EUR/USD Forecast: Corrective slide should find support around 1.0840

EUR/USD Current price: 1.0865

- United States macroeconomic data disappointed, US Dollar set to fall again.

- Wall Street’s futures picked up after US figures, aim to reach fresh weekly highs.

- EUR/USD maintains the overall bullish trend despite retreating from near 1.0900.

The EUR/USD pair peaked at 1.0894 early Thursday as the US Dollar extended its inflation-inspired decline. The United States (US) reported on Wednesday that the Consumer Price Index (CPI) rose 3.4% YoY in April from 3.5% in March, while the core annual reading printed at 3.6%, easing from the previous 3.8%, but also in line with the market forecast. Finally, the monthly CPI rose 0.3%, slightly below the expected 0.4%. The news put the Greenback under strong selling pressure, which extended throughout the Asian session.

The USD regained some ground in the European session as local stock markets edged lower, leading to modest losses in Wall Street’s futures. Without relevant macroeconomic news from the Eurozone, market players focused on US data and the usual bunch of Federal Reserve (Fed) speakers spread throughout the day.

The US released Initial Jobless Claims for the week ended May 3, which were up by 222K, worse than anticipated. Furthermore, the previous week’s figure was upwardly revised to 232K. The country also published the May Philadelphia Fed Manufacturing Survey, which contracted to 4.5, missing the market’s expectations. Coming up next are April Capacity Utilization and Industrial Production. Following the news, however, US indexes are pressuring weekly highs, somehow anticipating the USD could soon resume its slide.

EUR/USD short-term technical outlook

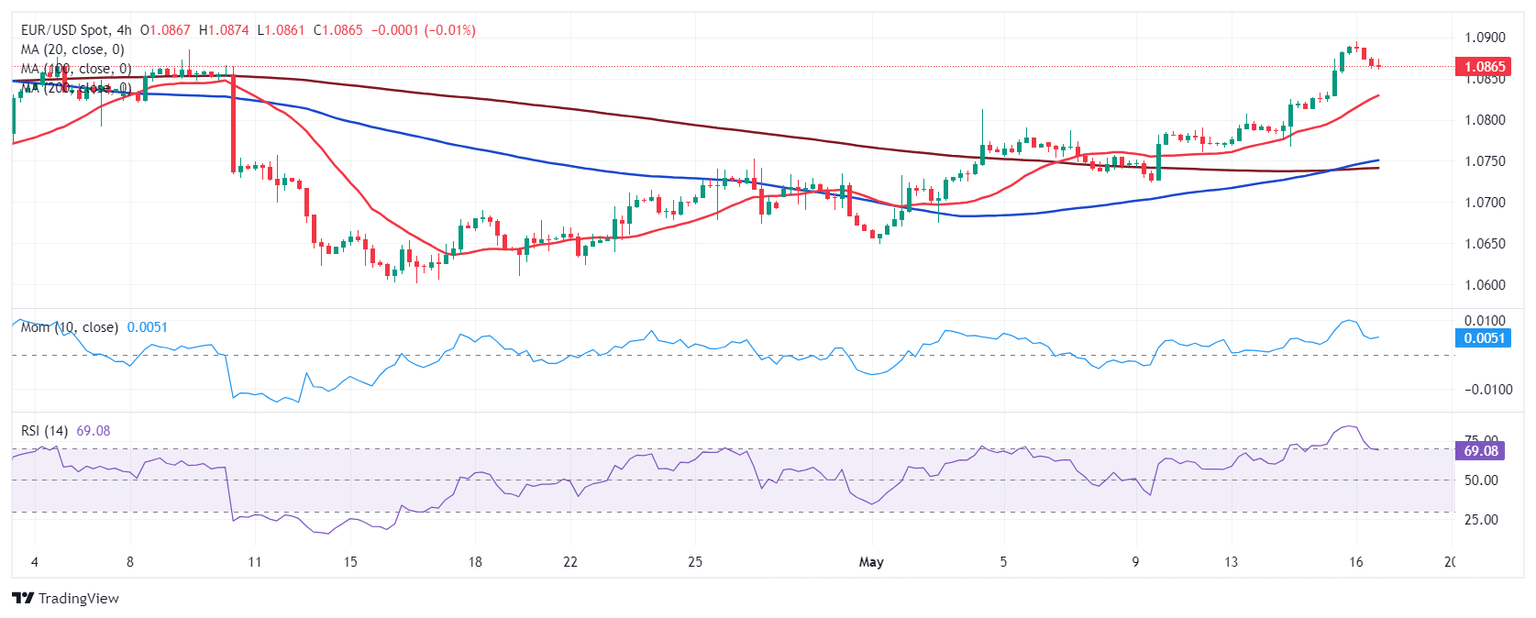

Technically, the intraday slide seems corrective after the pair flirted with the 1.0900 threshold. The daily chart shows EUR/USD trading at the upper end of Wednesday’s range and holding above all its moving averages. Furthermore, the 20 Simple Moving Average (SMA) maintains its bullish slope, although still below the 100 and 200 SMAs. Technical indicators, in the meantime, remain well above their midlines, although partially losing their bullish strength, reflecting the ongoing retracement rather than suggesting an upcoming slide.

In the near term, and according to the 4-hour chart, EUR/USD is in corrective mode. Technical indicators are retreating from their recent highs, with the Relative Strength Index (RSI) abandoning overbought territory. Nevertheless, indicators remain far above their midlines, far from confirming a bearish leg ahead. Finally, the 20 SMA heads firmly north at around 1.0825, while the 100 SMA crossed above the 200 SMA, all suggesting persistent buying interest. The pair can extend its downward correction on a break below the 1.0830 region, but overall, the risk remains skewed to the upside.

Support levels: 1.0830 1.0795 1.0750

Resistance levels: 1.0910 1.0945 1.0990

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.