EUR/USD: Are the cracks starting to show in the euro bull run? [Video]

![EUR/USD: Are the cracks starting to show in the euro bull run? [Video]](https://editorial.fxstreet.com/images/Markets/Currencies/Majors/EURUSD/euro-gm510173052-86141121_XtraLarge.jpg)

EUR/USD

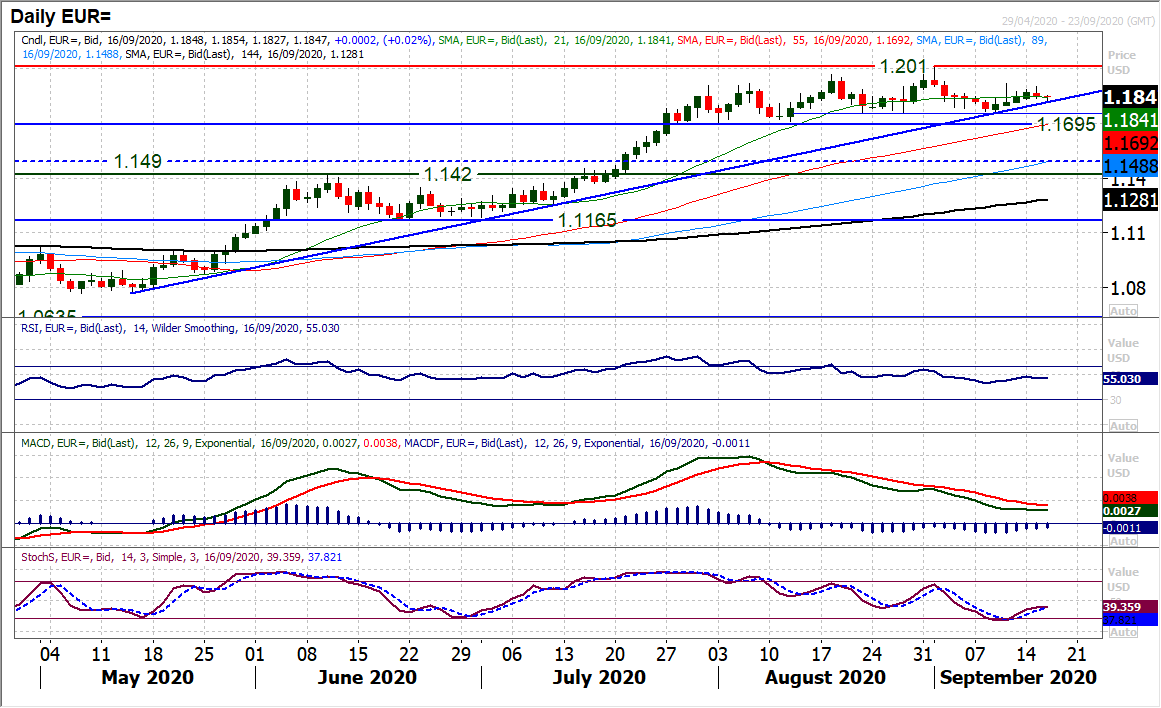

Are the cracks starting to show in the euro bull run? Positive candles have formed in recent sessions, but they have been relatively muted, and now yesterday’s negative candlestick (with a close towards the session low) shows EUR/USD starting to roll over again. This time, the resistance at 1.1915 (from last week’s post ECB spike high) has held. The four month uptrend rises at 1.1815 today but is under pressure. An uptrend breach does not necessarily mean a big sell-off, more immediately that the bulls have lost control. The lack of drive through momentum indicators reflects this, as Stochastics and MACD lines tail off again. This is all coming ahead of the FOMC meeting today and it could just be that the market is ranging within 1.1695/1.2010. The hourly chart shows 1.1810 as the initial support to watch to the downside, whilst 1.1915 is a barrier to gains. Closing either side of these levels will drive the next move.

Author

Richard Perry

Independent Analyst