- EUR/USD has been surging above 1.19, the highest since June 2018.

- Europe leads the US on the recovery, coronavirus, and fiscal stimulus.

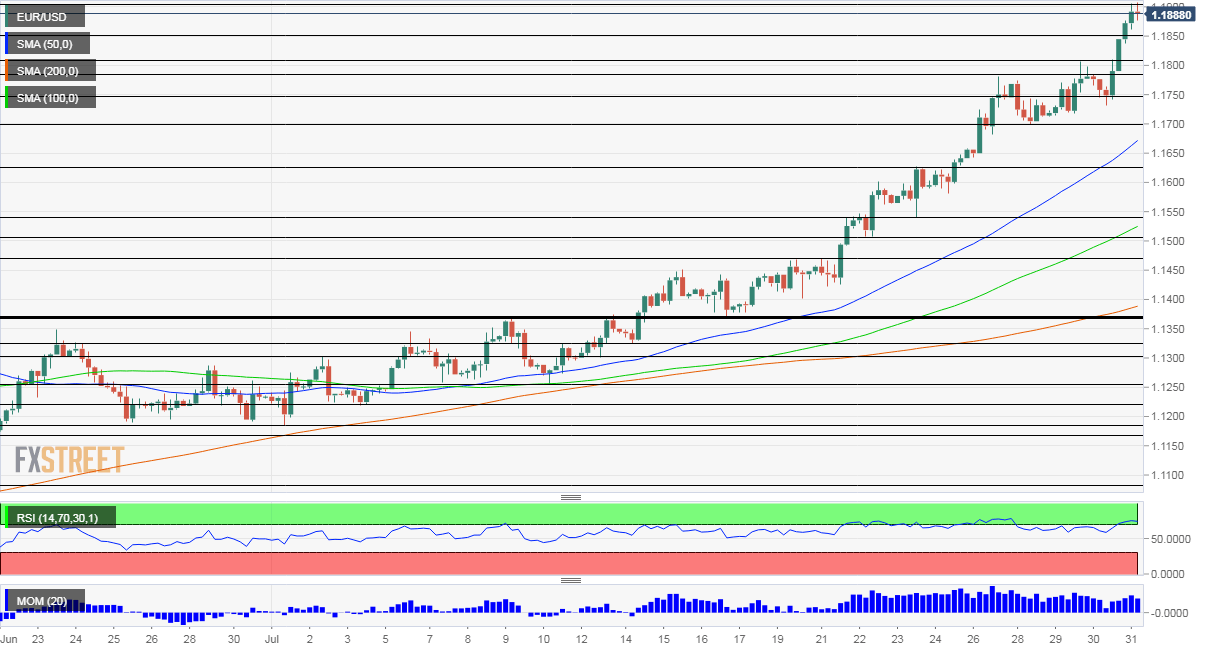

- Friday's four-hour chart is pointing to stretched overbought conditions.

Too good to be true? EUR/USD bulls must be grateful for an impressive uptrend – and for good reasons – after periods of low volatility. However, a correction may be on the cards, especially as money managers readjust their portfolio on the last day of the week and month.

Coronavirus advantage: Despite various flareups, most notably in Spain and Belgium, Europe's COVID-19 situation is mostly under control. The number of cases per 100,000 people is low or medium across the continent in the past 14 days, while it is over the top in the US – above 120.

Source: ECDC

American lawmakers have reported progress on talks – but there is still no white smoke on agreeing to extend federal unemployment benefits – essential for keeping consumption afloat – as well as other measures. In the old continent, EU leaders agreed on the recovery fund – a move that is the main underlying upward driver of the euro.

Moreover, the US electoral campaign – mostly out of investors' sights so far – took a nasty twist when President Donald Trump suggested postponing the vote, triggering a backlash from Democrats and also from members of his own Republican Party. Growing fear that Trump would not acknowledge the results could further weigh on sentiment.

Second-quarter Gross Domestic Product figures are better in the US than in major European countries – yet investors are focusing on the more recent trends rather than the period that ended a month ago.

US GDP Analysis: Could have been worse, but will not improve, winners and losers in markets

The American economy squeezed by an annualized rate of 32.9%, equivalent to 9.5% quarterly, marginally better than expected. Germany's output fell by 10.1% and France by 13.8%.

However, US initial jobless claims rose to 1.434 million in the week ending July 24, and more importantly – continuing applications jumped above 17 million in the previous week, the one when Non-Farm PAyrolls surveys are held.

The dovish message from the Federal Reserve – acknowledging the slowdown stemming from the surge in coronavirus cases since mid-June – continues grinding down the greenback as well.

Personal income figures for June and the University of Michigan's final Consumer Sentiment Index for July are due out on Friday.

See Personal Income, Spending, and Prices June Preview: After all the agony just an average quarter?

As mentioned earlier, an end-of-month adjustment may trigger a downside correction for EUR/USD, potentially driven by a bounce in US yields. The ten-year Treasury bond yield fell to the lowest since May, and a potential bounce could allow the dollar to recover.

EUR/USD Technical Analysis

The Relative Strength Index on the four-hour chart is considerably above 70 – showing overbought conditions and implying a sharp correction. Euro/dollar appears overbought also on the daily chart.

The fresh high of 1.1909 is the immediate line of resistance, and there are no notable caps until the all-important 1.20 level which was a swing high in May 2018. Further above, 1.2090 is the next level to watch.

Looking down, 1.1850 was a peak in the summer of 2018 and is now support. It is followed by 1.1805, the initial peak earlier this week, and then by 1.1780 and 1.1750.

More Where next for the dollar, stocks and the US economy after downbeat data and the Fed

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD regains traction, recovers above 1.0700

EUR/USD regained its traction and turned positive on the day above 1.0700 in the American session. The US Dollar struggles to preserve its strength after the data from the US showed that the economy grew at a softer pace than expected in Q1.

GBP/USD returns to 1.2500 area in volatile session

GBP/USD reversed its direction and recovered to 1.2500 after falling to the 1.2450 area earlier in the day. Although markets remain risk-averse, the US Dollar struggles to find demand following the disappointing GDP data.

Gold holds around $2,330 after dismal US data

Gold fell below $2,320 in the early American session as US yields shot higher after the data showed a significant increase in the US GDP price deflator in Q1. With safe-haven flows dominating the markets, however, XAU/USD reversed its direction and rose above $2,340.

XRP extends its decline, crypto experts comment on Ripple stablecoin and benefits for XRP Ledger

Ripple extends decline to $0.52 on Thursday, wipes out weekly gains. Crypto expert asks Ripple CTO how the stablecoin will benefit the XRP Ledger and native token XRP.

After the US close, it’s the Tokyo CPI

After the US close, it’s the Tokyo CPI, a reliable indicator of the national number and then the BoJ policy announcement. Tokyo CPI ex food and energy in Japan was a rise to 2.90% in March from 2.50%.