EUR/USD Forecast: Bears can take over with a break below 1.1305

EUR/USD Current price: 1.1329

- Fed’s chair Powell testified again on the CARES act before a different Senate Commission.

- The US ADP report showed that the private sector added 543K new job positions in November.

- EUR/USD holding above the 1.1300 level, but technical readings hint at a new leg south.

The EUR/USD pair has shed some ground on Wednesday but held above the 1.1300 figure. The market’s mood improved as investors digested the latest from the US Federal Reserve, as chief Jerome Powell hinted at speeding up tapering starting as soon as December. Powell testified again before a different Senate Commission and repeated that inflation has spread more broadly and that the risk of persistent inflation has risen. However, he also said that, while they need to remove the word “transitory,” he still believes inflation will come down “meaningfully” in the second half of 2022.

Meanwhile, the WHO noted that early indications point that cases related to the Omicron coronavirus strain are mild, adding that vaccines still offer protection against the new variant.

On the data front, Germany released October Retail Sales, which were down by 2.9% YoY, worst than the -2% expected. Also, Markit published the final readings of its November Manufacturing PMIs. The German reading was downwardly revised to 57.4, while the EU figure was confirmed at 58.4, below the preliminary estimate of 58.6.

The US published the November ADP report, which showed that the private sector added 543K positions in the month, better than the 525K expected. The official ISM Manufacturing PMI improved to 61.1 in November, beating expectations. On Thursday, the EU will release the October Producer Price Index while the US will publish November Challenger Job Cuts and Initial Jobless Claims for the week ended November 26.

EUR/USD short-term technical outlook

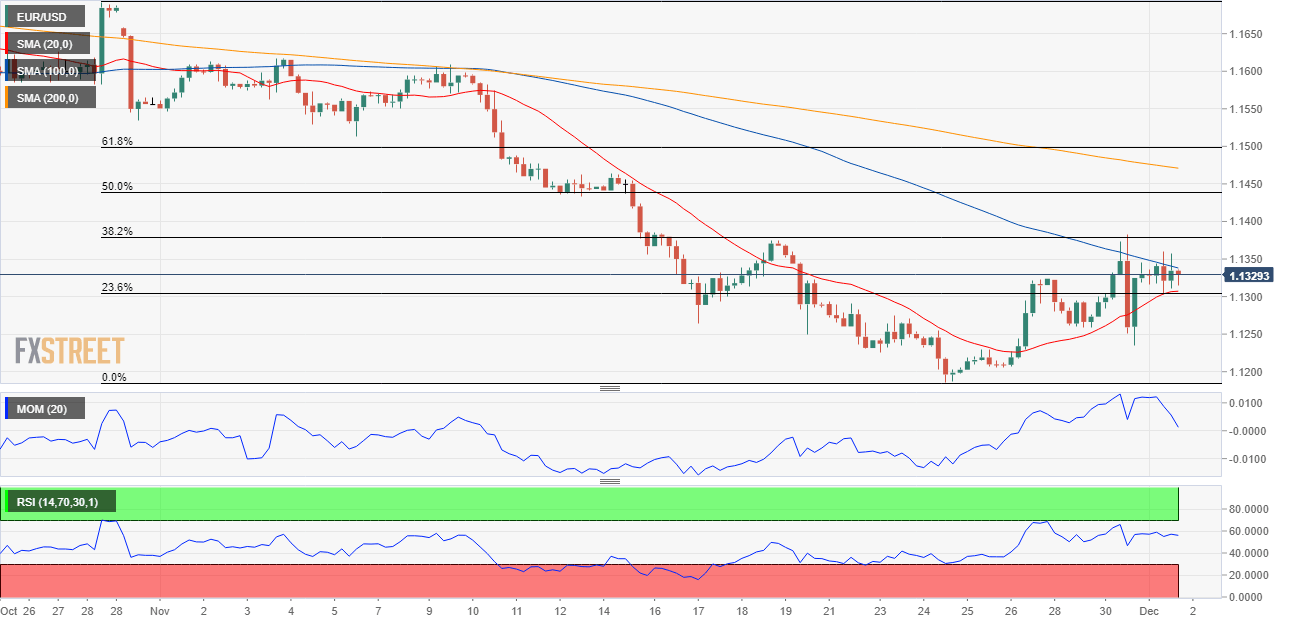

The EUR/USD pair has bottomed intraday around the 23.6% retracement of its November slide at 1.1305, the immediate support level. The daily chart indicates that the latest advance may have been corrective, as the rally stalled around the next Fibonacci retracement at around 1.1380, where it also has a firmly bearish 20 SMA. At the same time, technical indicators have continued to correct oversold conditions but currently turned flat within negative levels, indicating limited buying interest.

The 4-hour chart offers a neutral-to-bullish stance, as EUR/USD is finding support around a bullish 20 SMA but is unable to advance beyond a mildly bearish 100 SMA. Meanwhile, technical indicators remain within positive levels with uneven strength. The pair can gain bearish momentum on a clear break below 1.1305, while bulls may have a chance if the pair rallies beyond 1.1380.

Support levels: 1.1305 1.1260 1.1210

Resistance levels: 1.1380 1.1425 1.1470

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Valeria Bednarik

FXStreet

Valeria Bednarik was born and lives in Buenos Aires, Argentina. Her passion for math and numbers pushed her into studying economics in her younger years.