EUR/USD Forecast: Bulls maintain the pressure

EUR/USD Current Price: 1.2251

- The American dollar remained under selling pressure in a risk-on environment.

- Market players await news related to US coronavirus relief checks.

- EUR/USD keeps consolidating near this year´s high, bulls may take another chance.

Risk appetite pushed the shared currency up this Tuesday, with EUR/USD reaching a daily high of 1.2274, a couple of pips below the year´s top. However, diminished holiday volumes maintain major pairs within familiar levels. The American dollar was once again the worst performer, down against all of its major rivals. Optimism was spurred by news coming from the US, as the House of Representatives voted to increase the direct payments in the coronavirus relief bill from $600 to $2,000 and passed it to the Senate. Wall Street soared to record highs,but trimmed intraday gains ahead of the close, giving the greenback the chance to recover some ground.

The European macroeconomic calendar has nothing to offer this week, while the US one includes just minor figures. The country published the S&P Home Price Index, which beat expectations. On Wednesday, the US will publish the November Goods Trade Balance and Pending Home Sales for the same month.

EUR/USD short-term technical outlook

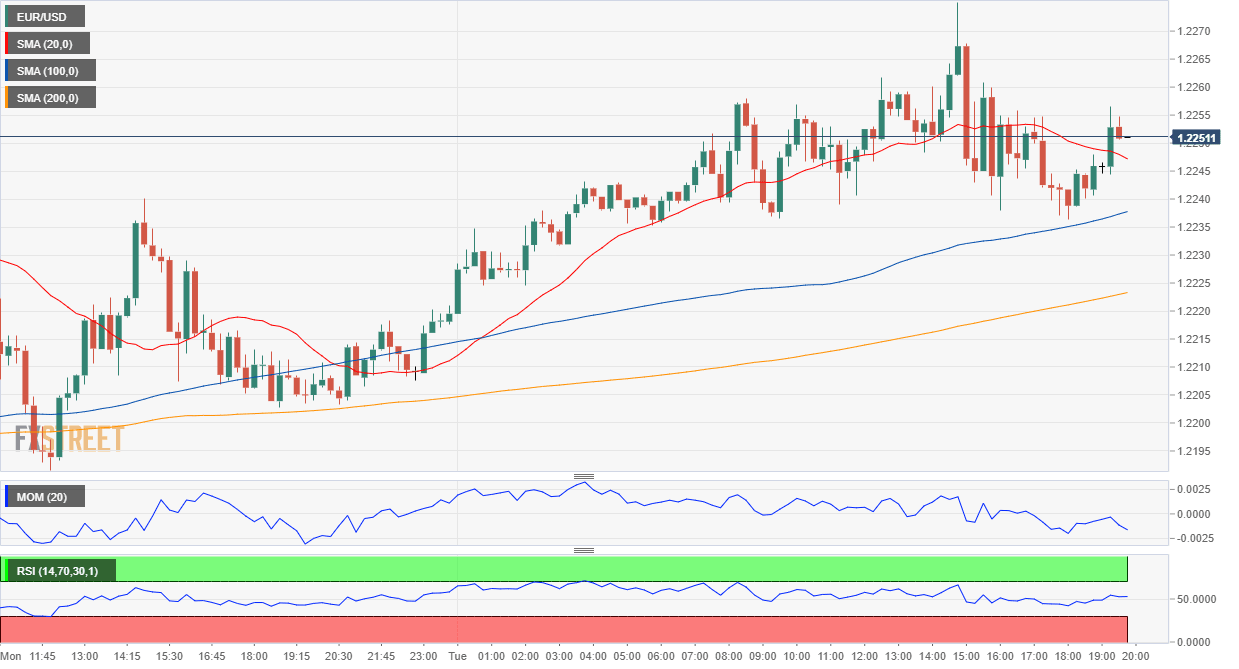

The EUR/USD pair is trading around 1.2250, posting modest gains for a second consecutive day. The near-term picture remains neutral amid thinned market conditions, but the shared currency has room to extend its advance in the long run. The 4-hour chart shows that the price holds mildly bullish moving averages, while technical indicators head marginally higher within positive levels. Bulls could have better chances on a break above 1.2277, this year’s high.

Support levels: 1.2210 1.2175 1.2120

Resistance levels: 1.2275 1.2320 1.2350

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.