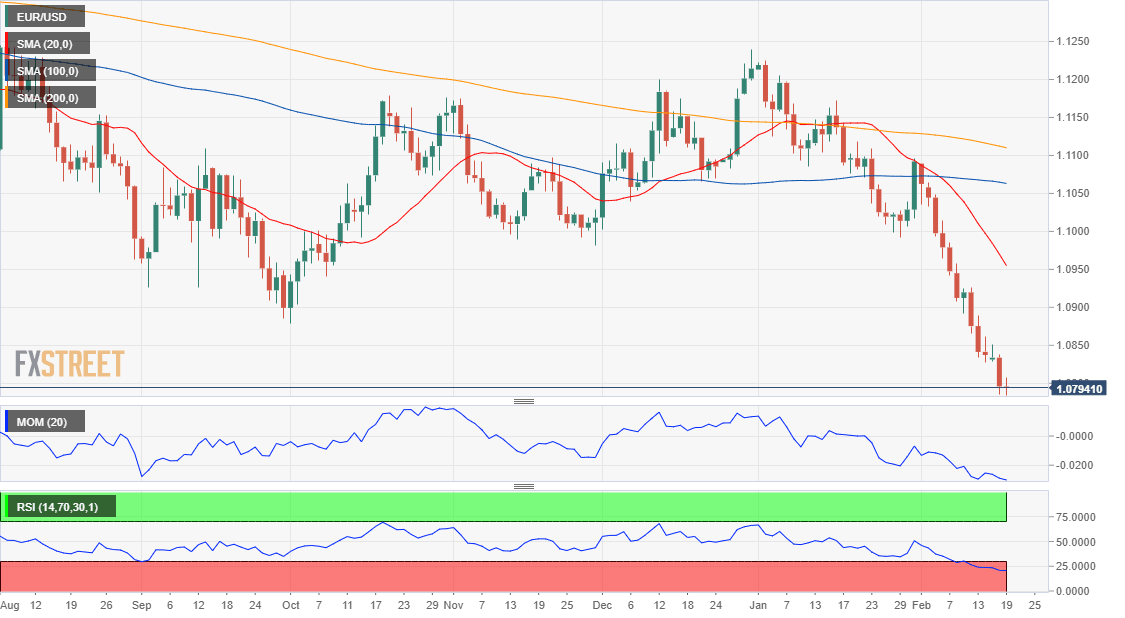

EUR/USD Forecast: Bears paused but retain control

EUR/USD Current Price: 1.0794

- Upbeat US data further highlights economic divergences between the EU and the US.

- Market players in a better mood, but still cautious amid coronavirus outbreak.

- EUR/USD consolidating, to pick up bearish momentum below 1.0770.

The EUR/USD pair remains depressed, hovering around the 1.0800 level, despite the market is in a better mood this Wednesday. Chinese authorities informed that the pace of contagion of the coronavirus outside Hubei province has slowed, spurring some relief among investors which anyway remain cautious.

The EU released December Current Account with the seasonally adjusted figure at €32.6 B, missing the market’s expectations. The Union also released December Construction output, which also came in below expected, down by 3.1% MoM and by 3.7% YoY.

The US, on the other hand, released MBA Mortgage Applications for the week ended February 14, which were down by 6.4%. The country also published the January Producer Price Index, which was up by 2.1% YoY, beating the market’s expectations. January Housing Starts were down by 3.6% while Building Permits were up by 9.2%, much better than anticipated. The dollar is firmer following the release of upbeat numbers.

EUR/USD short-term technical outlook

The EUR/USD pair is holding just below 1.0800 ahead of Wall Street’s opening, retaining its bearish stance. In the 4-hour chart, the pair is consolidating below a bearish 20 SMA, with the larger moving averages maintaining their bearish slopes far above the shorter one. The Momentum indicator heads lower just below its mid-line while the RSI consolidates around 31, all of which keeps the risk skewed to the downside.

Support levels: 1.0770 1.0725 1.0690

Resistance levels: 1.0840 1.0885 1.0910

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.