EUR/USD Analysis: Traders seem non-committed as Eurozone, US PMIs could bring fresh impetus

- EUR/USD remains confined in a narrow trading band around the 100-day SMA.

- The USD stands near a two-month high, acting as a headwind for the pair.

- Bets for more ECB rate hikes underpin the Euro and help limit any further losses.

The EUR/USD pair extends its sideways consolidative price move for the second successive day on Tuesday and oscillates in a narrow band around the 100-day Simple Moving Average (SMA) through the Asian session. The US Dollar (USD) holds steady just below a two-month high touched last Friday and turns out to be a key factor acting as a headwind for the major. Despite the less-hawkish remarks by Federal Reserve (Fed) Chair Jerome Powell, investors seem convinced that the US central bank is likely to continue hiking interest rates. In fact, Powell said on Friday that tighter credit conditions could mean fewer rate hikes. That said, St. Louis Fed President James Bullard said on Monday that the Fed may still need to raise its benchmark interest rate by another half-point this year. Furthermore, Minneapolis Fed President Neel Kashkari also said it was a close call whether he would vote to raise interest rates or to pause the central bank's tightening cycle when it meets next month.

Separately, Atlanta Fed President Raphael Bostic said he was comfortable waiting a little bit before deciding on any further moves. Meanwhile, Richmond Fed President Thomas Barkin said he was still looking to be convinced that inflation is in a steady decline. Nevertheless, the outlook pushes back against expectations for rate cuts by the Fed later this year and remains supportive of elevated US Treasury bond yields, which, in turn, continues to underpin the buck. Adding to this, worries over slowing global growth, particularly in China, and the US debt-ceiling impasse further benefits the Greenback's relative safe-haven status. In fact, US President Joe Biden and House Speaker Kevin McCarthy ended discussions on Monday with no agreement on how to raise the US government's $31.4 trillion debt ceiling and will keep talking just 10 days before a possible default.

The downside for the EUR/USD pair, however, seems cushioned, at least for the time being, amid expectations for more interest rate hikes by the European Central Bank (ECB) in the coming months. The bets were lifted by ECB President Christine Lagarde's comments on Monday, saying that the journey toward taming inflation and bringing it back to the target isn't over yet. Adding to this, ECB Governing Council member Pablo Hernandez de Cos noted that interest rates will have to remain in restrictive territory for a long time to reach the inflation target in a sustained manner. Moreover, ECB Governing Council member Francois Villeroy de Galhau reiterated that the central bank’s policy rate is expected to reach its peak no later than by summer. This, in turn, is holding back traders from placing aggressive bearish bets around the major and helping to limit any meaningful depreciating move.

Market participants now look forward to the release of the flash Purchasing Managers Index (PMI) prints from Europe and the US for a fresh impetus. The US economic docket also features New Home Sales data and the Richmond Fed Manufacturing Index. This, along with the US bond yields and the broader market risk sentiment, will influence the USD price dynamics and allow traders to grab short-term opportunities around the EUR/USD pair. The focus, however, will remain glued to the US debt-ceiling negotiations and the crucial FOMC meeting minutes, due on Wednesday. Investors this week will also confront the release of the Preliminary (second estimate) US Q1 GDP report on Thursday, followed by the Core PCE Price Index – the Fed's preferred inflation gauge – and Durable Goods Orders on Friday. This will play a key role in driving the USD demand and determine the near-term trajectory for the major.

Technical Outlook

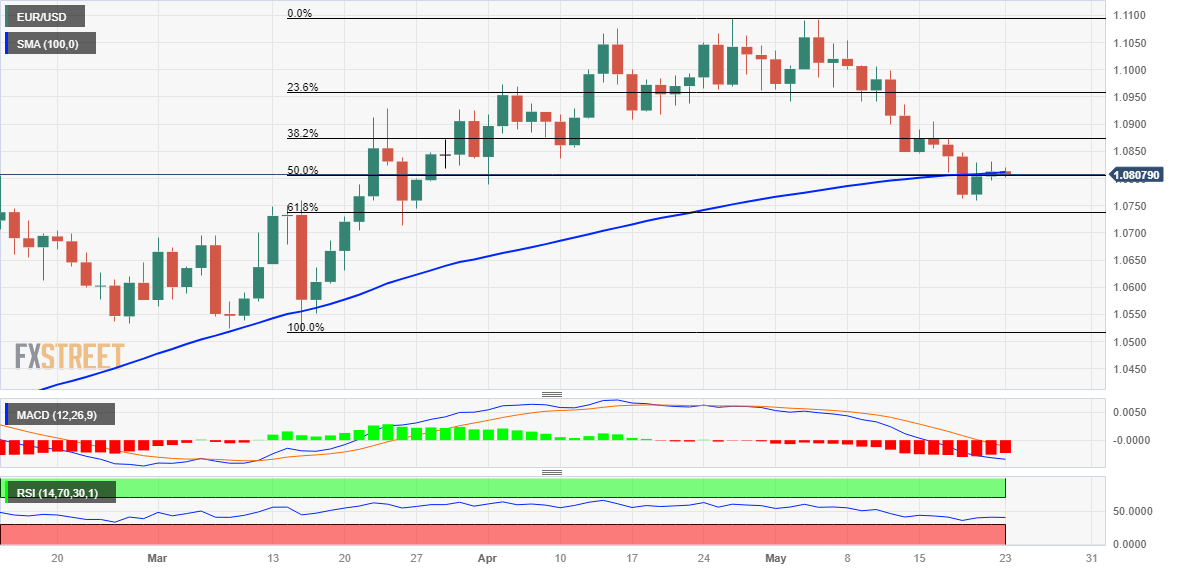

From a technical perspective, the EUR/USD pair's inability to build on the recent bounce from its lowest level since March 27 warrants some caution for bullish traders. Moreover, oscillators on the daily chart are holding in the negative territory and are still far from being in the oversold zone. This, in turn, suggests that the path of least resistance for spot prices is to the downside and supports prospects for a further near-term depreciating move.

That said, any subsequent slide is more likely to find some support near last week's swing low, around the 1.0760 region. This is closely followed by the 61.8% Fibonacci retracement level of the March-May rally, around the 1.0735 zone, which if broken will set the stage for an extension of the downfall from over a one-year high touched earlier this month. The EUR/USD pair might then slide below the 1.0700 mark and test the next relevant support near the 1.0675-1.0670 horizontal zone before eventually dropping to the 1.0635 region en route to the 1.0600 round figure.

On the flip side, the immedaite hurdle is pegged near the 1.0840 horizontal zone ahead of the 1.0870 region, or the 38.2% Fibonacci level. A sustained strength beyond might shift the bias back in favour of bullish traders and trigger aggressive technical buying. The EUR/USD pair might then climb further beyond the 1.0900 mark and aim to test the 1.0955-1.0960 support breakpoint, now turned resistance, which coincides with the 23.6% Fibonacci level.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.