EUR/USD Forecast: At critical support, with geopolitics threatening to send it lower

- EUR/USD has been under pressure amid intensifying Sino-American tensions.

- Objection to the Franco-German plan is weighing on the euro.

- Monday's four-hour chart is showing the pair is just above critical support.

The euro has reasons to fall, the dollar motives to rise – will it be enough to break below a crucial confluence of support?

Sino-American tensions have refused to wane over the weekend and continue supporting the safe-haven greenback.

Lawmakers in Washington are advancing a bill that would sanction Chinese officials for human rights violations in Xinjiang. The world has been watching protests in Hong Kong against a suggested Chinese law that would tighten Beijing's grip on the territory, with the West angry but seemingly unwilling to act. China is unhappy with closer relations between America and Taiwan.

The world's largest economies are also at odds over the origins of coronavirus. Authorities in China said that bat viruses were present in the Wuhan lab suspected by some to be the source of COVID-19, yet said the disease that is gripping the world did not originate from there.

The silver lining remains that both sides remain committed – at least for now – to the trade deal. That is limiting the dollar's gains.

In the old continent, investors have curbed their enthusiasm over the Franco-German €500 billion plan that includes funding by the European Commission and handing out grants to the hardest-hit countries. The "Frugal Four" – Austria, the Netherlands, Sweden, and Denmark – prefer loans and want conditionality, something that will rattle Italy and Spain.

As with everything in Europe, things are moving slowly, and a final decision may have to wait until the next leaders' summit in mid-June. While the news is weighing on the euro, investors still expect Germany's backing of the plan to win the day and support the recovery.

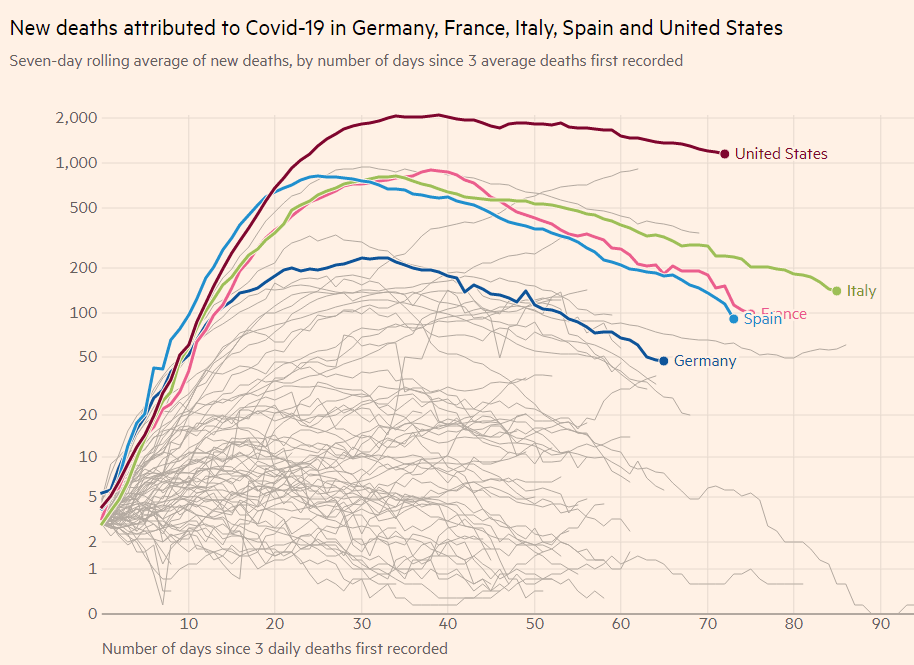

In the meantime, coronavirus statistics remain encouraging in Europe, with substantial falls in the number of deaths and new infections. Spain and Italy have continued easing restrictions, and Germany's reproductive indicator (R) remains below 1.

On the other side of the pond, mortalities in the US are getting close to 100,000, with only a moderate deceleration. Nevertheless, President Donald Trump insists on reopening the economy quickly and is unwilling to consider reimposing lockdowns if a second wave strikes.

Source: Financial Times

The German IFO Business Climate came out at 79.5 points in May, beating estimates and a bounce from April. On the other hand, the Current Assessment component disappointed with 78.9 points. Clemens Fuest, the institution's president, said that the mood is not catastrophic but still cautious. He added the fear of a second wave is not so pronounced in Germany and the reopening of retail explains the improvement in the mood.

EUR/USD Technical Analysis

The four-hour chart is showing that critical support awaits at 1.0870, which is the confluence of the 100 and 200 Simple Moving Averages, a swing high from early May and soon also the uptrend support line that has been accompanying the currency pair since mid-May.

Break or bounce? Momentum is to the downside, and EUR/USD is trading just below the 50 SMA, so the tendency is to the downside.

Below 1.0870, the next lines to watch are 1.0825, 1.0780, and 1.0765.

Resistance awaits at 1.0890, a peak from mid-May, followed by 1.0920, 1.0950, and 1.0975.

Author

Yohay Elam

FXStreet

Yohay is in Forex since 2008 when he founded Forex Crunch, a blog crafted in his free time that turned into a fully-fledged currency website later sold to Finixio.

-637259890924510981.png&w=1536&q=95)