EUR/USD Forecast: Bulls hesitate after solid US data

EUR/USD Current Price: 1.1133

- US Retail Sales met the market’s expectations in December, core readings upbeat.

- German inflation came as expected, the EU will publish its data this Friday.

- EUR/USD bearish potential limited by higher highs and higher lows.

The EUR/USD pair surged to 1.1172, a fresh weekly high, changing course in US trading hours and following an upbeat US Retail Sales report. The greenback started the day with a weak tone, as the market was still trying to digest the phase one of the trade deal, signed on Wednesday, without mentions to rolling back levies. Germany released December inflation, but given that it came in-line with the market’s expectations, it passed unnoticed.

As for US Retail Sales, they were up by 0.3% in the month, although the core readings were upbeat. According to the official report, Retail Sales Control Group was up by 0.5%, while Retail Sales ex-autos surged by 0.7%, both beating the market’s expectations. Also, Initial Jobless Claims for the week ended January 10 were up by 204K, better than the 216K expected. Finally, Business Inventories decreased by 0.2% in November, also better than anticipated. The data backed the greenback

This Friday, the EU will unveil the final version of December inflation, while the US will publish Building Permits and Housing Starts for December, December Industrial Production and the preliminary estimate of the January Michigan Consumer Sentiment Index, foreseen at 99.3.

EUR/USD short-term technical outlook

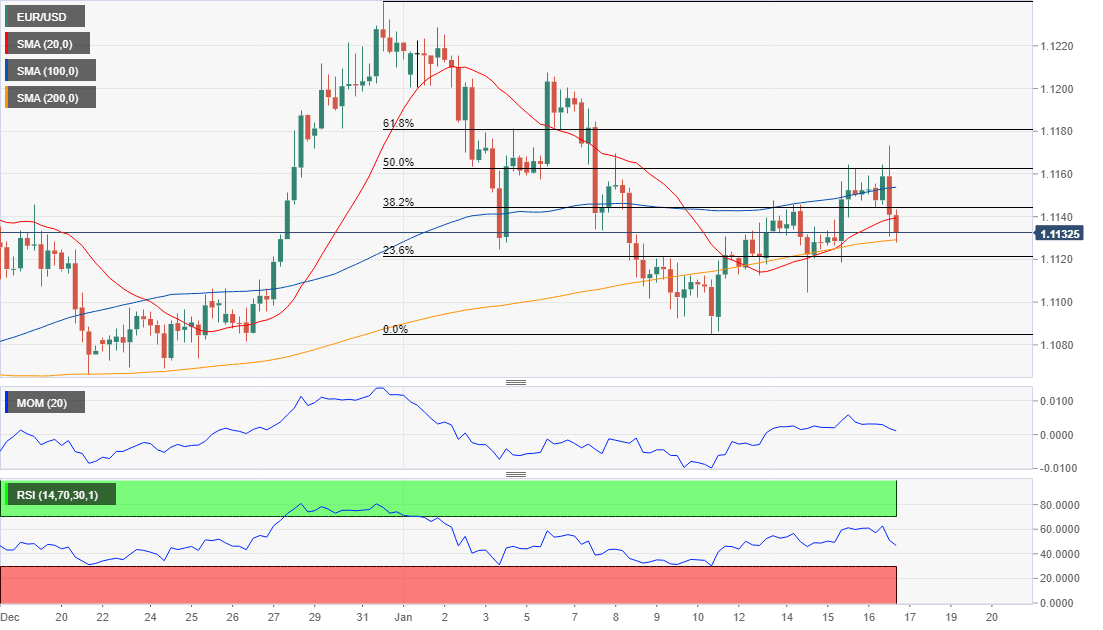

The EUR/USD pair is down daily basis, heading into the Asian session around 1.1130. Nevertheless, it keeps posting higher highs and higher lows daily basis, indicating that the dollar’s demand is still subdued. In the 4-hour chart, moving averages continue to lack directional strength, although the price is back below the 20 and 100 SMA. Technical indicators turned lower and are currently struggling with their midlines skewing the risk to the downside. Further declines could be confirmed on a break below 1.1120, the 23.6% retracement of the latest daily decline.

Support levels: 1.1120 1.1090 1.1065

Resistance levels: 1.1180 1.1220 1.1260

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.