EUR/JPY down through key psychology 122.00

EURJPY continued to experience a gloomy moment for the week where it recorded a decline of over 1.5%. Negative market sentiment following the movement control order in Europe due to the continuous wave of Covid-19 clearly caused the increased demand of the safe haven currency JPY.

The Dovish statement by President Lagarde after the ECB policy meeting yesterday also had an impact on the Euro.

President Lagarde acknowledged that the economy had lost momentum faster than ECB expectations and inflation had stayed low due to low energy prices. She also stressed that market risk is now tilted downwards.

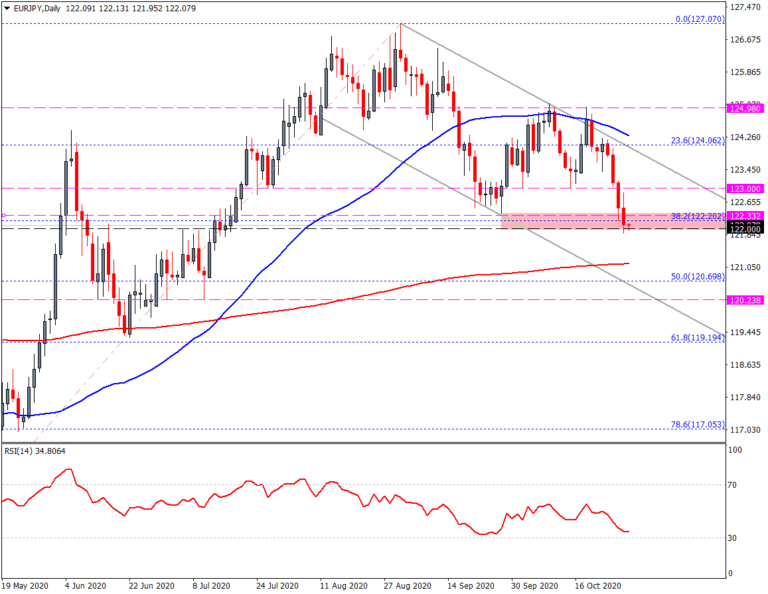

EURJPY tested the key support cluster levels yesterday. It tested the Fibonacci retracement level of 38.2% (122.20), after it broke the support level of 122.33, and tested the psychological level of 122.00. It is currently trading slightly 20 pips below this key level at 121.80 and is waiting for a new catalyst for the next move, following Eurozone GDP data.

If the 122.00 level remains breached and broken, the 200-DMA level at 121.13 is the nearest support followed by the 50% fibo retracement level at 120.70. Meanwhile, 123.00 is the nearest resistance level followed by 23.6% fibo retracement level at 124.06. The 50-DMA is slightly above 124.30. Although EURJPY recorded a big decline this week, it still has not reached the oversold level on the RSI-14.

By the last day of October trading, investors and traders will most likely make adjustments to their portfolios at the end of the London session. High volatility is expected by the end of London’s trading session today.