for the week ended July 9 resulted in 360K as expected. The country also released June Industrial Production, which was up a modest 0.4% MoM and Capacity Utilization, up 75.4%, missing the market’s expectations. On Friday, the EU will publish June inflation data and the May Trade Balance. The US will release June Retail Sales, seen at -0.4% MoM.

EUR/USD short-term technical outlook

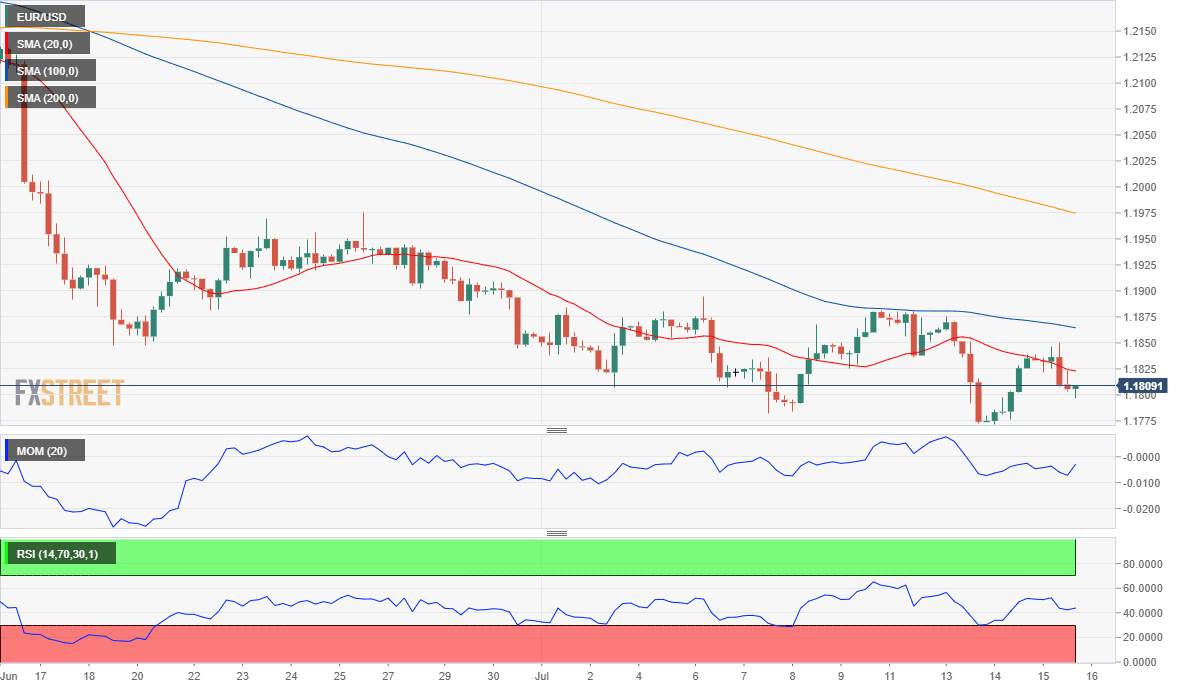

The EUR/USD pair holds around the 1.1800 level and is at risk of falling further. The 4-hour chart shows that the pair keeps developing below bearish moving averages after a failed attempt to run beyond the 20 SMA. The Momentum indicator advances while the RSI stands pat, both within negative levels. The pair set a three-month low at 1.1771, the level to break to confirm another leg south.

Support levels: 1.1770 1.1720 1.1685

Resistance levels: 1.1840 1.1885 1.1920

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.